TCF Bank 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TCF Financial Corporation | 2012 Annual Report

Building

a better

way

Table of contents

-

Page 1

a better Building way TCF Financial Corporation | 2012 Annual Report -

Page 2

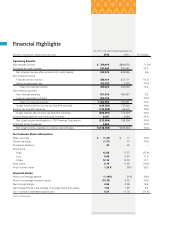

... Information: Basic earnings Diluted earnings Dividends declared Stock price: High Low Close Book value Price to book value Financial Ratios: Return on average assets Return on average common equity Net interest margin Net charge-offs as a percentage of average loans and leases Tier 1 common risk... -

Page 3

... building blocks for current and future success. From the expansion of national lending platforms to a balance sheet repositioning and the return of TCF's free checking product, TCF has taken the steps to generate results in 2013 and beyond. Table of Contents 02 12 Annual Report on Form 10-K 01 07... -

Page 4

... taking several key steps to enhance its business model and better prepare for the future. TCF expanded its national lending platforms, repositioned its balance sheet and brought back its free checking product to consumers. We recognize that the banking world has undergone a permanent change in many... -

Page 5

... an indirect auto ï¬nance company, completed in late November 2011, added an additional consumer lending channel to our organization. In addition, TCF announced in March 2012 the creation of TCF Capital Funding, a new commercial banking division specializing in asset-based and cash ï¬,ow lending to... -

Page 6

... rate 06 08 10 12 new account production and a decrease in account attrition. TCF customers and employees are happy to have one of the most competitive checking SM accounts in the country - TCF Free Checking. For the ï¬rst time in 22 years, TCF incurred a net loss in National Lending Loans... -

Page 7

... consumer real estate, 35 percent national lending and 22 percent commercial. Loan and lease balances in TCF's national lending businesses increased 41 percent to $5.3 billion at December 31, 2012. With experienced management teams and strong asset diversiï¬cation by industry, transaction size... -

Page 8

... 2012, we added TCF Capital Funding, a new commercial banking division specializing in asset-based and cash ï¬,ow lending, which has become a nice complement to our current commercial business. TCF brought aboard an experienced team to run the business and provide a new channel of commercial lending... -

Page 9

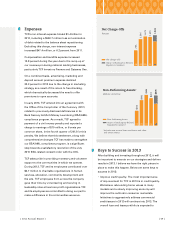

... national lending businesses have allowed TCF to create additional net interest income. Banking fees and service charges decreased 18.9 percent in 2012 due to the impact of regulatory changes and a reduced checking account base resulting from the impact of product changes made in 2011. Now that free... -

Page 10

... and 21 commercial properties, compared with 723 and 35 properties, respectively, at December 31, 2011. The leading indicator of consumer real estate credit quality, over 60-day delinquencies, showed steady improvement throughout the year. At year-end, 1.38 percent of consumer real estate loans were... -

Page 11

... rebounding home values in many markets and a slowly improving economy will improve the outlook in consumer real estate. Initiatives to aggressively address commercial credit issues in 2012 will continue into 2013. The overall loan and lease portfolio is expected to { 2012 Annual Report } $476... -

Page 12

..., TCF maintains access to secured funding sources and must continue to explore new sources of liquidity to enable loan and lease growth, such as auto ï¬nance, as necessary. • Make investments in enterprise risk management. In today's banking world, having strong enterprise risk management is... -

Page 13

... increasing rates in the future continues to be a risk management focus. • The competitive landscape in the banking industry remains unsettled. TCF chose to expand its auto ï¬nance and inventory ï¬nance businesses, as well as to bring back its free checking product in 2012 while other banks are... -

Page 14

...Vice Chairman and Executive Vice President, Funding, Operations & Finance, TCF Financial Corporation Director since 2012 George G. Johnson CPA/Managing Director, George Johnson & Company and George Johnson Consultants Director since 1998 Vance K. Opperman President and Chief Executive Officer, Key... -

Page 15

... (Address of principal executive offices and zip code) Registrant's telephone number, including area code: 952-745-2760 Securities registered pursuant to Section 12(b) of the Act: (Title of each class) (Name of each exchange on which registered) Common Stock (par value $.01 per share) New York Stock... -

Page 16

... 14. Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and felated Stockholder Matters Certain felationships and felated Transactions, and Director Independence Principal Accountant Fees and Services 111 111... -

