TCF Bank 2012 Annual Report Download - page 65

Download and view the complete annual report

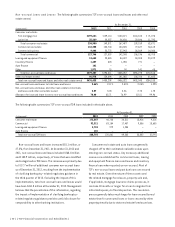

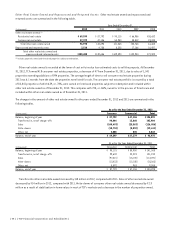

Please find page 65 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In contrast to the Tier 1 risk-based capital ratio, the Tier 1

common capital ratio excludes the effect of qualifying trust

preferred securities, qualifying non-controlling interest

in subsidiaries and non-cumulative perpetual preferred

stock. Management reviews the total Tier 1 common

capital ratio when evaluating capital adequacy and

utilization. This measure is a non-GAAP financial measure

and is viewed by management as a useful indicator of

capital levels available to withstand unexpected market

or economic conditions, and also provides investors,

regulators, and other users with information to be viewed

in relation to other banking institutions.

Total Tier 1 capital at December 31, 2012, was $1.6

billion, or 11.09% of risk-weighted assets, compared

with $1.7 billion, or 12.67% of risk-weighted assets at

December 31, 2011. Tier 1 common capital at

December 31, 2012, was $1.4 billion, or 9.21% of risk-

weighted assets, compared with $1.6 billion, or 11.74%

of risk-weighted assets at December 31, 2011. The

decrease in Tier 1 capital and Tier 1 common capital

from December 31, 2011, was due to the balance sheet

repositioning completed in the first quarter of 2012 and

the redemption of Trust Preferred Securities in the second

quarter of 2012, partially offset by the issuances of

preferred stock in the second and fourth quarters of 2012.

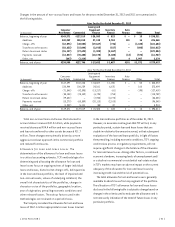

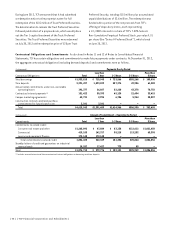

TCF maintains a Capital Plan and Dividend Policy which

applies to TCF Financial and incorporates TCF Bank’s Capital

Adequacy Plan and Dividend Policy (the “Policies”). The

Policies ensure that capital strategy actions, including the

addition of new capital, if needed, and/or the declaration

of preferred stock, common stock or bank dividends, are

prudent, efficient, and provide value to TCF’s stockholders,

while ensuring that past and prospective earnings retention

is consistent with TCF’s capital needs, asset quality,

and overall financial condition. TCF’s capital levels are

managed in such a manner that all regulatory capital

requirements for well-capitalized banks and bank holding

companies are exceeded.

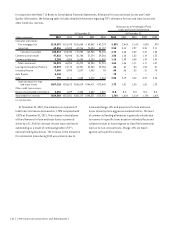

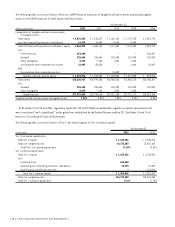

Critical Accounting Policies

Critical accounting estimates occur in certain accounting

policies and procedures, and are particularly susceptible to

significant change. Policies that contain critical accounting

estimates include the determination of the allowance for

loan and lease losses, lease financings and income taxes.

See Note 1 of Notes to Consolidated Financial Statements

for further discussion of critical accounting policies.

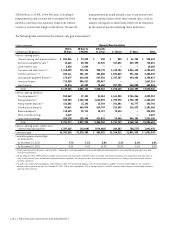

Recent Accounting Pronouncements

On February 5, 2013, the Financial Accounting Standards

Board (“FASB”) issued Accounting Standards Update

(“ASU”) No. 2013-02, Reporting of Amounts Reclassified

Out of Accumulated Other Comprehensive Income (Topic

220), which requires the presentation of certain amounts

reclassified out of accumulated other comprehensive

income to net income, by component, either on the

face of the financial statements or in the notes. Other

reclassifications out of accumulated other comprehensive

income will require cross reference to existing disclosures.

The adoption of this ASU will be required for TCF’s Quarterly

Report on Form 10-Q for the quarter ending March 31, 2013,

and is not expected to have a material impact on TCF. This

ASU is the result of certain provisions deferred within ASU

No. 2011-12, Deferral of the Effective Date for Amendments

to the Presentation of Reclassifications of Items out of

Accumulated Other Comprehensive Income in Accounting

Standards Update No. 2011-05 (Topic 220), which was

adopted in TCF’s Quarterly Report on Form 10-Q for the

quarter ended March 31, 2012.

On January 31, 2013, the FASB issued ASU No. 2013-01,

Clarifying the Scope of Disclosures about Offsetting Assets

and Liabilities (Topic 210), which clarifies the scope

of ASU No. 2011-11 applies to derivatives, including

bifurcated embedded derivatives, repurchase agreements,

reverse repurchase agreements, and securities borrowing

and securities lending transactions. ASU No. 2011-11,

Disclosures about Offsetting Assets and Liabilities

(Topic 210), requires companies with financial and derivative

instruments subject to a master netting agreement to disclose

the gross amounts of the financial assets and liabilities,

the amounts offset on the balance sheet, the net amounts

presented, and the amounts subject to a master netting

arrangement not offset. The adoption of these ASUs will be

required with retrospective application for TCF’s Quarterly

Report on Form 10-Q for the quarter ending March 31, 2013,

and is not expected to have a material impact on TCF.

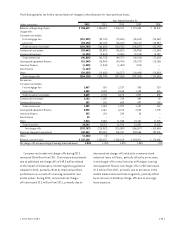

Legislative, Legal and Regulatory Developments

Federal and state legislation imposes numerous legal and

regulatory requirements on financial institutions. Future

legislative or regulatory change, or changes in enforcement

practices or court rulings, may have a dramatic and

potentially adverse impact on TCF.

{ 2012 Form 10K } { 49 }