TCF Bank 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II

Item 5. Market for Registrant’s

Common Equity, Related

Stockholder Matters and Issuer

Purchases of Equity Securities

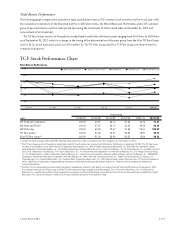

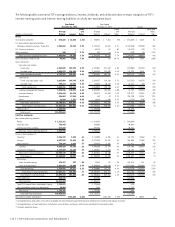

TCF’s common stock trades on the New York Stock Exchange

under the symbol “TCB”. The following table sets forth

the high and low prices and dividends declared for TCF’s

common stock. The stock prices represent the high and low

sale prices for TCF common stock on the New York Stock

Exchange Composite Tape, as reported by Bloomberg.

As of January 31, 2013, there were 6,619 holders of

record of TCF’s common stock.

High Low

Dividends

Declared

2012

Fourth Quarter $12.49 $10.45 $.05

Third Quarter 12.43 9.59 .05

Second Quarter 12.53 10.43 .05

First Quarter 12.58 10.04 .05

2011

Fourth Quarter $11.68 $ 8.61 $.05

Third Quarter 14.37 8.66 .05

Second Quarter 16.04 13.37 .05

First Quarter 17.37 14.60 .05

The Board of Directors of TCF Financial and TCF Bank have

each adopted a Capital Plan and Dividend Policy. The policies

define how enterprise risk related to capital will be managed,

how the adequacy of capital will be measured and the

process by which capital strategy, capital management and

preferred and common stock dividend recommendations will

be presented to TCF’s Board of Directors. TCF’s management

is charged with ensuring that capital strategy actions,

including the declaration of preferred and common stock

dividends, are prudent, efficient and provide value to TCF’s

stockholders, while ensuring that past and prospective

earnings retention is consistent with TCF’s capital needs,

asset quality, risk profile and overall financial condition. The

Board of Directors intends to continue its practice of paying

quarterly cash dividends on TCF’s common stock as justified

by the financial condition of TCF. The declaration and amount

of future dividends will depend on circumstances existing

at the time, including TCF’s earnings, level of internally

generated common capital excluding earnings, financial

condition and capital requirements, the cash available

to pay such dividends (derived mainly from dividends

and distributions from TCF Bank), as well as regulatory

and contractual limitations and such other factors as the

Board of Directors may deem relevant. Also, dividends

for the current dividend period on all outstanding shares

of preferred stock must be declared and paid or declared

and a sum sufficient for the payment thereof must be set

aside before any dividend may be declared or paid on TCF’s

common stock. In general, TCF Bank may not declare or pay a

dividend to TCF Financial in excess of 100% of its net retained

profits for that year combined with its net retained profits

for the preceding two calendar years without prior approval

of the OCC. Restrictions on the ability of TCF Bank to pay cash

dividends or possible diminished earnings of TCF may limit

the ability of TCF Financial to pay dividends in the future

to holders of its preferred and common stock. In addition,

the ability of TCF Financial and TCF Bank to pay dividends

depends on regulatory policies and capital requirements and

may be subject to regulatory approval. See “Item 1. Business

— Regulation — Regulatory Capital Requirements”, “Item 1.

Business — Regulation — Restrictions on Distributions” and

Note 15 of Notes to Consolidated Financial Statements.

{ 16 } { TCF Financial Corporation and Subsidiaries }