Page 17

...debt consolidation, financing of home improvements, autos, vacations and education. TCF's retail lending origination activity primarily consists of consumer real estate secured lending. It also includes originating loans secured by personal property and, to a limited extent, unsecured personal loans... -

Page 18

... rates, market conditions and other factors. Consumer, small business and commercial deposits are attracted from within TCF's primary banking markets through the offering of a broad selection of deposit products, including free checking accounts, money market accounts, regular savings accounts... -

Page 19

.... TCF offers retail checking account customers low-cost, convenient access to funds at local merchants and ATMs through its debit card programs. TCF's debit card programs are supported by interchange fees charged to retailers. Key drivers of banking fees and service charges are the number of deposit... -

Page 20

... for deposits comes from institutions selling money market mutual funds and corporate and government securities. TCF competes for the origination of loans with banks, mortgage bankers, mortgage brokers, consumer, and commercial finance companies, credit unions, insurance companies and savings... -

Page 21

... Bank has become impaired. If TCF Financial were to fail to pay such an assessment within three months, the Board of Directors must cause the sale of TCF Bank's stock to cover a deficiency in the capital. In the event of a bank holding company's bankruptcy, any commitment by the bank holding company... -

Page 22

... loan, lease and real estate loss reserve requirements, increased supervisory assessments, activity limitations or other restrictions that could have an adverse effect on such institutions, their holding companies or holders of their debt and equity securities. Certain enforcement actions may... -

Page 23

... risk management practices. Available Information TCF's website, http://ir.tcfbank.com, includes free access to Company news releases, investor presentations, conference calls to discuss published financial results, TCF's Annual feport and periodic filings required by the United States Securities... -

Page 24

...such difficulties in TCF's equipment, inventory and auto finance businesses could have a material adverse effect on its financial condition and results of operations. or anticipated reduction in TCF's credit ratings could adversely affect the ability of TCF Bank and its subsidiaries to lend and its... -

Page 25

... funds from payment networks, consumers and other paying agents. TCF's businesses depend on their ability to process, record and monitor a large number of complex transactions. If any of TCF's financial, accounting or other data processing systems fail or if personal information of TCF's customers... -

Page 26

... as continued industry consolidation, which may increase in connection with current economic and market conditions. TCF competes with other commercial banks, savings and loan associations, mutual savings banks, finance companies, mortgage banking companies, credit unions and investment companies. In... -

Page 27

... file suspicious activity reports with the U.S. Treasury's Office of Financial Crimes Enforcement Network. These rules require financial institutions to establish procedures for identifying and verifying the identity of customers seeking to open new accounts. Failure to comply with these regulations... -

Page 28

... of operations. TCF relies on other companies to provide key components of its business infrastructure. Third party vendors provide key components of TCF's business infrastructure, such as internet connections, network access and transaction and other processing services. While TCF has selected... -

Page 29

... or have potential for improved profitability through financial management, economies of scale or expanded services. Acquiring other banks, businesses or branches involves potential adverse impact to TCF's results of operations and various other risks commonly associated with acquisitions, such as... -

Page 30

... material adverse effect on TCF's financial condition and results of operations. TCF is subject to environmental liability risk associated with lending activities. A significant portion of TCF's loan portfolio is secured by real property. In the ordinary course of business, TCF may foreclose on and... -

Page 31

..., leasing and deposit operations. TCF is, and expects to become, engaged in a number of foreclosure proceedings and other collection actions as part of its lending and leasing collections activities. TCF may also be subject to enforcement action by federal regulators, including the SEC, the Federal... -

Page 32

....05 $.05 .05 .05 .05 The Board of Directors of TCF Financial and TCF Bank have each adopted a Capital Plan and Dividend Policy. The policies define how enterprise risk related to capital will be managed, how the adequacy of capital will be measured and the process by which capital strategy, capital... -

Page 33

... Group, Inc.; First fepublic Bank; FirstMerit Corporation; Flagstar Bancorp, Inc.; Fulton Financial Corporation; Hancock Holding Company; Hudson City Bancorp, Inc.; IBEfIABANK Corporation; International Bancshares Corporation; Investors Bancorp, Inc. (MHC); New York Community Bancorp, Inc.; People... -

Page 34

... N.A. Not Applicable. (1) The current share repurchase authorization was approved by the Board of Directors on April 14, 2007 and was announced in a press release dated April 16, 2007. The authorization was for a repurchase of up to an additional 5% of TCF's common stock outstanding at the time of... -

