TCF Bank 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

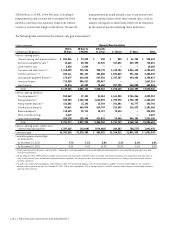

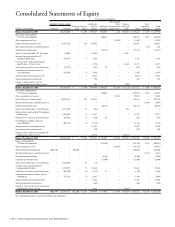

Consolidated Statements of Equity

TCF Financial Corporation

(Dollars in thousands)

Number of Shares Issued

Preferred

Stock

Common

Stock

Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Treasury

Stock and

Other Total

Non-

controlling

Interests

Total

EquityPreferred Common

Balance, December 31, 2009 – 130,339,500 $ – $1,303 $297,429 $ 925,797 $ 1,660 $(50,827) $1,175,362 $ 4,393 $1,179,755

Net income attributable to

TCF Financial Corporation – – – – – 150,947 – – 150,947 3,297 154,244

Other comprehensive (loss) – – – – – – (17,352) – (17,352) – (17,352)

Public offering of common stock – 12,322,250 – 124 164,443 – – – 164,567 – 164,567

Net investment by non-controlling interest – – – – – – – – – 810 810

Dividends on common stock – – – – – (27,617) – – (27,617) – (27,617)

Grants of restricted stock, 347,916 shares – 20,000 – – (8,491) – – 8,491 – – –

Common shares purchased by TCF

employee benefit plans – 442,579 – 4 6,358 – – – 6,362 – 6,362

Treasury shares sold to TCF employee

benefit plans, 757,612 shares – – – – (7,893) – – 19,620 11,727 – 11,727

Cancellation of shares of restricted stock – (23,723) – – (247) 29 – – (218) – (218)

Cancellation of common shares for

tax withholding – (135,594) – (1) (1,946) – – – (1,947) – (1,947)

Amortization of stock compensation – – – – 9,534 – – – 9,534 – 9,534

Stock compensation tax benefits – – – – 298 – – – 298 – 298

Change in shares held in trust for

deferred compensation plans, at cost – – – – 399 – – (399) – – –

Balance, December 31, 2010 – 142,965,012 $ – $1,430 $459,884 $1,049,156 $(15,692) $(23,115) $1,471,663 $ 8,500 $1,480,163

Net income attributable to

TCF Financial Corporation – – – – – 109,394 – – 109,394 4,993 114,387

Other comprehensive income – – – – – – 72,518 – 72,518 – 72,518

Public offering of common stock – 15,081,968 – 151 219,515 – – – 219,666 – 219,666

Net distribution to non-controlling interest – – – – – – – – – (2,999) (2,999)

Dividends on common stock – – – – – (30,772) – – (30,772) – (30,772)

Grants of restricted stock, 1,256,094 shares – 1,247,500 – 12 (234) – – 222 – – –

Common shares purchased by TCF employee

benefit plans – 1,402,505 – 14 17,957 – – – 17,971 – 17,971

Cancellation of shares of restricted stock – (120,886) – (1) (620) 45 – – (576) – (576)

Cancellation of common shares for

tax withholding – (209,719) – (2) (3,114) – – – (3,116) – (3,116)

Amortization of stock compensation – – – – 11,105 – – – 11,105 – 11,105

Stock compensation tax benefits – – – – 280 – – – 280 – 280

Change in shares held in trust for deferred

compensation plans, at cost – – – – 10,474 – – (10,474) – – –

Balance, December 31, 2011 – 160,366,380 $ – $1,604 $715,247 $1,127,823 $ 56,826 $(33,367) $1,868,133 $10,494 $1,878,627

Net loss attributable to

TCF Financial Corporation – – – – – (212,884) – – (212,884) 6,187 (206,697)

Other comprehensive loss – – – – – – (44,383) – (44,383) – (44,383)

Public offering of preferred stock 4,006,900 – 263,240 – – – – – 263,240 – 263,240

Net distribution to non-controlling interest – – – – – – – – – (3,411) (3,411)

Dividends on preferred stock – – – – – (5,606) – – (5,606) – (5,606)

Dividends on common stock – – – – – (31,904) – – (31,904) – (31,904)

Grants of restricted stock, 1,822,025 shares – 1,822,025 – 18 (18) – – – – – –

Common shares purchased by TCF

employee benefit plans – 1,742,990 – 17 19,445 – – – 19,462 – 19,462

Cancellation of shares of restricted stock – (322,908) – (3) (1,198) 16 – – (1,185) – (1,185)

Cancellation of common shares for tax

withholding – (179,724) – (2) (1,947) – – – (1,949) – (1,949)

Amortization of stock compensation – – – – 11,108 – – – 11,108 – 11,108

Stock compensation tax expense – – – – (659) – – – (659) – (659)

Change in shares held in trust for deferred

compensation plans, at cost – – – – 8,062 – – (8,062) – – –

Balance, December 31, 2012 4,006,900 163,428,763 $263,240 $1,634 $750,040 $ 877,445 $ 12,443 $(41,429) $1,863,373 $13,270 $1,876,643

See accompanying notes to consolidated financial statements.

{ 60 } { TCF Financial Corporation and Subsidiaries }