TCF Bank 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stockholder Information

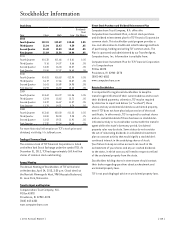

Stock Data

Year Close High Low

Dividends

Paid

Per Share

2012

Fourth Quarter $12.15 $12.49 $10.45 $.05

Third Quarter 11.94 12.43 9.59 .05

Second Quarter 11.48 12.53 10.43 .05

First Quarter 11.89 12.58 10.04 .05

2011

Fourth Quarter $10.32 $11.68 $ 8.61 $.05

Third Quarter 9.16 14.37 8.66 .05

Second Quarter 13.80 16.04 13.37 .05

First Quarter 15.86 17.37 14.60 .05

2010

Fourth Quarter $14.81 $16.63 $12.90 $.05

Third Quarter 16.19 17.66 13.87 .05

Second Quarter 16.61 18.89 14.95 .05

First Quarter 15.94 16.83 13.40 .05

2009

Fourth Quarter $13.62 $14.72 $11.36 $.05

Third Quarter 13.04 15.83 12.71 .05

Second Quarter 13.37 16.67 11.37 .05

First Quarter 11.76 14.31 8.74 .25

2008

Fourth Quarter $13.66 $20.00 $11.22 $.25

Third Quarter 18.00 28.00 9.25 .25

Second Quarter 12.03 19.31 11.91 .25

First Quarter 17.92 22.04 14.65 .25

For more historical information on TCF’s stock price and

dividend, visit http://ir.tcfbank.com.

Trading of Common Stock

The common stock of TCF Financial Corporation is listed

on the New York Stock Exchange under the symbol TCB. At

December 31, 2012, TCF had approximately 163.4 million

shares of common stock outstanding.

Annual Meeting

The Annual Meeting of Stockholders of TCF will be held

on Wednesday, April 24, 2013, 3:30 p.m. (local time) at

the Marriott Minneapolis West, 9960 Wayzata Boulevard,

St. Louis Park, Minnesota.

Transfer Agent and Registrar

Computershare Trust Company, N.A.

PO Box 43078

Providence, RI 02940-3078

(800) 443-6852

www.computershare.com

Direct Stock Purchase and Dividend Reinvestment Plan

Computershare Trust Company, N.A. offers the

Computershare Investment Plan, a direct stock purchase

and dividend reinvestment plan for TCF Financial Corporation

common stock. This stockholder-paid program provides a

low-cost alternative to traditional retail brokerage methods

of purchasing, holding and selling TCF common stock. The

Plan is sponsored and administered by our Transfer Agent,

Computershare, Inc. Information is available from:

Computershare Investment Plan for TCF Financial Corporation

c/o Computershare

PO Box 43078

Providence, RI 02940-3078

(800) 443-6852

www.computershare.com

Note to Stockholders

It is important for registered stockholders to keep the

transfer agent informed of their current address and to cash

their dividend payments; otherwise, TCF may be required

by state law to report and deliver (or “escheat”) these

shares and any unclaimed dividends as unclaimed property,

even if TCF does not have physical possession of the stock

certificate. In other words, TCF is required to escheat shares

and un-cashed dividends if there has been no stockholder-

initiated activity or no stockholder contact with the transfer

agent within the state’s dormancy period. Unclaimed

property rules vary by state. Some states do not consider

the act of reinvesting dividends in a dividend reinvestment

plan as account activity that would signify a stockholder’s

continued interest in the underlying shares of stock.

Your failure to keep an active account can result in the

escheatment of your shares and any un-cashed dividends

to the state, in which case you will need to request a refund

of the unclaimed property from the state.

Stockholders holding shares in street name should contact

their broker regarding questions about escheatment and

unclaimed property laws.

TCF is not providing legal advice on unclaimed property laws.

{ 2012 Annual Report } { 123 }