TCF Bank 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

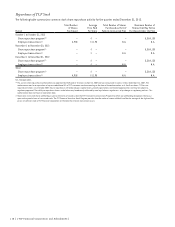

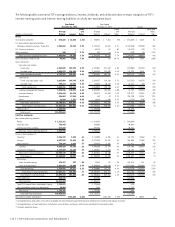

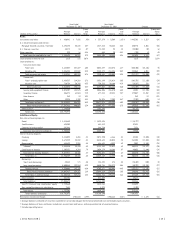

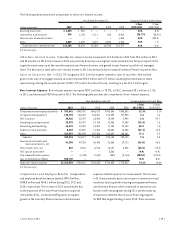

The following table presents the components of the changes in net interest income by volume and rate.

Year Ended December 31, 2012

Versus Same Period in 2011

Year Ended December 31, 2011

Versus Same Period in 2010

Increase (Decrease) Due to Increase (Decrease) Due to

(In thousands) Volume(1) Rate(1) Total Volume(1) Rate(1) Total

Interest income:

Investments and Other $ (2,883) $ 5,451 $ 2,568 $ 5,355 $ (3,028) $ 2,327

U.S. Government sponsored entities:

Mortgage-backed securities, fixed rate (39,388) (10,607) (49,995) 15,522 (10,716) 4,806

Debentures – – – – – –

U.S. Treasury Securities (34) – (34) (24) (35) (59)

Other securities (6) (3) (9) (6) 2 (4)

Total securities available for sale (40,689) (9,349) (50,038) 14,171 (9,428) 4,743

Loans and leases held for sale 3,591 (33) 3,558 131 – 131

Loans and leases:

Consumer home equity:

Fixed-rate (22,841) (6,353) (29,194) (27,755) (4,391) (32,146)

Variable-rate 5,596 (1,970) 3,626 12,443 (6,347) 6,096

Total consumer real estate (15,072) (10,496) (25,568) (12,729) (13,321) (26,050)

Commercial:

Fixed- and adjustable-rate (9,439) (5,136) (14,575) (5,992) (5,658) (11,650)

Variable-rate 3,383 (3,472) (89) (832) 970 138

Total commercial (4,475) (10,189) (14,664) (6,740) (4,772) (11,512)

Leasing and equipment finance 4,776 (18,360) (13,584) 1,165 (13,160) (11,995)

Inventory finance 36,609 (9,258) 27,351 12,903 (1,201) 11,702

Auto finance 17,869 67 17,936 13 – 13

Other (233) (137) (370) (639) 38 (601)

Total loans and leases 34,374 (43,273) (8,899) (8,915) (29,528) (38,443)

Total interest income (42,714) (10,097) (52,811) 38,821 (70,063) (31,242)

Interest expense:

Checking 279 (1,625) (1,346) 129 (2,144) (2,015)

Savings 1,754 (10,862) (9,108) 1,851 (12,932) (11,081)

Money market 460 (552) (92) 14 (1,595) (1,581)

Certificates of deposit 5,341 1,084 6,425 460 (1,904) (1,444)

Borrowings:

Short-term borrowings 792 (26) 766 (264) (39) (303)

Long-term borrowings (69,951) (60,353) (130,304) (3,614) (12,374) (15,988)

Total borrowings (60,665) (68,873) (129,538) (6,802) (9,489) (16,291)

Total interest expense (9,230) (124,429) (133,659) 4,081 (36,493) (32,412)

Net interest income $(32,277) $ 113,125 $ 80,848 $28,190 $(27,020) $ 1,170

(1) Changes attributable to the combined impact of volume and rate have been allocated proportionately to the change due to volume and the change due to rate. Changes

due to volume and rate are calculated independently for each line item presented.

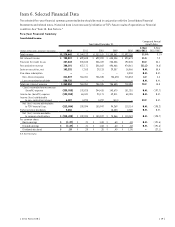

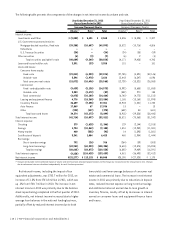

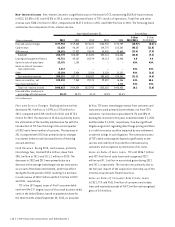

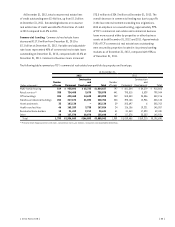

Net interest income, including the impact of tax

equivalent adjustments, was $782.7 million for 2012, an

increase of 11.5% from $701.8 million in 2011, which was

up .2% from $700.7 million in 2010. The increase in net

interest income in 2012 was primarily due to the balance

sheet repositioning completed in the first quarter of 2012.

Additionally, net interest income increased due to higher

average loan balances in the national lending business,

partially offset by reduced interest income due to both

lower yields and lower average balances of consumer real

estate and commercial loans. The increase in net interest

income in 2011 was primarily due to reductions in deposit

rates, reduced interest expense on long-term borrowings

and additional interest earned due to loan growth in

inventory finance, mostly offset by decreases in interest

earned on consumer loans and equipment finance loans

and leases.

{ 26 } { TCF Financial Corporation and Subsidiaries }