TCF Bank 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

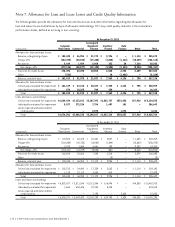

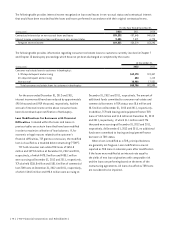

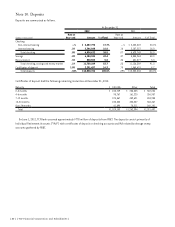

Note 7. Allowance for Loan and Lease Losses and Credit Quality Information

The following tables provide the allowance for loan and lease losses and other information regarding the allowance for

loan and leases losses and balances by type of allowance methodology. TCF’s key credit quality indicator is the receivable’s

performance status, defined as accruing or non-accruing.

At December 31, 2012

(In thousands)

Consumer

Real Estate Commercial

Leasing and

Equipment

Finance

Inventory

Finance

Auto

Finance Other Total

Allowance for loan and lease losses:

Balance, at beginning of year $ 183,435 $ 46,954 $ 21,173 $ 2,996 $ – $ 1,114 $ 255,672

Charge-offs (184,785) (40,836) (15,248) (1,838) (1,164) (10,239) (254,110)

Recoveries 5,649 1,959 5,058 333 30 7,314 20,343

Net charge-offs (179,136) (38,877) (10,190) (1,505) (1,134) (2,925) (233,767)

Provision for credit losses 178,496 43,498 10,054 6,060 6,726 2,609 247,443

Other (782) – – 18 (1,456) – (2,220)

Balance, at end of year $ 182,013 $ 51,575 $ 21,037 $ 7,569 $ 4,136 $ 798 $ 267,128

Allowance for loan and lease losses:

Collectively evaluated for impairment $ 181,139 $ 37,210 $ 20,337 $ 7,339 $ 4,136 $ 798 $ 250,959

Individually evaluated for impairment 874 14,365 700 230 – – 16,169

Total $ 182,013 $ 51,575 $ 21,037 $ 7,569 $ 4,136 $ 798 $ 267,128

Loans and leases outstanding:

Collectively evaluated for impairment $6,669,424 $3,133,011 $3,187,393 $1,565,727 $551,456 $27,924 $15,134,935

Individually evaluated for impairment 5,077 272,224 7,754 1,487 101 – 286,643

Loans acquired with deteriorated

credit quality – – 2,870 – 1,276 – 4,146

Total $6,674,501 $3,405,235 $3,198,017 $1,567,214 $552,833 $27,924 $15,425,724

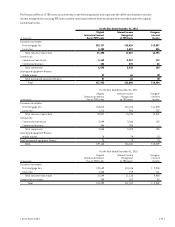

At December 31, 2011

(In thousands)

Consumer

Real Estate Commercial

Leasing and

Equipment

Finance

Inventory

Finance

Auto

Finance Other Total

Allowance for loan and lease losses:

Balance, at beginning of year $ 172,850 $ 62,478 $ 26,301 $ 2,537 $ – $ 1,653 $ 265,819

Charge-offs (156,854) (42,733) (16,984) (1,044) – (12,680) (230,295)

Recoveries 3,743 1,654 4,461 193 – 9,262 19,313

Net charge-offs (153,111) (41,079) (12,523) (851) – (3,418) (210,982)

Provision for credit losses 163,696 25,555 7,395 1,318 – 2,879 200,843

Other – – – (8) – – (8)

Balance, at end of year $ 183,435 $ 46,954 $ 21,173 $ 2,996 $ – $ 1,114 $ 255,672

Allowance for loan and lease losses:

Collectively evaluated for impairment $ 182,315 $ 24,842 $ 17,339 $ 2,583 $ – $ 1,114 $ 228,193

Individually evaluated for impairment 1,120 22,112 3,834 413 – – 27,479

Total $ 183,435 $ 46,954 $ 21,173 $ 2,996 $ – $ 1,114 $ 255,672

Loans and leases outstanding:

Collectively evaluated for impairment $ 6,887,627 $ 2,811,046 $ 3,112,864 $ 616,496 $ – $34,885 $ 13,462,918

Individually evaluated for impairment 7,664 638,446 22,200 8,204 – – 676,514

Loans acquired with deteriorated

credit quality – – 7,195 – 3,628 – 10,823

Total $ 6,895,291 $ 3,449,492 $ 3,142,259 $ 624,700 $ 3,628 $34,885 $ 14,150,255

{ 72 } { TCF Financial Corporation and Subsidiaries }