Page 35

... operations or financial condition. See "Item 1A. fisk Factors." Five-Year Financial Summary Consolidated Income: Year Ended December 31, (Dollars in thousands, except per-share data) Total revenue Net interest income Provision for credit losses Fees and other revenue Gains on securities, net Visa... -

Page 36

...31, (Dollars in thousands, except per-share data) Loans and leases Securities available for sale Total assets Checking, savings and money market deposits Certificates of deposit Total deposits Borrowings Equity Book value per common share Financial Ratios: 2012 2011 $15,425,724 $14,150,255 712,091... -

Page 37

.... The Company focuses on attracting and retaining customers through service and convenience, including branches that are open seven days a week and on most holidays, extensive full-service supermarket branches, automated teller machine ("ATM") networks and internet, mobile and telephone banking. TCF... -

Page 38

... income. Key drivers of bank fees and service charges are the number of deposit accounts and related transaction activity. In 2011, TCF introduced a new anchor checking account that replaced its free checking product. This new anchor checking account required a monthly maintenance fee if specific... -

Page 39

... Products, Inc. ("BfP") program in inventory finance. FUNDING-TCF's funding is primarily derived from branch banking, consumer and small business deposits, and treasury investments. With a renewed focus on quality customer relationships through the introduction of TCF Free Checking, deposits... -

Page 40

... finance Auto finance Other Total loans and leases(2) Total interest-earning assets Other assets(3) Total assets Liabilities and Equity: Non-interest bearing deposits: fetail Small business Commercial and custodial Total non-interest bearing deposits Interest-bearing deposits: Checking Savings Money... -

Page 41

... finance Auto finance Other Total loans and leases(2) Total interest-earning assets Other assets(3) Total assets Liabilities and Equity: Non-interest bearing deposits: fetail Small business Commercial and custodial Total non-interest bearing deposits Interest-bearing deposits: Checking Savings Money... -

Page 42

... Total consumer real estate Commercial: Fixed- and adjustable-rate Variable-rate Total commercial Leasing and equipment finance Inventory finance Auto finance Other Total loans and leases Total interest income Interest expense: Checking Savings Money market Certificates of deposit Borrowings: Short... -

Page 43

... as customer performance improved, partially offset by an increase in net-charge offs and TDf reserves in the consumer real estate portfolio. Also see "Consolidated Financial Condition Analysis - Allowance for Loan and Lease Losses" in this Management's Discussion and Analysis. { 2012 Form 10K... -

Page 44

... income. Year Ended December 31, (Dollars in thousands) Fees and service charges Card revenue ATM revenue Subtotal Leasing and equipment finance Gains on sales of auto loans Gains on sales of consumer real estate loans Other Fees and other revenue Gains on securities, net Visa share redemption... -

Page 45

...) Compensation and employee benefits Occupancy and equipment FDIC insurance Operating lease depreciation Advertising and marketing Deposit account premiums Other Subtotal Foreclosed real estate and repossessed assets, net Other credit costs, net FDIC special assessment Visa indemnification expense... -

Page 46

...associated with the reintroduction of free checking. The decrease in 2011 was primarily due to the discontinuation of the debit card rewards program in the third quarter of 2011 in response to new federal regulation regarding debit card interchange fees. Deposit account premiums expense decreased to... -

Page 47

... in other assets in the Consolidated Statements of Financial Condition. (In thousands) Geographic Distribution: Minnesota Illinois Michigan Wisconsin California Colorado Canada Texas Florida New York Ohio Pennsylvania Arizona Indiana Other Total (1) Consumer Real Estate $2,500,128 1,995,802 747... -

Page 48

...obtains updated FICO score information quarterly. The average updated FICO score for the retail lending portfolio was 727 at both December 31, 2012 and 2011. TCF's consumer real estate underwriting standards are intended to produce adequately secured loans to customers with good credit scores at the... -

Page 49

... 99% of TCF's commercial real estate and commercial business loans were secured either by properties or other business assets at both December 31, 2012 and 2011. Approximately 91% of TCF's commercial real estate loans outstanding were secured by properties located in its primary banking markets as... -

