TCF Bank 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In late 2011, TCF announced an agreement for TCF

Inventory Finance to provide inventory financing to

the dealers of Bombardier Recreational Products,

Inc. (BRP) in the U.S. and Canada adding approxi-

mately 1,200 dealers to its already growing

footprint. The acquisition of Gateway One

Lending & Finance, Inc. (Gateway One), an

indirect auto finance company, completed in late

November 2011, added an additional consumer

lending channel to our organization. In addition,

TCF announced in March 2012 the creation of TCF

Capital Funding, a new commercial banking

division specializing in asset-based and cash flow

lending to smaller middle market companies across

the U.S. As a result of these key additions, TCF’s

loan and lease portfolio grew 9 percent in 2012.

The emphasis on national lending platforms has

had a significant impact on lending as a whole at

TCF. Instead of having to rely on growing commer-

cial and consumer loans regionally in a very

competitive pricing environment, we now have the

ability to be more selective given our asset growth

and diversification opportunities through national

lending platforms.

• Balance Sheet Repositioning

In March 2012, TCF repositioned its balance sheet

by prepaying $3.6 billion of long-term debt and

selling $1.9 billion of mortgage-backed securities.

While this action resulted in a one-time, net

after-tax charge of $295.8 million, the elimination

of higher cost, longer term debt has had the

beneficial impacts we expected. We now have

a more flexible funding structure which better

supports TCF’s strategic focus on growth in shorter

duration assets. The balance sheet repositioning

also had a positive impact on TCF’s net interest

margin which was 4.65 percent in 2012, up 66

basis points from 2011. The increase has primarily

been driven by the elimination of higher cost,

long-term debt and the growth in our higher

yielding national lending businesses. We believe

that TCF is positioned to continue to have one of

the highest net interest margins in the industry.

We have also reduced our mark-to-market risk on

securities and net interest income at risk, which

should better position us when interest rates

eventually rise.

• Deposit Acquisition

TCF acquired $778 million of deposits from

Prudential Bank & Trust, FSB in June 2012. The

deposit acquisition has provided a diversified and

stable portfolio of deposit funding from accounts

located throughout the U.S.

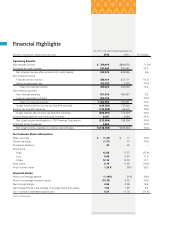

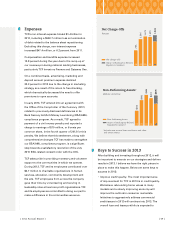

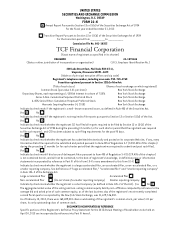

Net Interest Margin

Percent

1211100908

4.65%

3.91%

3.87%

4.15%

3.99%

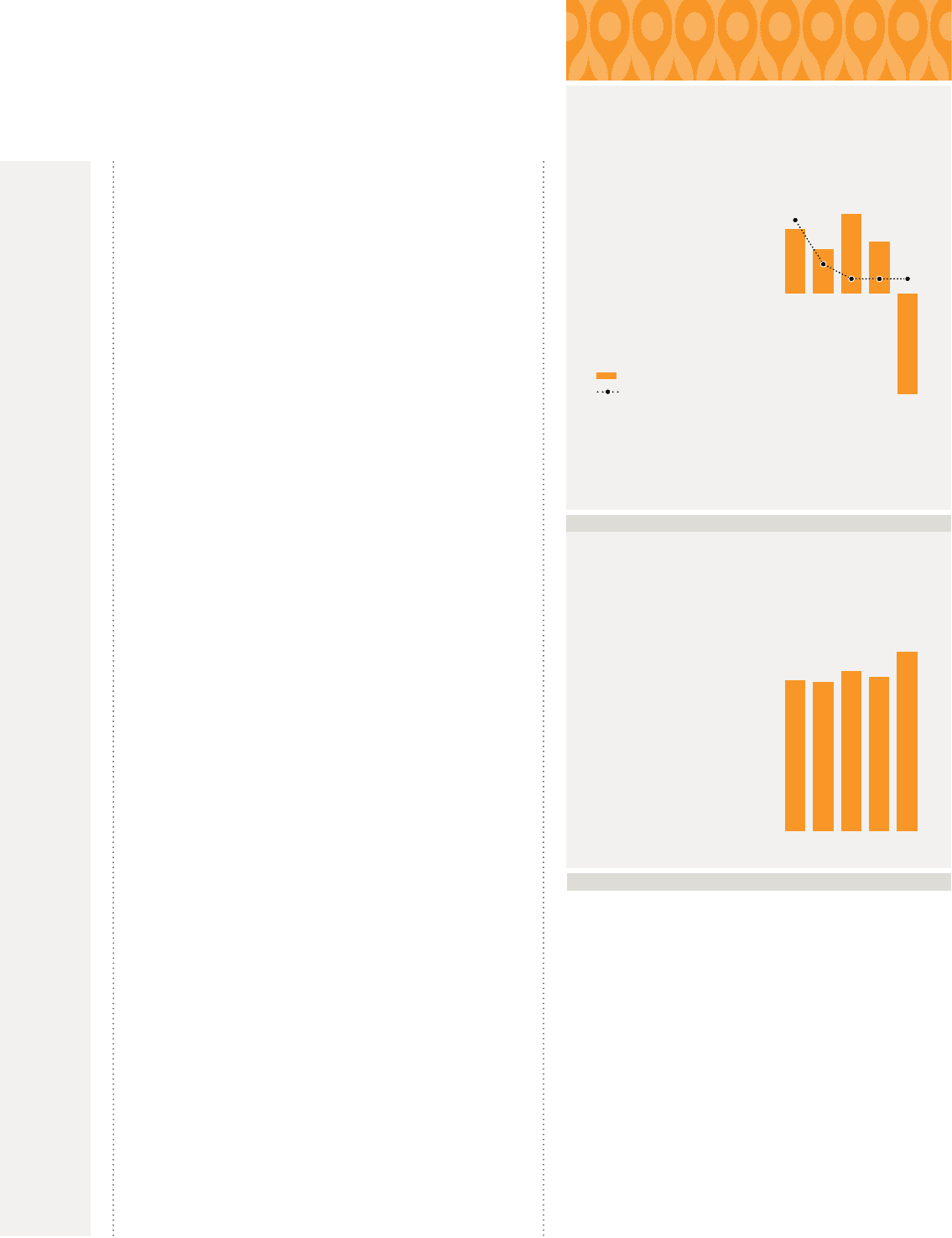

Diluted Earnings

Per Common Share

Dollars

1

Includes a net, after-tax charge of $295.8 million or $1.87 per

share, related to repositioning TCF’s balance sheet in the rst

quarter of 2012.

Diluted EPS

1211100908

$(1.37)1

$.88

$.60

$1.08

$.71

Dividends Paid

{ 2012 Annual Report } { 03 }