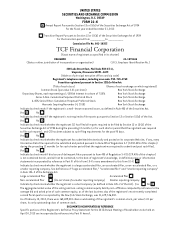

TCF Bank 2012 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8 campus branches. TCF operates 194 branches in Illinois,

108 in Minnesota, 53 in Michigan, 36 in Colorado, 25 in

Wisconsin, 7 in Arizona, 4 in Indiana and 1 in South Dakota.

Of its 228 supermarket branches, TCF had 157 branches in

SUPERVALU’s Jewel-Osco® stores at December 31, 2012. See

Item 1A. Risk Factors for additional information regarding

the risks related to TCF’s supermarket branch relationships.

Campus banking represents an important part of

TCF’s branch banking business. TCF has alliances with the

University of Minnesota, the University of Michigan, the

University of Illinois and two other universities. These

alliances include exclusive marketing, naming rights and

other agreements. Branches have been opened on many of

the college campuses of these universities. TCF provides

multi-purpose campus cards for many of these universities.

These cards serve as a school identification card, ATM card,

library card, security card, health care card, phone card

and stored value card for vending machines or similar uses.

As of April 2012, TCF was ranked the 5th largest in number

of campus card banking relationships in the United States.

At December 31, 2012, there were $284.5 million in campus

deposits. TCF has a 25-year naming rights agreement with

the University of Minnesota to sponsor its on-campus

football stadium, “TCF Bank Stadium®

,” which opened in 2009.

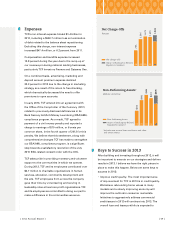

Non-interest income is a significant source of

revenue for TCF and an important factor in TCF’s results of

operations. Maintaining fee and service charge revenue

has been challenging as a result of economic conditions,

changing customer behavior and the impact of regulations.

Providing a wide range of branch banking services is an

integral component of TCF’s business philosophy and a major

strategy for generating additional non-interest income.

TCF offers retail checking account customers low-cost,

convenient access to funds at local merchants and ATMs

through its debit card programs. TCF’s debit card programs

are supported by interchange fees charged to retailers. Key

drivers of banking fees and service charges are the number

of deposit accounts and related transaction activity.

TCF’s card revenues have been impacted by the Durbin

Amendment to the Dodd-Frank Wall Street Reform and

Consumer Protection Act of 2010 (the “Dodd-Frank

Act”), which regulates debit-card interchange fees. The

final rule, which became effective on October 1, 2011,

sets a base interchange fee limit of 21 cents, plus a per

transaction component of 5 basis points, and a one cent

charge if issuers comply with certain fraud protection

provisions. The impact of the rule resulted in a decrease

in TCF’s card revenue of $43.2 million, or 45%, for the year

ended December 31, 2012 compared with the year ended

December 31, 2011. See “Item 7. Management’s Discussion

and Analysis — Consolidated Income Statement Analysis —

Non-Interest Income” for additional information.

Treasury Services Treasury Services’ primary responsibility

is management of liquidity, capital, interest rate risk, and

portfolio investments and borrowings. Treasury Services

has authority to invest in various types of liquid assets

including, but not limited to, United States Department of

the Treasury (“U.S. Treasury”) obligations and securities

of various federal agencies and U.S. Government sponsored

enterprises, deposits of insured banks, bankers’ acceptances

and federal funds. Treasury Services also has the authority

to enter into wholesale borrowing transactions which may

be used to compensate for reductions in deposit inflows

or net deposit outflows, or to support lending, leasing and

other expansion activities. These borrowings may include

Federal Home Loan Bank (“FHLB”) advances, repurchase

agreements, federal funds, and other permitted borrowings

from credit worthy counterparties.

Information concerning TCF’s FHLB advances, repurchase

agreements, federal funds and other borrowings is set forth in

“Item 7. Management’s Discussion and Analysis — Consolidated

Financial Condition Analysis — Borrowings” and in Notes 11 and

12 of Notes to Consolidated Financial Statements.

Support Services

TCF’s support services business segment consists of the

holding company and corporate functions that provide data

processing, bank operations and other professional services

to the operating segments.

Other Information

Activities of Subsidiaries of TCF TCF’s business

operations include those conducted by direct and indirect

subsidiaries of TCF Financial, all of which are consolidated

for purposes of preparing TCF’s consolidated financial

statements. TCF Bank’s subsidiaries principally engage in

leasing and equipment finance, inventory finance and

auto finance activities. See “Item 1. Business — Lending”

for more information.

Competition TCF competes with a number of depository

institutions and financial service providers and experiences

significant competition in attracting and retaining deposits

and in lending funds. Direct competition for deposits comes

primarily from banks, savings institutions, credit unions

{ 2012 Form 10K } { 3 }