Page 50

...may result in lower sales-type revenue at the end of the contractual lease term. See Note 1 of Notes to Consolidated Financial Statements - Summary of Significant Accounting Policies - Policies felated to Critical Accounting Policies for information on lease accounting. At December 31, 2012 and 2011... -

Page 51

... to Consolidated Financial Statements, Allowance for Loan and Lease Losses and Credit Quality Information, are disclosures of loans considered to be "impaired" for accounting purposes. Consumer real estate TDf loans are evaluated separately in TCF's allowance methodology. Commercial TDf loans are... -

Page 52

...,255 100.0% (Dollars in thousands) Consumer real estate Commercial Leasing and equipment finance Inventory finance Auto finance Other Total loans and leases Percent of total loans and leases (1) (2) Includes all loans and leases that are not 60+ days delinquent or on non-accrual status. Excludes... -

Page 53

... 552,100 26,322 $14,950,244 (In thousands) Consumer real estate Commercial Leasing and equipment finance Inventory finance Auto finance Other Total loans and leases (1) Total $ 6,636,285 3,320,825 3,115,421 623,717 3,231 34,829 $13,734,308 Excludes classified loans and leases that are 60+ days... -

Page 54

...: First mortgage lien Junior lien Total consumer real estate Commercial real estate Commercial business Total commercial Leasing and equipment finance Inventory finance Auto finance Other Subtotal(1) Delinquencies in acquired portfolios(2) Total (1) Excludes delinquencies and non-accrual loans in... -

Page 55

... rate changes to current market rates for similarly situated borrowers who have access to alternative funds. Loan modifications to borrowers who are not experiencing financial difficulties are not included in the following reporting of loan modifications. Under consumer real estate programs, TCF... -

Page 56

... inventory finance loans when reported as non-accrual. Most of TCF's non-accrual loans and past due loans are secured by real estate. Given the nature of these assets and the related mortgage foreclosure, property sale and, if applicable, mortgage insurance claims processes, it can take 18 months or... -

Page 57

... (755) - (2,943) (4,278) - (20,113) (2,100) - (88) 87 - $ 20,583 $ 823 $ - (In thousands) Balance, beginning of year Additions Charge-offs Transfers to other assets feturn to accrual status Payments received Other, net Balance, end of year Consumer Real Estate Commercial $149,371 $127,519 340,359... -

Page 58

... N.A. 1.30% 2012 2008 Consumer real estate: First mortgage lien $119,957 $115,740 $105,634 $ 89,542 $ 47,279 Junior lien 62,056 67,695 67,216 75,424 51,157 Consumer real estate 182,013 183,435 172,850 164,966 98,436 Commercial real estate 47,821 40,446 50,788 37,274 39,386 Commercial business 3,754... -

Page 59

... Total consumer real estate Commercial real estate Commercial business Total commercial Leasing and equipment finance Inventory finance Auto Finance Other Total recoveries Net charge-offs Provision charged to operations Other Balance, at end of year Net charge-offs as a percentage of average loans... -

Page 60

... real estate owned for the years ended December 31, 2012 and 2011 are summarized in the following tables. (In thousands) Balance, beginning of year Transferred in, net of charge-offs Sales Write-downs Other, net Balance, end of year At or For the Year Ended December 31, 2012 Consumer Commercial... -

Page 61

... Federal Home Loan Bank ("FHLB") of Des Moines, institutional sources under repurchase agreements and other sources. TCF's ALCO and Finance Committee of the Board of Directors have adopted a Holding Company Investment and Liquidity Management Policy, which establishes the minimum amount of cash or... -

Page 62

...Time deposits Annual rental commitments under non-cancelable operating leases Contractual interest payments(1) Campus marketing agreements Construction contracts and land purchase commitments for future branch sites Total (In thousands) Commitments Commitments to extend credit: Consumer real estate... -

Page 63

... offering costs of $5.8 million, were $166.7 million. Dividends are payable on the Series A Preferred Stock if, as, and when declared by TCF's Board of Directors on a non-cumulative basis on March 1, June 1, September 1, and December 1 of each year, at a per annum rate of 7.5%. { 2012 Form 10K... -

Page 64

... of tangible realized common equity to tangible assets: Total equity Less: Non-controlling interest in subsidiaries Total TCF Financial Corporation stockholders' equity Less: Preferred stock Goodwill Other intangibles Accumulated other comprehensive income Add: Accumulated other comprehensive loss... -

