TCF Bank 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the amount of impairment. Impairment losses, if any,

are recorded as a charge to non-interest expense and an

adjustment to the carrying value of goodwill.

Other intangible assets are reviewed for impairment

whenever events or changes in circumstances indicate

their carrying amount may not be recoverable. Impairment

is indicated if the sum of the undiscounted estimated

future net cash flows is less than the carrying value of the

intangible asset. Impairment losses, if any, permanently

reduce the carrying value of the other intangible assets.

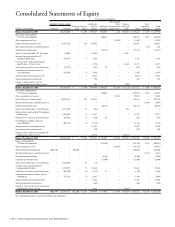

Stock-Based Compensation The fair value of

restricted stock and stock options is determined on the

date of grant and amortized to compensation expense,

with a corresponding increase in additional paid-in capital,

over the longer of the service period or performance period,

but in no event beyond an employee’s retirement date

or date of employment termination. For performance-

based restricted stock, TCF estimates the degree to

which performance conditions will be met to determine

the number of shares that will vest and the related

compensation expense. Compensation expense is adjusted

in the period such estimates change. Non-forfeitable

dividends, if any, paid on shares of restricted stock are

recorded to retained earnings for shares that are expected

to vest and to compensation expense for shares that are

not expected to vest.

Income tax benefits related to stock compensation,

in excess of grant date fair value less any proceeds on

exercise, are recognized as additional paid-in capital

upon vesting or exercise and delivery of the stock. Any

income tax benefits that are less than grant date fair

value less any proceeds on exercise are recognized as

a reduction of additional paid in capital to the extent

of previously recognized income tax benefits and then

as income tax expense for any remaining amount. See

Note 16, Stock Compensation, for additional information

concerning stock-based compensation.

Deposit Account Overdrafts Deposit account overdrafts

are reported in other loans and leases. Net losses on

uncollectible overdrafts are reported as net charge-offs

in the allowance for loan and lease losses within 60 days

from the date of overdraft. Uncollectible deposit fees are

reversed against fees and service charges and a related

reserve for uncollectible deposit fees is maintained in other

liabilities. Other deposit account losses are reported in

other non-interest expense.

Note 2. Business Combination

On November 30, 2011, TCF Bank entered the auto finance

business with the acquisition of 100% of the outstanding

common shares of Gateway One Lending & Finance, LLC

(“Gateway One”), a privately held lending company that

indirectly originates loans on new and used autos to

consumers through established dealer relationships.

As a result of the acquisition, Gateway One became a

wholly-owned subsidiary of TCF Bank and, accordingly,

its results of operations have been included within TCF’s

consolidated financial statements since November 30, 2011.

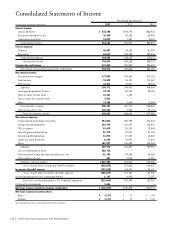

TCF’s Consolidated Statements of Income for the year ended

December 31, 2011 included net interest income, non-

interest income and net income of Gateway One totaling

$282 thousand, $1.9 million and $89 thousand,

respectively. During the fourth quarter of 2011, TCF

recognized $2 million of acquisition costs. These costs

are reported in other non-interest expense within the

Consolidated Statement of Income for the year ended

December 31, 2011.

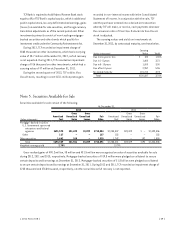

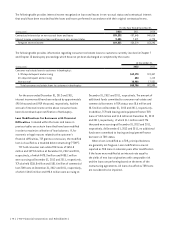

The following unaudited pro forma financial information

presents the combined results of operations of TCF and

Gateway One as if the acquisition had been effective

January 1, 2010. These results include the impact of

amortizing certain purchase accounting adjustments such

as intangible assets, compensation expenses and the

impact of the acquisition on income tax expense. There

were no material nonrecurring pro forma adjustments

directly attributable to the acquisition included within the

following pro forma financial information. The pro forma

financial information does not necessarily reflect the

results of operations that would have occurred had TCF and

Gateway One constituted a single entity during such periods.

Years Ended December 31,

(In thousands, except per-share data)

2011

Unaudited

2010

Unaudited

Interest income $943,776 $978,623

Net interest income 704,693 706,556

Non-interest income 458,998 547,940

Net income available to common

stockholders 107,597 150,613

Basic net income per common share $ .70 $ 1.08

Diluted net income per common share $ .69 $ 1.08

{ 2012 Form 10K } { 67 }