TCF Bank 2012 Annual Report Download - page 38

Download and view the complete annual report

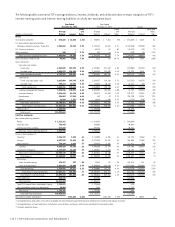

Please find page 38 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.non-interest income. Key drivers of bank fees and service

charges are the number of deposit accounts and related

transaction activity.

In 2011, TCF introduced a new anchor checking account

that replaced its free checking product. This new anchor

checking account required a monthly maintenance fee

if specific requirements were not met by the customer.

After listening to customer feedback, in June 2012,

TCF introduced TCF Free CheckingSM to focus on quality

customer relationships. TCF Free Checking has no monthly

maintenance fee and no minimum balance requirement.

TCF continues to be the 15th largest issuer of Visa®

consumer debit cards in the United States, based on payment

volumes for the three months ended September 30, 2012,

as provided by Visa. TCF earns interchange revenue from

customer card transactions paid primarily by merchants, not

TCF’s customers. In October 2011, Section 1075 (commonly

known as the “Durbin Amendment”) of the Dodd-Frank

Wall Street Reform and Consumer Protection Act of 2010

(the “Dodd-Frank Act”) went into effect, which reduced the

amount of interchange revenue recognized on transaction

activity. For 2012, the Durbin Amendment was in effect for

the full year.

Over the years, TCF has diversified its revenue sources

through the growth of its national lending businesses.

These businesses generate a growing portion of fee revenue

through leasing revenue, gain on sale of loans and other

fees for value-added services and products provided.

The following portions of Management’s Discussion and

Analysis of Financial Condition and Results of Operations

(“Management’s Discussion and Analysis”) focus in more

detail on the results of operations for 2012, 2011 and 2010

and on information about TCF’s balance sheet, loan and

lease portfolio, liquidity, funding resources, capital and

other matters.

Results of Operations

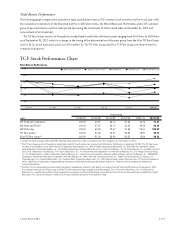

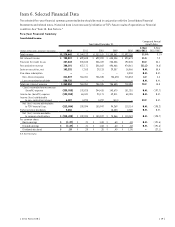

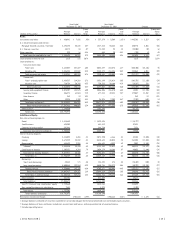

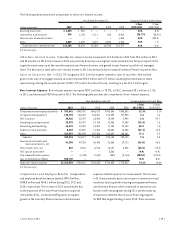

Performance Summary TCF reported diluted loss per

common share of $1.37 for 2012, compared with diluted

earnings per common share of 71 cents for 2011 and $1.08

for 2010. TCF reported a net loss of $218.5 million for the

year ended December 31, 2012, compared with net income

of $109.4 million and $150.9 million for the years ended

December 31, 2011 and 2010, respectively. TCF’s 2012 net

loss included a net, after-tax charge of $295.8 million, or

$1.87 per common share, related to the repositioning of

TCF’s balance sheet completed in the first quarter of 2012.

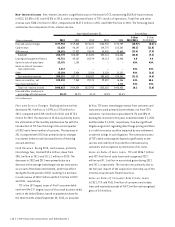

On March 13, 2012, TCF announced the repositioning

of its balance sheet by prepaying $3.6 billion of long-

term debt and selling $1.9 billion of mortgage-backed

securities, which resulted in a $119.9 million reduction to

the cost of borrowings, partially offset by a $47.1 million

reduction of interest income on lower levels of mortgage-

backed securities for 2012. TCF’s long-term, fixed-rate debt

was originated at market rates that prevailed prior to the

2008 economic crisis and were significantly above current

market rates. In addition, in late January 2012, the Federal

Reserve forecasted interest rates to remain at historically

low levels through at least 2014. As a result, this action

better positioned TCF for the current interest rate outlook

while reducing interest rate risk.

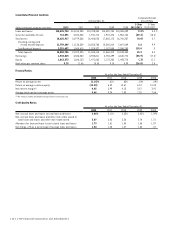

The return on average assets was a negative 1.14% in

2012, compared with positive returns on average assets

of .61% in 2011 and .85% in 2010. The return on common

equity was a negative 13.33% in 2012, compared with a

positive return of 6.32% in 2011 and 10.67% in 2010. The

effective income tax rate for 2012 was 39.1%, compared

with 36% in 2011 and 36.9% in 2010.

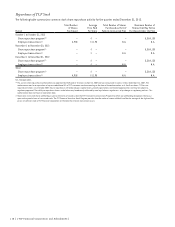

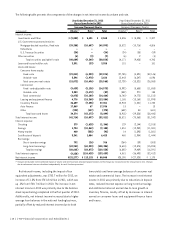

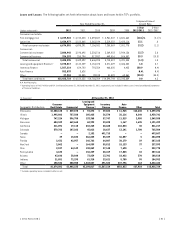

Reportable Segment Results LENDING–TCF’s lending

strategy is to originate high credit quality, primarily

secured, loans and leases. The lending portfolio consists of

retail lending, commercial banking and the national lending

businesses. The national lending businesses are comprised

of leasing and equipment finance, inventory finance and

auto finance. Lending’s consistent disciplined portfolio

growth generates earning assets and, along with its fee

generating capabilities, produces a significant portion

of the Company’s revenue. Lending generated net income

attributable to common stockholders of $30.9 million for

2012, compared with net income of $31.5 million in 2011.

Lending net interest income for 2012 was $524.4 million,

up 11.5% from $470.2 million for 2011. This increase was

primarily due to an increase in the average balances in the

national lending businesses, partially offset by yield com-

pression due to the continued low interest rate environment.

Lending provision for credit losses totaled $245.4 million in

2012, up 23.8% from $198.1 million for 2011. The increase was

primarily due to the implementation of clarifying regulatory

guidance on consumer loans and increased provision in the

commercial portfolio as TCF aggressively addressed credit

issues. See Item 7. Management’s Discussion and Analysis

— “Consolidated Income Statement Analysis — Provision for

Credit Losses” section for further discussion.

{ 22 } { TCF Financial Corporation and Subsidiaries }