Page 65

...Plan and Dividend Policy which applies to TCF Financial and incorporates TCF Bank's Capital Adequacy Plan and Dividend Policy (the "Policies"). The Policies ensure that capital strategy actions, including the addition of new capital, if needed, and/or the declaration of preferred stock, common stock... -

Page 66

... the number of deposit accounts; customers completing financial transactions without using a bank; adverse changes in credit quality and other risks posed by TCF's loan, lease, investment and securities available for sale portfolios, including declines in commercial or residential real estate values... -

Page 67

... resulting from action by the Consumer Financial Protection Bureau and changes in the scope of Federal preemption of state laws that could be applied to national banks; the imposition of requirements with an adverse impact relating to TCF's lending, loan collection and other business activities as... -

Page 68

... of the customer's financial and operational condition. Asset quality is monitored separately based on the type or category of loan or lease. The rating process allows management to better define the Company's loan and lease portfolio risk profile. Management also uses various risk models to... -

Page 69

... low level, TCF estimates that an immediate 100 basis point increase in current mortgage loan interest rates would reduce prepayments on the fixed-rate mortgagebacked securities, residential real estate loans and consumer loans at December 31, 2012, by approximately { 2012 Form 10K } { 53... -

Page 70

... sale(1) Loans held for sale Consumer and other loans(1) (2) Commercial loans(1) (2) Leasing and equipment finance(1) Inventory finance Auto Finance Total Interest-bearing liabilities: Checking deposits(3) Savings deposits(3) Money market deposits(3) Certificates of deposits Brokered deposits Short... -

Page 71

... Consolidated Financial Statements for further information). ALCO and the Finance Committee of the Board of Directors have adopted a Liquidity Management Policy to direct management of the Company's liquidity risk. The objective of the Liquidity Management Policy is to ensure that TCF meets its cash... -

Page 72

... of the Public Company Accounting Oversight Board (United States), TCF Financial Corporation's internal control over financial reporting as of December 31, 2012, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the... -

Page 73

...: Consumer real estate Commercial Leasing and equipment finance Inventory finance Auto finance Other Total loans and leases Allowance for loan and lease losses Net loans and leases Premises and equipment, net Goodwill Other assets Total assets Liabilities and Equity Deposits: Checking Savings Money... -

Page 74

...: Fees and service charges Card revenue ATM revenue Subtotal Leasing and equipment finance Gains on sales of auto loans Gain on sales of consumer loans Other Fees and other revenue Gains on securities, net Total non-interest income Non-interest expense: Compensation and employee benefits Occupancy... -

Page 75

... available for sale Foreign currency hedge Foreign currency translation adjustment fecognized postretirement prior service cost and transition obligation Income tax benefit (expense) Total other comprehensive (loss) income Comprehensive (loss) income See accompanying notes to consolidated financial... -

Page 76

...- Amortization of stock compensation - Stock compensation tax benefits - Change in shares held in trust for deferred compensation plans, at cost - Balance, December 31, 2011 - Net loss attributable to TCF Financial Corporation - Other comprehensive loss - Public offering of preferred stock 4,006,900... -

Page 77

... Home Loan Bank stock fedemption of Federal Home Loan Bank stock Proceeds from sales of real estate owned Purchases of premises and equipment Other, net Net cash provided by (used in) investing activities Cash flows from financing activities: Net increase in deposits Net decrease in short-term... -

Page 78

...data used in the allowance for loan and lease losses calculations. Consumer real estate and auto finance loans are generally charged-off to the estimated fair value of underlying collateral, less estimated selling costs, when they are placed on non-accrual status. Additional review of the fair value... -

Page 79

... for credit losses in the periods in which they become known. Lease Financing TCF provides various types of commercial lease financing that are classified for accounting purposes as direct financing, sales-type or operating leases. Leases that transfer substantially all of the benefits and risks of... -

Page 80

... direct fees and costs on all lines of credit are amortized on a straight line basis over the contractual life of the line of credit and adjusted for payoffs. Net deferred fees and costs on consumer real estate lines of credit are amortized to service fee income. { 64 } { TCF Financial Corporation... -

Page 81

... loans considered impaired, are reviewed regularly by management. Consumer real estate loans are placed on non-accrual status when the collection of interest and principal is 150 days or more past due or when six payments are owed. Consumer loans other than real estate and auto loans are charged... -

