TCF Bank 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

at the Federal Reserve. TCF has also issued preferred

stock and subordinated debt in 2012 to help fund future

asset growth and is actively identifying alternative

funding sources that may be beneficial in the future,

such as developing securitization capabilities.

To execute on our asset growth strategy moving

forward, TCF needs to have diversified funding

sources and flexibility in place to take advantage of

marketplace opportunities. With the actions taken in

2012 and the management structure in place, we are

well-positioned to meet our goals in 2013.

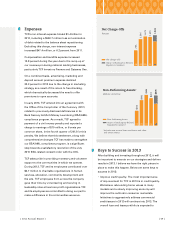

Revenue

In 2012, TCF worked to further diversify its revenue

sources. TCF, as a result of its large deposit account

base, has long been regarded as having a strong

fee-based revenue stream. With the implementation

of Regulation E in 2010 and the Durbin Amendment

in 2011, TCF has moved toward becoming more of a

spread-based business through its balance sheet

repositioning and emphasis on national lending.

TCF’s total revenue was $1.3 billion in 2012, up

11 percent from 2011. Net interest income increased

11.5 percent while non-interest income increased

10.3 percent. The reduction in long-term debt and

the growth in the higher yielding national lending

businesses have allowed TCF to create additional

net interest income.

Banking fees and service charges decreased

18.9 percent in 2012 due to the impact of regulatory

changes and a reduced checking account base

resulting from the impact of product changes made

in 2011. Now that free checking is back at TCF, we

have recently seen increases in gross account

production, decreases in attrition and reduced

premium expense to open accounts. It will take some

time to restore our checking account base and make

up the lost maintenance fee revenue, but with the

return of free checking, we are optimistic we can

meet this goal in 2013.

While leasing and equipment finance revenue of

$92.7 million, up 4 percent in 2012, continues to be a

key revenue source for TCF, we introduced additional

core revenue sources during the year with the gains

from the sales of auto loans and consumer real

estate loans. We expect these loan sales to remain

core sources of revenue in 2013.

Card revenue in 2012 totaled $52.6 million, a 45.3

percent decline from 2011 due to the full year impact

of the Durbin Amendment, which went into effect in

October 2011. Increased net interest income resulting

from the balance sheet repositioning as well as new

core revenue sources, including the gains from the

sales of loans, have and are expected to continue to

play a significant role in replacing this lost revenue.

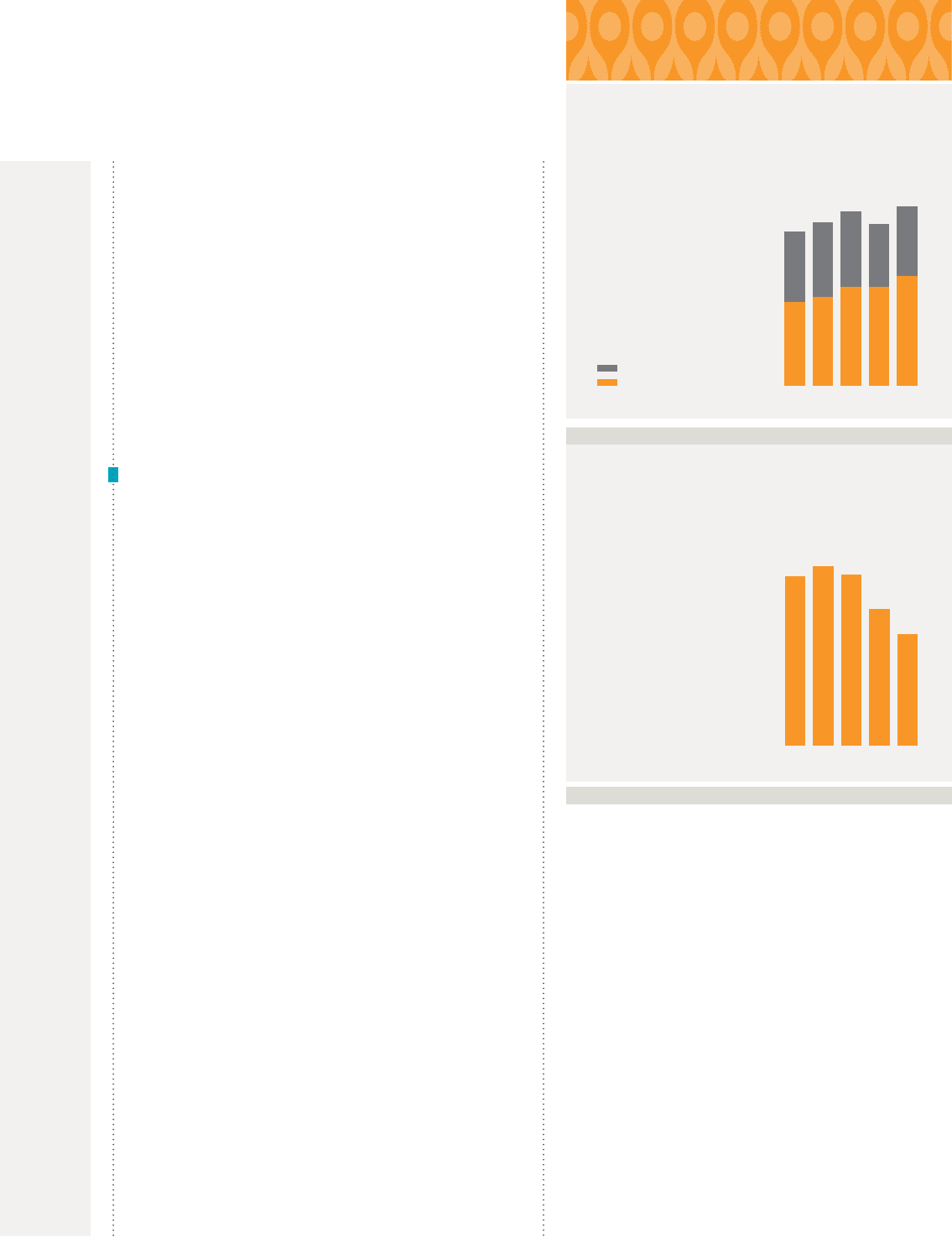

Fees & Service

Charges

Millions of Dollars

1211100908

$178

$271

$287

$273

$219

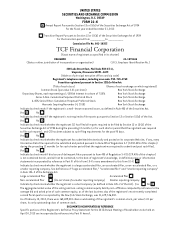

Total Revenue

Millions of Dollars

1211100908

$1,27

0

$1,092

$1,159

$1,237

$1,144

Net Interest Income

Non-Interest Income

{ 2012 Annual Report } { 07 }