TCF Bank 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

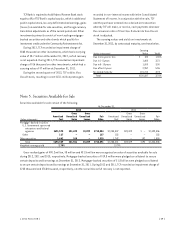

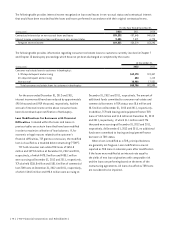

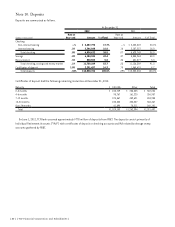

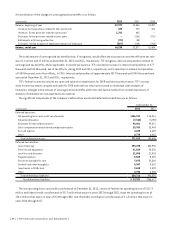

The table below summarizes TDR loans that defaulted during the years ended December 31, 2012 and 2011, which were

modified within one year of the beginning of the respective reporting period. TCF considers a loan to have defaulted when it

becomes 90 or more days delinquent under the modified terms, has been transferred to non-accrual status subsequent to the

modification or has been transferred to other real estate owned.

For the Year Ended December 31,

2012 2011

(Dollars in thousands) Number of Loans Loan Balance(1) Number of Loans Loan Balance(1)

Consumer real estate:

First mortgage lien 62 $ 10,007 147 $ 26,693

Junior lien 25 1,221 42 4,934

Total consumer real estate 87 11,228 189 31,627

Commercial real estate 21 41,027 5 32,161

Total defaulted modified loans 108 $ 52,255 194 $ 63,788

Total loans modified in the applicable period 2,383 $575,014 2,017 $482,197

Defaulted modified loans as a percent of total loans

modified in the applicable period 4.5% 9.1% 9.6% 13.2%

(1) The loan balances presented are not materially different than the pre-modification loan balances as TCF’s loan modifications generally do not forgive principal amounts.

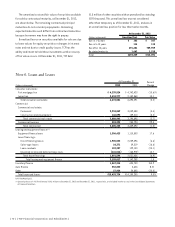

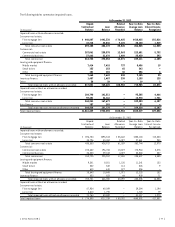

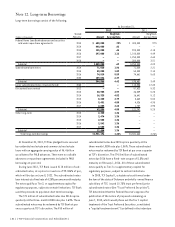

Consumer real estate TDR loans are evaluated

separately in TCF’s allowance methodology. Impairment

is generally based upon the present value of the expected

future cash flows or the fair value of the collateral less

selling expenses for fully collateral-dependent loans. The

allowance on accruing consumer real estate TDR loans

was $82.3 million, or 17.2% of the outstanding balance

at December 31, 2012, and $58.3 million, or 13.5% of the

outstanding balance at December 31, 2011. For consumer

real estate TDR loans, in 2012 TCF utilized average

re-default rates ranging from 10% to 25%, depending on

modification type, in determining impairment, which is

consistent with actual experience. Consumer real estate

loans remain on accruing status upon modification if they

are less than 150 days past due, or six payments owing,

and payment in full under the modified loan terms is

expected. Otherwise, the loans are placed on non-accrual

status and reported as non-accrual until there is sustained

repayment performance for six consecutive payments,

except for loans discharged in Chapter 7 bankruptcy and

not reaffirmed, which permanently remain on non-accrual

status for the remainder of the term of the loan. All

eligible loans are re-aged to current delinquency status

upon modification.

Commercial TDR loans are individually evaluated for

impairment, based upon the present value of the expected

future cash flows or the fair value of the collateral less

selling expenses for fully collateral-dependent loans.

The allowance on accruing commercial loan TDR loans

was $1.5 million, or 1.0% of the outstanding balance,

at December 31, 2012, and $1.4 million, or 1.4% of the

outstanding balance, at December 31, 2011.

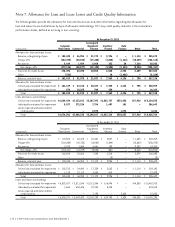

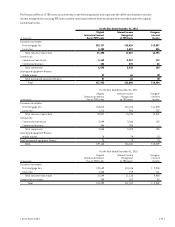

Impaired Loans TCF considers impaired loans to include

non-accrual commercial loans, non-accrual equipment

finance loans and non-accrual inventory finance loans,

as well as all TDR loans. Impaired loans are included in

the previous tables within the amounts disclosed as non-

accrual and the accruing loans. Accruing TDR loans that

are less than 60 days delinquent have been disclosed as

performing within the previous tables of performing and

non-accrual loans and leases. In the following tables, the

loan balance of impaired loans represents the amount

recorded within loans and leases on the Consolidated

Statements of Financial Condition whereas the unpaid

contractual balance represents the balances legally owed

by the borrowers, excluding write-downs.

{ 76 } { TCF Financial Corporation and Subsidiaries }