Page 82

... credit-rated company, which further reduces the risk of loss. In addition to the guarantees, the investments are supported by the performance of the underlying real estate properties which also mitigates the risk of loss. Interest-Only Strips TCF periodically sells loans to third-party financial... -

Page 83

...service charges and a related reserve for uncollectible deposit fees is maintained in other liabilities. Other deposit account losses are reported in other non-interest expense. Note 2. Business Combination On November 30, 2011, TCF Bank entered the auto finance business with the acquisition of 100... -

Page 84

... to the sale and servicing of auto loans and consumer real estate loans. Cash proceeds from loans serviced for third parties are held in restricted accounts until remitted. TCF also retains restricted cash balances for potential loss recourse on certain sold auto loans. festricted cash totaling $28... -

Page 85

TCF Bank is required to hold Federal feserve Bank stock equal to 6% of TCF Bank's capital surplus, which is additional paid in capital stock, less any deficit retained earnings, gains (losses) on available for sale securities, and foreign currency translation adjustments as of the current period end... -

Page 86

... mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate: Permanent Construction and development Total commercial real estate Commercial business Total commercial Leasing and equipment finance:(1) Equipment finance loans Lease financings: Direct financing leases Sales... -

Page 87

... consumer real estate loans with limited representations and indemnification, and a limited credit guarantee and recognized gains of $5.4 million and received cash of $167.2 million. felated to a fourth-quarter sale, TCF retained an interest-only strip of $1.1 million. Future minimum lease payments... -

Page 88

... for loan and leases losses and balances by type of allowance methodology. TCF's key credit quality indicator is the receivable's performance status, defined as accruing or non-accruing. At December 31, 2012 Leasing and Consumer Equipment Inventory Auto Real Estate Commercial Finance Finance Finance... -

Page 89

... Commercial: Commercial real estate Commercial business Total commercial Leasing and equipment finance: Middle market Small ticket Winthrop Other Total leasing and equipment finance Inventory finance Auto finance Other Subtotal Portfolios acquired with deteriorated credit quality Total { 2012 Form... -

Page 90

... have been modified in order to maximize collection of loan balances. If, for economic or legal reasons related to the customer's financial difficulties, TCF grants a concession, the modified loan is classified as a troubled debt restructuring ("TDf"). TCF held consumer real estate TDf loans of $651... -

Page 91

... fecognized Due on TDf Loans on TDf Loans $19,649 1,450 21,099 200 $21,299 $10,416 719 11,135 182 $11,317 Foregone Interest Income $ 9,233 731 9,964 18 $ 9,982 Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial real estate Total { 2012 Form 10K } { 75 } -

Page 92

... 2012 TCF utilized average re-default rates ranging from 10% to 25%, depending on modification type, in determining impairment, which is consistent with actual experience. Consumer real estate loans remain on accruing status upon modification if they are less than 150 days past due, or six payments... -

Page 93

... Income Balance fecorded Balance fecognized Impaired loans with an allowance recorded: Consumer real estate: First mortgage lien Junior lien Total consumer real estate Commercial: Commercial real estate Commercial business Total commercial Leasing and equipment finance: Middle market Small ticket... -

Page 94

.... At December 31, 2012, the total future minimum rental payments for operating leases of premises and equipment are as follows. (In thousands) 2013 2014 2015 2016 2017 Thereafter Total $ 26,028 27,014 25,207 22,222 21,156 70,752 $192,379 { 78 } { TCF Financial Corporation and Subsidiaries } -

Page 95

...,640 As a result of the acquisition of Gateway One in 2011, TCF recorded goodwill and other intangibles of $73 million and $6.2 million, respectively. On June 1, 2012, TCF Bank assumed $778 million of deposits from Prudential Bank & Trust, FSB ("PB&T"). Deposit base intangibles of $3 million were... -

Page 96

... 100.0% Rate at Year-end -% .10 .05 .28 .34 .19 1.05 .33% Amount $ 2,487,792 2,346,840 4,834,632 6,104,104 820,553 11,759,289 2,291,497 $14,050,786 Checking: Non-interest bearing Interest bearing Total checking Savings Money market Total checking, savings and money market Certificates of deposit... -

Page 97

... Line of Credit - TCF Commercial Finance Canada, Inc. Total Maximum month-end balance Federal Home Loan Bank advances Federal funds purchased Securities sold under repurchase agreements U.S. Treasury, tax and loan borrowings Line of Credit - TCF Commercial Finance Canada, Inc. N.A. Not Applicable... -

