TCF Bank 2012 Annual Report Download - page 69

Download and view the complete annual report

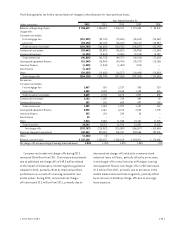

Please find page 69 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rate indices (basis risk). Management measures these risks

and their impact in various ways, including through the

use of simulation and valuation analyses. The interest rate

scenarios may include gradual or rapid changes in interest

rates, spread narrowing and widening, yield curve twists

and changes in assumptions about customer behavior in

various interest rate scenarios.

TCF utilizes net interest income simulation models to

estimate the near-term effects (next one to two years)

of changing interest rates on its net interest income.

Net interest income simulation involves forecasting net

interest income under a variety of scenarios, including

through variation of interest rate levels, the shape of

the yield curve and the spreads between market interest

rates. Management exercises its best judgment in making

assumptions regarding both events that management can

influence, such as non-contractual deposit repricings, and

events outside of its control, such as customer behavior on

loan and deposit activity and the effect that competition

has on both loan and deposit pricing. These assumptions

are inherently uncertain and, as a result, net interest

income simulation results will likely differ from actual

results due to the timing, magnitude and frequency of

interest rate changes, changes in market conditions,

customer behavior and management strategies, among

other factors.

At December 31, 2012, net interest income is estimated to

increase by 3.1%, compared with the base case scenario over

the next 12 months if short- and long-term interest rates

were to sustain an immediate increase of 100 basis points.

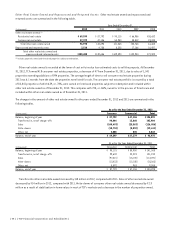

Management also uses valuation analyses to measure

risk in the balance sheet that might not be taken into

account in the net interest income simulation analyses.

Net interest income simulation highlights exposure over

a relatively short time period (12 or 24 months), while

valuation analysis incorporates all cash flows over the

estimated remaining life of all balance sheet positions.

The valuation of the balance sheet, at a point in time,

is defined as the discounted present value of asset cash

flows minus the discounted value of liability cash flows.

Valuation analysis addresses only the current balance

sheet and does not incorporate the growth assumptions

that are used in the net interest income simulation model.

As with the net interest income simulation model, valuation

analysis is based on key assumptions about the timing and

variability of balance sheet cash flows and does not take

into account any potential responses by management to

anticipated changes in interest rates.

Management also utilizes an interest rate gap

measurement, which is calculated by taking the difference

between interest-earning assets and interest-bearing

liabilities repricing within a given period. While the interest

rate gap measurement has some limitations, including

a lack of assumptions regarding future asset or liability

production and a static interest rate assumption, it

represents the net asset or liability sensitivity at a point

in time. An interest rate gap measurement could be

significantly affected by external factors such as loan

prepayments, early withdrawals of deposits, changes in

the correlation of various interest-bearing instruments,

competition or a rise or decline in interest rates.

TCF’s one-year interest rate gap was a positive $903.9

million, or 5% of total assets, at December 31, 2012,

compared with a positive $2.1 billion, or 10.9% of total

assets, at December 31, 2011. The change in the gap from

the previous year-end is primarily due to the balance sheet

repositioning completed in the first quarter of 2012 and

growth of fixed-rate auto loans, partially offset by growth

in certificates of deposit with maturities greater than one

year. A positive interest rate gap position exists when the

amount of interest-earning assets maturing or repricing

exceeds the amount of interest-bearing liabilities

maturing or repricing, including assumed prepayments,

within a particular time period. A negative interest rate

gap position exists when the amount of interest-bearing

liabilities maturing or repricing exceeds the amount of

interest-earning assets maturing or repricing, including

assumed prepayments, within a particular time period.

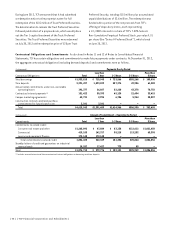

TCF estimates that an immediate 25 basis point

decrease in current mortgage loan interest rates would

increase prepayments on the $4.6 billion of fixed-rate

mortgage-backed securities and consumer real estate

loans at December 31, 2012, by approximately $48 million,

or 10%, in the first year. An increase in prepayments

would decrease the estimated life of the portfolios

and may adversely impact net interest income or net

interest margin in the future. Although prepayments

on fixed-rate portfolios are currently at a relatively

low level, TCF estimates that an immediate 100 basis

point increase in current mortgage loan interest rates

would reduce prepayments on the fixed-rate mortgage-

backed securities, residential real estate loans and

consumer loans at December 31, 2012, by approximately

{ 2012 Form 10K } { 53 }