TCF Bank 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TCF Bank is required to hold Federal Reserve Bank stock

equal to 6% of TCF Bank’s capital surplus, which is additional

paid in capital stock, less any deficit retained earnings, gains

(losses) on available for sale securities, and foreign currency

translation adjustments as of the current period end. Other

investments primarily consist of non-trading mortgage-

backed securities and other bonds which qualify for

investment credit under the Community Reinvestment Act.

During 2012, TCF recorded an impairment charge of

$865 thousand on other investments, which had a carrying

value of $5.7 million at December 31, 2012, as full recovery

is not expected. During 2011, TCF recorded an impairment

charge of $16 thousand on other investments, which had a

carrying value of $7 million at December 31, 2011.

During the second quarter of 2012, TCF sold its Visa

Class B stock, resulting in a net $13.1 million pretax gain

recorded in non-interest income within the Consolidated

Statement of Income. In conjunction with the sale, TCF

and the purchaser entered into a derivative transaction

whereby TCF will make, or receive, cash payments whenever

the conversion ratio of Visa Class B stock into Visa Class A

stock is adjusted.

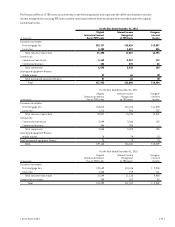

The carrying values and yields on investments at

December 31, 2012, by contractual maturity, are shown below.

(Dollars in thousands)

Carrying

Value Yield

Due in one year or less $ 100 1.00%

Due in 1-5 years 1,600 3.31

Due in 5-10 years 1,000 3.00

Due after 10 years 2,957 5.55

No stated maturity 115,210 3.73

Total $120,867 3.76%

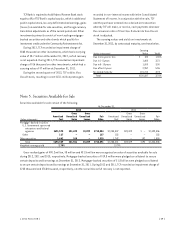

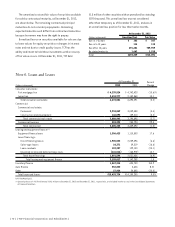

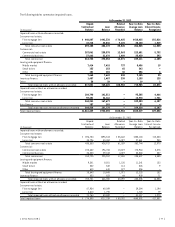

Note 5. Securities Available for Sale

Securities available for sale consist of the following.

At December 31,

2012 2011

(Dollars in thousands)

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Mortgage-backed securities

U.S. Government sponsored

enterprises and federal

agencies $691,570 $21,693 $3,209 $710,054 $2,233,307 $89,029 $ – $2,322,336

Other 127 – – 127 152 – – 152

Other securities 1,642 268 – 1,910 1,742 – 192 1,550

Total $693,339 $21,961 $3,209 $712,091 $2,235,201 $89,029 $192 $2,324,038

Weighted-average yield 2.70% 3.79%

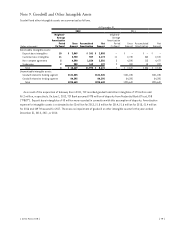

Gross realized gains of $90.2 million, $8 million and $31.5 million were recognized on sales of securities available for sale

during 2012, 2011 and 2010, respectively. Mortgage-backed securities of $19.8 million were pledged as collateral to secure

certain deposits and borrowings at December 31, 2012. Mortgage-backed securities of $1.8 billion were pledged as collateral

to secure certain deposits and borrowings at December 31, 2011. During 2012 and 2011, TCF recorded an impairment charge of

$225 thousand and $768 thousand, respectively, on other securities as full recovery is not expected.

{ 2012 Form 10K } { 69 }