TCF Bank 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

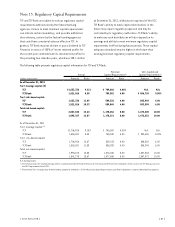

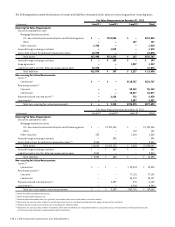

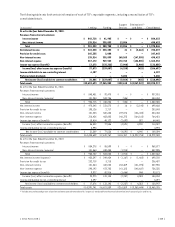

The following tables present the balances of assets and liabilities measured at fair value on a recurring and non-recurring basis.

Fair Value Measurements at December 31, 2012

(In thousands) Level 1(1) Level 2(2) Level 3(3) Total

Recurring Fair Value Measurements:

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored enterprises and federal agencies $ – $710,054 $ – $710,054

Other – – 127 127

Other securities 1,910 – – 1,910

Forward foreign exchange contracts – 1,578 – 1,578

Assets held in trust for deferred compensation plans 12,078 – – 12,078

Total assets $13,988 $711,632 $ 127 $725,747

Forward foreign exchange contracts $ – $ 193 $ – $ 193

Swap agreement – – 1,227 1,227

Liabilities held in trust for deferred compensation plans 12,078 – – 12,078

Total liabilities $12,078 $ 193 $ 1,227 $ 13,498

Non-recurring Fair Value Measurements:

Loans:(4)

Commercial $ – $ – $118,767 $118,767

Real estate owned:(5)

Consumer – – 55,162 55,162

Commercial – – 18,077 18,077

Repossessed and returned assets(5) – 2,218 712 2,930

Investments(6) – – 2,557 2,557

Total non-recurring fair value measurements $ – $ 2,218 $195,275 $197,493

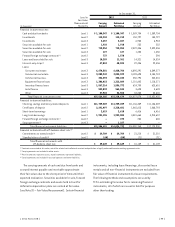

Fair Value Measurements at December 31, 2011

(In thousands) Level 1(1) Level 2(2) Level 3(3) Total

Recurring Fair Value Measurements:

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored enterprises and federal agencies $ – $2,322,336 $ – $2,322,336

Other – – 152 152

Other securities 252 – 1,298 1,550

Forward foreign exchange contracts – 396 – 396

Assets held in trust for deferred compensation plans(4) 9,833 – – 9,833

Total assets $10,085 $2,322,732 $ 1,450 $2,334,267

Forward foreign exchange contracts $ – $ 665 $ – $ 665

Liabilities held in trust for deferred compensation plans 9,833 – – 9,833

Total liabilities $ 9,833 $ 665 $ – $ 10,498

Non-recurring Fair Value Measurements:

Loans:(4)

Commercial $ – $ – $ 29,003 $ 29,003

Real estate owned:(5)

Consumer – – 77,126 77,126

Commercial – – 45,137 45,137

Repossessed and returned assets(5) – 3,889 270 4,159

Investments(6) – – 4,244 4,244

Total non-recurring fair value measurements $ – $ 3,889 $155,780 $ 159,669

(1) Based on readily available market prices.

(2) Based on observable market prices.

(3) Based on valuation models that use significant assumptions that are not observable in an active market.

(4) Represents the carrying value of loans for which impairment reserves are determined based on the appraisal value of the collateral.

(5) Amounts do not include assets held at cost at December 31, 2012 and 2011.

(6) Represents the carrying value of other investments which were recorded at fair value determined by using quoted prices, when available, and incorporating results

of internal pricing techniques and observable market information.

{ 96 } { TCF Financial Corporation and Subsidiaries }