TCF Bank 2012 Annual Report Download - page 61

Download and view the complete annual report

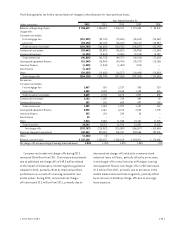

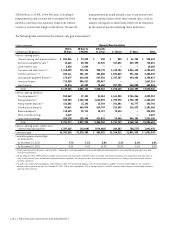

Please find page 61 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity Management TCF manages its liquidity

position to ensure that the funding needs of depositors and

borrowers are met promptly and in a cost-effective manner.

Asset liquidity arises from the ability to convert assets to

cash as well as from the maturity of assets. Liability liquidity

results from the ability of TCF to maintain a diverse set of

funding sources to promptly meet funding requirements.

TCF’s Asset/Liability Committee (“ALCO”) and Finance

Committee of the Board of Directors have adopted a Liquidity

Management Policy to direct management of the Company’s

liquidity risk, see “Item 7A. Quantitative and Qualitative

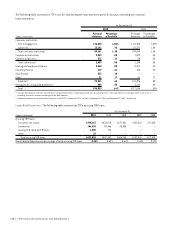

Disclosures about Market Risk” for more information. At both

December 31, 2012 and 2011, interest-bearing deposits held

at the Federal Reserve and unencumbered securities were

$1.4 billion. At December 31, 2012, TCF had $712 million of

interest-bearing deposits at the Federal Reserve.

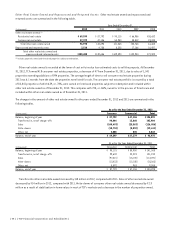

Deposits are the primary source of TCF’s funds for

use in lending and for other general business purposes.

In addition to deposits, TCF derives funds from loan and

lease repayments and borrowings. Deposit inflows and

outflows are significantly influenced by general interest

rates, money market conditions, competition for funds,

customer service and other factors. TCF’s deposit inflows

and outflows have been and will continue to be affected

by these factors. Borrowings may be used to compensate

for reductions in normal sources of funds, such as deposit

inflows at less than projected levels, net deposit outflows

or to fund balance sheet growth. Historically, TCF has

borrowed primarily from the Federal Home Loan Bank

(“FHLB”) of Des Moines, institutional sources under

repurchase agreements and other sources.

TCF’s ALCO and Finance Committee of the Board of

Directors have adopted a Holding Company Investment

and Liquidity Management Policy, which establishes the

minimum amount of cash or liquid investments TCF Financial

will hold, see “Item 7A. Quantitative and Qualitative

Disclosures about Market Risk” for more information. TCF

Financial had cash and liquid investments of $84 million and

$133 million at December 31, 2012 and 2011, respectively.

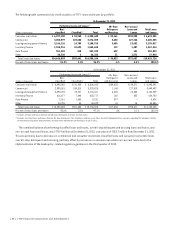

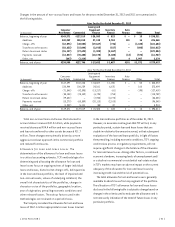

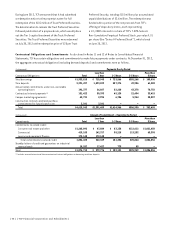

Deposits Deposits totaled $14.1 billion at December 31,

2012, an increase of $1.8 billion, or 15.2% from December

31, 2011. On June 1, 2012, TCF Bank assumed approximately

$778 million of deposits from Prudential Bank & Trust,

FSB (“PB&T”). The deposits consist primarily of Individual

Retirement Account (“IRA”) accounts with certificates of

deposit or checking accounts and IRA related brokerage

sweep accounts gathered by PB&T. As of December 31, 2012,

the balance of assumed deposits from PB&T totaled

$731 million. Additionally, TCF reintroduced free checking

during 2012, which resulted in net gains in checking

accounts in the second half of 2012.

Checking, savings and money market deposits are an

important source of low-cost funds and fee income for TCF.

These deposits totaled $11.8 billion at December 31, 2012,

up $622.9 million from December 31, 2011, and comprised

83.7% of total deposits at December 31, 2012, compared

with 91.3% of total deposits at December 31, 2011. The

average balance of these deposits for 2012 was $11.4

billion, an increase of $582 million over the $10.9 billion

average balance for 2011.

Certificates of deposit totaled $2.3 billion at

December 31, 2012, up $1.2 billion from December 31,

2011, due to special programs offered in select markets

during 2012. Non-interest bearing deposits represented

17.7% of total deposits at December 31, 2012, compared

with 20% at December 31, 2011. TCF’s weighted-average

rate for deposits, including non-interest bearing deposits,

was .33% at December 31, 2012, compared with .29% at

December 31, 2011. At December 31, 2012, TCF had $294.3

million of brokered deposits acquired from PB&T in June

2012. TCF had no brokered deposits at December 31, 2011.

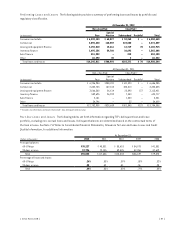

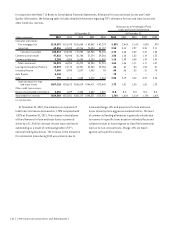

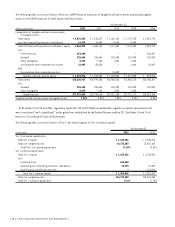

Borrowings Borrowings totaled $1.9 billion at December 31,

2012, down $2.5 billion from December 31, 2011. The

weighted-average rate on borrowings was 1.42% at

December 31, 2012, compared with 4.26% at December 31, 2011.

Historically, TCF has borrowed primarily from the FHLB of

Des Moines, from institutional sources under repurchase

agreements and from other sources. At December 31,

2012, TCF had $2.6 billion in unused, secured borrowing

capacity at the FHLB of Des Moines. See Notes 11 and 12

of Notes to Consolidated Financial Statements for detailed

information on TCF’s borrowings.

During June 2012, TCF Bank issued $110 million of

subordinated notes, at a price to investors of 99.086% of

par, which will be due on June 8, 2022. The subordinated

notes bear interest at a fixed rate per annum of 6.25%

until maturity. The notes qualify as Tier 2, or supplementary

capital for regulatory purposes, subject to certain

limitations. TCF Bank used the proceeds to pay down short

term borrowings.

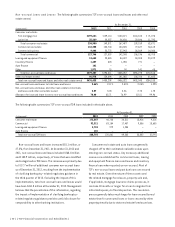

In 2008, TCF Capital I, a statutory trust formed under

the laws of the state of Delaware and wholly-owned

finance subsidiary of TCF, issued 10.75% preferred junior

subordinated notes (the “Trust Preferred Securities”).

{ 2012 Form 10K } { 45 }