Page 98

..., TCF has pledged loans secured by residential real estate and commercial real estate loans with an aggregate carrying value of $6.4 billion as collateral for FHLB advances. There were no callable advances or repurchase agreements included in FHLB borrowings at year end. During June 2012, TCF Bank... -

Page 99

...available as collateral for FHLB advances was $6.4 billion. Such loans are secured by residential real estate, commercial real estate loans, and FHLB stock. Note 13. Income Taxes The following table summarizes applicable income taxes in the Consolidated Statements of Income. (In thousands) Current... -

Page 100

... financing Premises and equipment Loan fees and discounts Prepaid expenses Securities available for sale Goodwill and other intangibles Investments in FHLB stock Other Total deferred tax liabilities Net deferred tax liabilities The net operating losses and credit carryforwards at December 31, 2012... -

Page 101

...1 of each year, commencing on March 1, 2013, at a per annum rate of 6.45%. No cash dividends were paid to holders of Series B Preferred Stock in 2012. Shares Held in Trust for Deferred Compensation Plans Executive, Senior Officer, Winthrop and Directors Deferred Compensation Plans TCF has maintained... -

Page 102

... of financing. TCF and Toro maintain a 55% and 45% ownership interest, respectively, in fed Iron. As TCF has a controlling financial interest in fed Iron, its financial results are consolidated in TCF's financial statements. Toro's interest is reported as a noncontrolling interest within equity and... -

Page 103

... Not Applicable. (1) The minimum and well-capitalized requirements are determined by the Federal feserve for TCF and by the Office of the Comptroller of the Currency for TCF Bank pursuant to the FDIC Improvement Act of 1991. (2) The minimum Tier 1 leverage ratio for bank holding companies and banks... -

Page 104

... and related assumption information for TCF's stock option plans related to options issued in 2008 is presented below. No stock options were issued in 2009-2012. Expected volatility Weighted-average volatility Expected dividend yield Expected term (in years) fisk-free interest rate 28.50% 28... -

Page 105

... Plan (the "ESPP"), a qualified 401(k) and employee stock ownership plan, generally allows participants to make contributions of up to 50% of their covered compensation on a tax-deferred basis, subject to the annual covered compensation limitation imposed by the Internal fevenue Service ("IfS"). TCF... -

Page 106

... of year Actual (loss) return on plan assets Benefits paid TCF Contributions Fair value of plan assets at end of year Funded status of plans at end of year Amounts recognized in the Consolidated Statements of Financial Condition: Prepaid (accrued) benefit cost at end of year Prior service cost... -

Page 107

... to determine estimated net benefit plan cost Discount rate Expected long-term rate of return on plan assets N.A. Not Applicable. Postretirement Plan Year Ended December 31, 2012 4.00% N.A. 2011 4.75% N.A. 2010 5.25% N.A. 2012 4.00% 1.50 2011 4.75% 5.00 2010 5.50% 8.50 { 2012 Form 10K } { 91 } -

Page 108

... Plan. A 1% change in assumed health care cost trend rates would have the following effects. (In thousands) 1-Percentage-Point Increase Decrease $ 14 297 $ (13) (268) Effect on total service and interest cost components Effect on postretirement benefits obligations { 92 } { TCF Financial... -

Page 109

... the same credit policies in making these commitments as it does for making direct loans. TCF evaluates each customer's creditworthiness on a caseby-case basis. The amount of collateral obtained is based on a credit evaluation of the customer. Financial instruments with off-balance sheet risk are... -

Page 110

...Net Investment Hedges Foreign exchange contracts, which include forward contracts and currency options, are used to manage the foreign exchange risk associated with the Company's net investment in TCF Commercial Finance Canada, Inc., a wholly-owned Canadian subsidiary of TCF Bank, along with certain... -

Page 111

... date. Securities available for sale, derivatives (forward foreign exchange contracts and swaps), and assets held in trust for deferred compensation plans are recorded at fair value on a recurring basis. Certain investments, commercial loans, real estate owned, repossessed and returned assets are... -

Page 112

... Value Measurements: Securities available for sale: Mortgage-backed securities: U.S. Government sponsored enterprises and federal agencies Other Other securities Forward foreign exchange contracts Assets held in trust for deferred compensation plans(4) Total assets Forward foreign exchange contracts... -

