TCF Bank 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

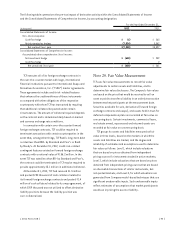

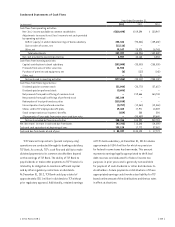

Management assesses the appropriate classification

of financial assets and liabilities within the fair value

hierarchy by monitoring the level of availability of

observable market information. Changes in market and/

or economic conditions, as well as to Company valuation

models may require the transfer of financial instruments

from one fair value level to another. Such transfers, if

any, represent the fair values as of the beginning of the

quarter in which the transfer occurred. For the year ended

December 31, 2012, TCF transferred approximately $1.1

million of securities from Level 3 to Level 1 due to the

adoption of new FASB guidance in the first quarter of 2012.

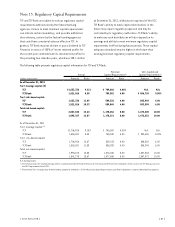

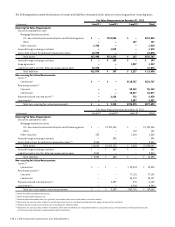

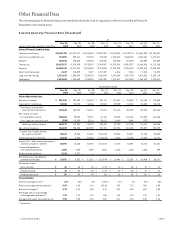

The following table presents changes in Level 3 assets

and liabilities measured at fair value on a recurring basis.

Year Ended December 31, 2012

(In thousands) Assets Liabilities

Balance, beginning of year $ 1,450 $ –

Transfers out of Level 3 (1,098) –

Total net losses for the period:

Included in net (loss) income – (150)

Included in other comprehensive

(loss) income (100) –

Purchases – (1,434)

Principal paydowns/Settlements (125) 357

Asset (liability) balance, end of year $ 127 $(1,227)

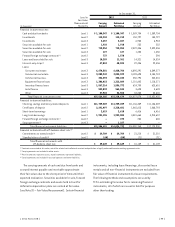

The decrease in Level 3 assets measured at fair value

on a recurring basis of $1.3 million during 2012, was the

result of transfers to Level 1 of $1.1 million related to the

adoption of new FASB guidance in the first quarter of 2012,

decreases in fair value of $100 thousand and reductions

due to principal paydowns of $125 thousand. The increase

in Level 3 liabilities measured at fair value on a recurring

basis of $1.2 million during 2012, was due to the fair value

measurement of a swap agreement entered into during the

second quarter of 2012.

The decrease in Level 3 assets measured at fair value

on a recurring basis of $1.2 million during 2011, was the

result of decreases in fair values of $672 thousand recorded

within non-interest expense, decreases in fair value of

$82 thousand recorded through other comprehensive

income (loss), sales of $100 thousand and reductions

due to principal paydowns of $70 thousand. Transfers to

securities measured at fair value using Readily Available

Market Prices from securities measured using Company

Determined Market Prices were $264 thousand.

The decrease in Level 3 assets measured at fair value on

a recurring basis of $2.6 million during 2010, was the result

of an other than temporary impairment charges totaling

$2.1 million recorded through gains on securities, net,

decreases in fair values of $417 thousand recorded through

other comprehensive income (loss) and reductions due to

principal paydowns of $90 thousand.

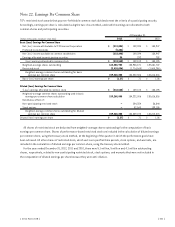

The following is a description of valuation methodologies

used for assets and liabilities recorded at fair value on a

recurring basis.

Securities Available for Sale Securities available

for sale consist primarily of U.S. Government sponsored

enterprise and federal agency securities. The fair value

of U.S. Government sponsored enterprise securities is

recorded using prices obtained from independent asset

pricing services that are based on observable transactions,

but not quoted markets, and are classified as Level 2

assets. Management reviews the prices obtained from

independent asset pricing services for unusual fluctuations

and comparisons to current market trading activity. Other

securities, for which there is little or no market activity,

are categorized as Level 3 assets and the fair value of these

assets is determined by using internal pricing methods.

Forward Foreign Exchange Contracts TCF’s forward

foreign exchange contracts are currency contracts

executed in over-the-counter markets and are valued

using a cash flow model that includes key inputs such as

foreign exchange rates and, in accordance with GAAP, an

assessment of the risk of counterparty non-performance.

The risk of counterparty non-performance is based on

external assessments of credit risk. The majority of

these contracts are based on observable transactions,

but not quoted markets, and are classified as Level 2

assets and liabilities. As permitted under GAAP, TCF has

elected to net derivative receivables and derivative

payables and the related cash collateral received and

paid, when a legally enforceable master netting agreement

exists. For purposes of the previous tables, the derivative

receivable and payable balances are presented gross of

this netting adjustment.

{ 2012 Form 10K } { 97 }