TCF Bank 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

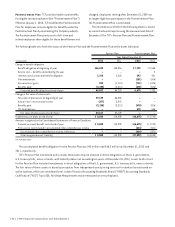

Postretirement Plan TCF provides health care benefits

for eligible retired employees (the “Postretirement Plan”).

Effective January 1, 2000, TCF modified the Postretirement

Plan for employees not yet eligible for benefits under the

Postretirement Plan by eliminating the Company subsidy.

The Postretirement Plan provisions for full-time and

retired employees then eligible for these benefits were not

changed. Employees retiring after December 31, 2009 are

no longer eligible to participate in the Postretirement Plan.

The Postretirement Plan is not funded.

The information set forth in the following tables is based

on current actuarial reports using the measurement date of

December 31 for TCF’s Pension Plan and Postretirement Plan.

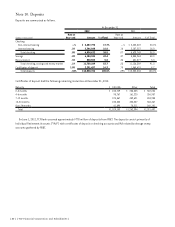

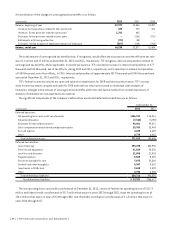

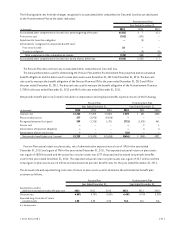

The following table sets forth the status of the Pension Plan and the Postretirement Plan at the dates indicated.

Pension Plan Postretirement Plan

Year Ended December 31,

(In thousands) 2012 2011 2012 2011

Change in benefit obligation

Benefit obligation at beginning of year $46,220 $48,916 $ 7,732 $ 9,555

Service cost — benefits earned during the year – – – 2

Interest cost on projected benefit obligation 1,763 2,223 293 431

Plan amendment – – (151) (304)

Actuarial loss (gain) 289 (1,718) (721) (1,426)

Benefits paid (3,235) (3,201) (478) (526)

Projected benefit obligation at end of year 45,037 46,220 6,675 7,732

Change in fair value of plan assets:

Fair value of plan assets at beginning of year 57,129 56,355 – –

Actual (loss) return on plan assets (277) 3,975 – –

Benefits paid (3,235) (3,201) (478) (526)

TCF Contributions – – 478 526

Fair value of plan assets at end of year 53,617 57,129 – –

Funded status of plans at end of year $ 8,580 $10,909 $(6,675) $(7,732)

Amounts recognized in the Consolidated Statements of Financial Condition:

Prepaid (accrued) benefit cost at end of year $ 8,580 $10,909 $(6,675) $(7,732)

Prior service cost included in accumulated other comprehensive income – – (424) (301)

Accumulated other comprehensive income, before tax – – (424) (301)

Total recognized asset (liability) $ 8,580 $10,909 $(7,099) $(8,033)

N.A. Not Applicable.

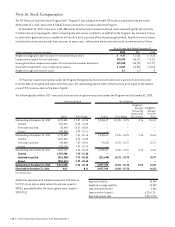

The accumulated benefit obligation for the Pension Plan was $45 million and $46.2 million at December 31, 2012 and

2011, respectively.

TCF’s Pension Plan investment policy states that assets may be invested in direct obligations of the U.S. government,

U.S. treasury bills, notes or bonds, with maturity dates not exceeding ten years. At December 31, 2012, assets held in trust

for the Pension Plan included investments in direct obligations of the U.S. government, U.S. treasury bills, notes or bonds.

The fair value of these assets is based upon quotes from independent asset pricing services for identical assets based on

active markets, which are considered Level 1 under Financial Accounting Standards Board (“FASB”) Accounting Standards

Codification (“ASC”) Topic 820, Fair Value Measurements and are measured on a recurring basis.

{ 90 } { TCF Financial Corporation and Subsidiaries }