TCF Bank 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

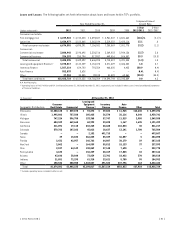

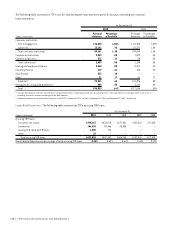

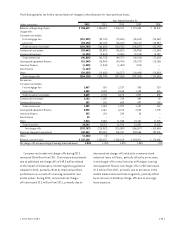

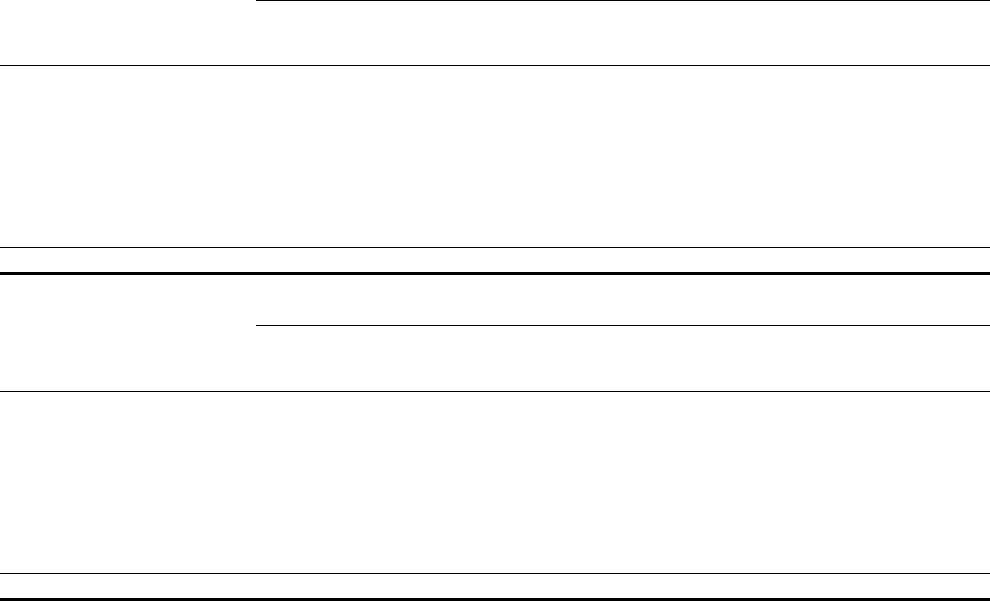

Changes in the amount of non-accrual loans and leases for the years ended December 31, 2012 and 2011 are summarized in

the following tables.

At or For the Year Ended December 31, 2012

(In thousands)

Consumer

Real Estate Commercial

Leasing and

Equipment

Finance

Inventory

Finance

Auto

Finance Other Total

Balance, beginning of year $149,371 $127,519 $ 20,583 $ 823 $ – $ 15 $ 298,311

Additions 340,359 120,155 27,138 8,784 110 14 496,560

Charge-offs (62,591) (40,502) (19,667) (736) – (1,188) (124,684)

Transfers to other assets (82,632) (15,044) (2,915) (817) – (605) (102,013)

Return to accrual status (96,137) (27,692) (1,308) (3,867) – – (129,004)

Payments received (12,827) (35,480) (10,170) (2,885) (13) (572) (61,947)

Other, net (643) (1,210) (9) 185 4 3,907 2,234

Balance, end of year $234,900 $127,746 $ 13,652 $ 1,487 $101 $ 1,571 $ 379,457

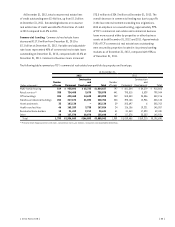

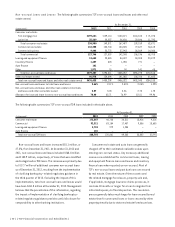

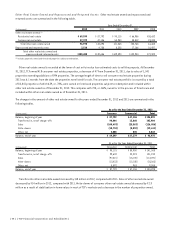

At or For the Year Ended December 31, 2011

(In thousands)

