TCF Bank 2012 Annual Report Download - page 102

Download and view the complete annual report

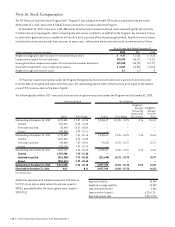

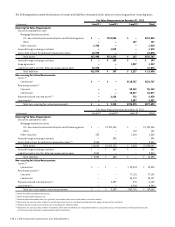

Please find page 102 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TCF Employees Stock Purchase Plan —

Supplemental Plan TCF also maintains the TCF

Employees Stock Purchase Plan — Supplemental Plan,

a non-qualified plan, to which certain employees can

contribute up to 50% of their salary and bonus. TCF

matching contributions to this plan totaled $556 thousand

and $474 thousand in 2012 and 2011, respectively. The

Company made no other contributions to this plan,

other than payment of administrative expenses. The

amounts deferred under the above plan were invested in

TCF common stock or mutual funds. At December 31, 2012,

the fair value of the assets in the plan totaled $19 million

and included $11.5 million invested in TCF common stock,

compared with a total fair value of $14.5 million,

including $8.9 million invested in TCF common stock

at December 31, 2011.

The cost of TCF common stock held by TCF’s deferred

compensation plans is reported separately in a manner

similar to treasury stock (that is, changes in fair value are

not recognized) with a corresponding deferred compensation

obligation reflected in additional paid-in capital.

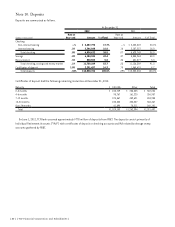

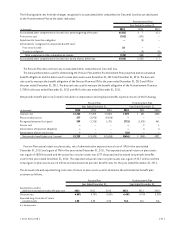

Warrants At December 31, 2012, TCF had 3,199,988

warrants outstanding with an exercise price of $16.93

per share, which expire on November 14, 2018. Upon the

completion of the U.S. Treasury’s secondary public offering

of the warrants issued under the Capital Purchase Program

(“CPP”), in December 2009, the warrants became publicly

traded on the New York Stock Exchange under the symbol

“TCBWS”. As a result, TCF has no further obligations to the

Federal Government in connection with the CPP.

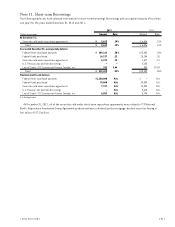

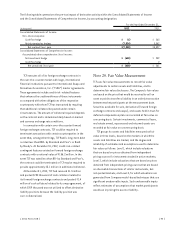

Joint Venture TCF has a joint venture with The Toro

Company (“Toro”) called Red Iron Acceptance, LLC (“Red

Iron”). Red Iron provides U.S. distributors and dealers and

select Canadian distributors of the Toro® and Exmark®

branded products with sources of financing. TCF and Toro

maintain a 55% and 45% ownership interest, respectively,

in Red Iron. As TCF has a controlling financial interest in

Red Iron, its financial results are consolidated in TCF’s

financial statements. Toro’s interest is reported as a non-

controlling interest within equity and qualifies as Tier 1

regulatory capital.

{ 86 } { TCF Financial Corporation and Subsidiaries }