TCF Bank 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

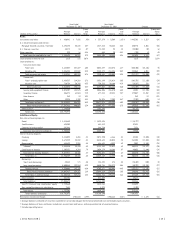

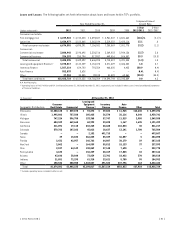

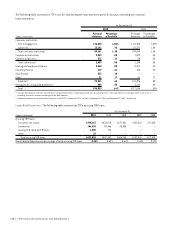

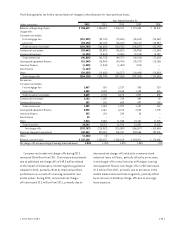

TCF Inventory Finance The following table summarizes TCF’s inventory finance portfolio by marketing segment.

At December 31,

(Dollars in thousands) 2012 2011

Marketing Segment Balance

Percent

of Total Balance

Percent

of Total

Powersports $ 943,704 60.2% $153,217 24.5%

Lawn and garden 339,224 21.7 324,607 52.0

Electronics and appliances 50,394 3.2 52,603 8.4

Other 233,892 14.9 94,273 15.1

Total $1,567,214 100.0% $624,700 100.0%

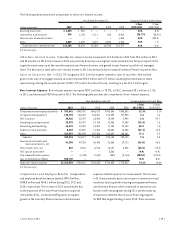

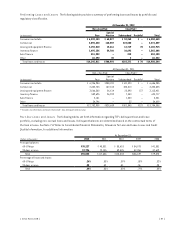

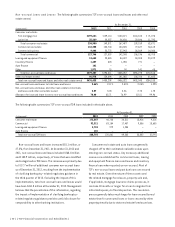

Inventory finance continued to expand its core programs

during 2012, primarily in the powersports industry, with an

increase in the total portfolio to $1.6 billion, or 10.2% of

total loans and leases, at December 31, 2012, compared with

$624.7 million, or 4.4% at December 31, 2011. The increase

was primarily due to the funding of BRP dealers beginning

February 1, 2012. Inventory finance originations increased to

$5.2 billion in 2012 compared to $2.5 billion in 2011.

Auto Finance TCF’s auto finance loan portfolio

represented 3.6% of TCF’s total loan and lease portfolio at

December 31, 2012. The auto finance portfolio increased

significantly in 2012 to $552.8 million from $3.6 million

at December 31, 2011, due to continued growth from the

acquisition of Gateway One in the fourth quarter of 2011.

Auto finance loans are expected to continue growing as

it expands its number and geographic coverage of active

dealers in its network by expanding its sales force. As of

December 31, 2012, the auto finance network included 6,176

active dealers in 43 states, compared with 3,451 active

dealers in 30 states as of December 31, 2011. Auto finance

also increased its portfolio of managed loans, which includes

portfolio loans, loans held for sale, and loans sold and

serviced for others to $1.3 billion as of December 31, 2012.

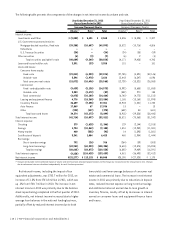

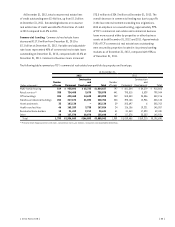

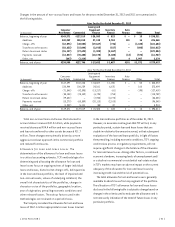

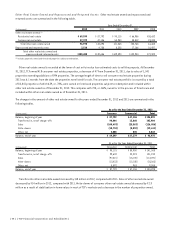

Credit Quality The following tables summarize TCF’s

loan and lease portfolio based on what TCF believes are

the most important credit quality data that should be used

to understand the overall condition of the portfolio. The

following items should be considered throughout the credit

quality section.

• Within the performing loans and leases, TCF classifies

customers within regulatory classification guidelines.

Loans and leases that are “classified” are loans or

leases that management has concerns regarding the

ability of the borrowers to meet existing loan or lease

terms and conditions, but may never become non-

performing or result in a loss.

• Performing loans that are 60+ days delinquent have a

higher potential to become non-performing and generally

are a leading indicator for future charge-off trends.

• Accruing troubled debt restructurings are loans to

borrowers that have been modified such that TCF has

granted a concession in terms to improve the likelihood

of collection of all principal and modified interest owed.

• Non-accrual loans and leases have been charged down

to the estimated fair value of the collateral less selling

costs, or reserved for expected loss upon workout.

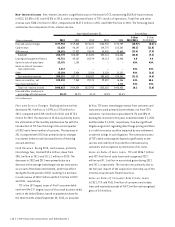

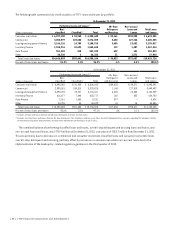

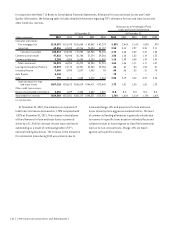

Included in Note 7 of Notes to Consolidated Financial

Statements, Allowance for Loan and Lease Losses and Credit

Quality Information, are disclosures of loans considered

to be “impaired” for accounting purposes. Consumer real

estate TDR loans are evaluated separately in TCF’s allowance

methodology. Commercial TDR loans are individually evaluated

for impairment. Impairment is based upon the present value

of the expected future cash flows or the fair value of the

collateral less selling expense for collateral-dependent loans.

Impaired loans comprise a portion of non-accrual loans and

accruing TDR loans and therefore are not additive to the

information in the table below. Impaired loan accounting

policies prescribe specific methodologies for determining

a portion of the allowance for loan and lease losses. Loan

modifications are not reported as TDR loans in the calendar

years after modification if the loans were modified with an

interest rate equal to or greater than the yields of new loan

originations with comparable risk at the time of restructuring,

and if the loan is performing based on the restructured terms;

however, these loans are still considered impaired and follow

TCF’s impaired loan reserve policies. In addition, TCF has

modified certain loans and leases to troubled borrowers

which are not considered TDR loans because a concession

was not granted. These other modified loans and leases

totaled $6.1 million and $39.4 million at December 31, 2012

and 2011, respectively, and are further discussed below

under “Loan Modifications.”

{ 2012 Form 10K } { 35 }