Consumer

Real Estate Commercial

Leasing and

Equipment

Finance

Inventory

Finance

Auto

Finance Other Total

Balance, beginning of year $ 167,497 $142,248 $ 34,407 $ 1,055 $ – $ 50 $ 345,257

Additions 230,944 106,259 29,261 6,875 – 160 373,499

Charge-offs (71,848) (42,098) (13,217) (61) – (195) (127,419)

Transfers to other assets (83,138) (23,142) (6,724) (755) – – (113,759)

Return to accrual status (79,602) – (2,943) (4,278) – – (86,823)

Payments received (13,273) (60,859) (20,113) (2,100) – – (96,345)

Other, net (1,209) 5,111 (88) 87 – – 3,901

Balance, end of year $ 149,371 $ 127,519 $ 20,583 $ 823 $ – $ 15 $ 298,311

Total non-accrual loans and leases that returned to

accrual status increased $42.2 million, while payments

received decreased $34.4 million and non-accrual loans

and leases transferred to other assets decreased $11.7

million. These changes were primarily driven by a more

aggressive workout approach in the commercial portfolio

and reduced foreclosures.

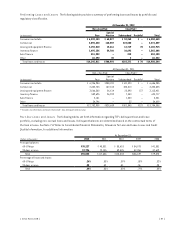

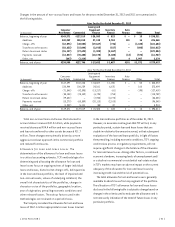

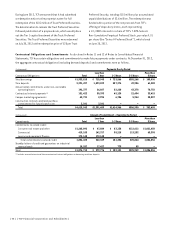

Allowance for Loan and Lease Losses The

determination of the allowance for loan and lease losses

is a critical accounting estimate. TCF’s methodologies for

determining and allocating the allowance for loan and

lease losses focus on ongoing reviews of larger individual

loans and leases, historical net charge-offs, delinquencies

in the loan and lease portfolio, the level of impaired and

non-accrual assets, values of underlying collateral, the

overall risk characteristics of the portfolios, changes in

character or size of the portfolios, geographic location,

year of origination, prevailing economic conditions and

other relevant factors. The various factors used in the

methodologies are reviewed on a periodic basis.

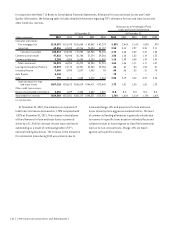

The Company considers the allowance for loan and lease

losses of $267.1 million appropriate to cover losses incurred

in the loan and lease portfolios as of December 31, 2012.

However, no assurance can be given that TCF will not, in any

particular period, sustain loan and lease losses that are

sizable in relation to the amount reserved, or that subsequent

evaluations of the loan and lease portfolio, in light of factors

then prevailing, including economic conditions, TCF’s ongoing

credit review process or regulatory requirements, will not

require significant changes in the balance of the allowance

for loan and lease losses. Among other factors, a continued

economic slowdown, increasing levels of unemployment and/

or a decline in commercial or residential real estate values

in TCF’s markets may have an adverse impact on the current

adequacy of the allowance for loan and lease losses by

increasing credit risk and the risk of potential loss.

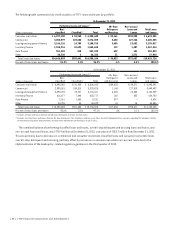

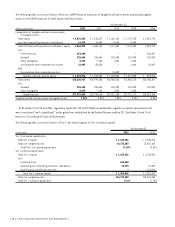

The total allowance for loan and lease losses is generally

available to absorb losses from any segment of the portfolio.

The allocation of TCF’s allowance for loan and lease losses

disclosed in the following table is subject to change based on

changes in the criteria used to evaluate the allowance and is

not necessarily indicative of the trend of future losses in any

particular portfolio.

{ 2012 Form 10K } { 41 }