Page 113

... is determined by using internal pricing methods. Forward Foreign Exchange Contracts TCF's forward foreign exchange contracts are currency contracts executed in over-the-counter markets and are valued using a cash flow model that includes key inputs such as foreign exchange rates and, in accordance... -

Page 114

...of the Company as a whole. Non-financial instruments such as the intangible value of TCF's branches and core deposits, leasing operations, goodwill, premises and equipment and the future revenues from TCF's customers are not reflected in this disclosure. Therefore, this information is of limited use... -

Page 115

... available for sale Securities available for sale Forward foreign exchange contracts(1) Loans and leases held for sale Interest-only strips(2) Loans: Consumer real estate Commercial real estate Commercial business Equipment finance loans Inventory finance loans Auto finance Other Total financial... -

Page 116

... and discounted cash flows using interest rates for borrowings of similar remaining maturities and characteristics. Financial Instruments with Off-Balance Sheet Risk The fair values of TCF's commitments to extend credit and standby letters of credit are estimated using fees currently charged to... -

Page 117

...) income attributable to TCF Financial Corporation Preferred stock dividends Net (loss) income available to common stockholders Earnings allocated to participating securities (Loss) earnings allocated to common stock Weighted-average shares outstanding festricted stock Weighted-average common shares... -

Page 118

... finance and auto finance. Funding includes branch banking and treasury services. Support Services includes holding company and corporate functions that provide data processing, bank operations and other professional services to the operating segments. In 2012, TCF changed the management structure... -

Page 119

... forth certain information of each of TCF's reportable segments, including a reconciliation of TCF's consolidated totals. (In thousands) Lending Funding Support Services Eliminations(1) and Other Consolidated At or For the Year Ended December 31, 2012: Revenues from external customers: Interest... -

Page 120

Note 25. Parent Company Financial Information TCF Financial Corporation's (parent company only) condensed statements of financial condition as of December 31, 2012 and 2011, and the condensed statements of income and cash flows for the years ended December 31, 2012, 2011 and 2010 are as follows. ... -

Page 121

... offerings of preferred stock fedemption of trust preferred securities Interest paid on trust preferred securities Shares sold to TCF employee benefit plans Stock compensation tax (expense) benefits (fepayments of) proceeds from senior unsecured term note Net cash provided by financing activities... -

Page 122

...lending and leasing collections activities. TCF may also be subject to enforcement action by federal regulators, including the Securities and Exchange Commission, the Federal feserve, the OCC and the Consumer Financial Protection Bureau. From time to time, borrowers and other customers, or employees... -

Page 123

... data) Dec. 31, 2012 Sep. 30, 2012 Jun. 30, 2012 Dec. 31, 2011 Sep. 30, 2011 Jun. 30, 2011 Mar. 31, 2011 Selected Financial Condition Data: Total loans and leases Securities available for sale Goodwill Total assets Deposits Short-term borrowings Long-term borrowings Total equity $15,425,724... -

Page 124

... recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms. Disclosure controls are also designed with the objective of ensuring that such information is accumulated and communicated to the Company's management, including the Chief Executive Officer... -

Page 125

... issues and instances of fraud, if any, will be detected. William A. Cooper Chairman and Chief Executive Officer Michael S. Jones Executive Vice President and Chief Financial Officer Susan D. Bode Senior Vice President and Chief Accounting Officer February 22, 2013 { 2012 Form 10K } { 109 } -

Page 126

...Company Accounting Oversight Board (United States), the consolidated statements of financial condition of TCF Financial Corporation and subsidiaries as of December 31, 2012 and 2011, and the related consolidated statements of income, comprehensive income, equity, and cash flows for each of the years... -

Page 127

... directors and employees of TCF (the "Code of Ethics"). The Code of Ethics and Senior Financial Management Code of Ethics are both available for review at TCF's website at www.tcfbank.com by clicking on "About TCF" and then "Learn More" under the heading "About TCF Corporate Governance." Any changes... -

Page 128

...Security Ownership of Certain Beneï¬cial Owners and Management and Related Stockholder Matters Information regarding ownership of TCF's common stock by TCF's directors, executive officers, and certain other stockholders and shares authorized under plans is set forth in the following sections of TCF... -

Page 129

... of Equity for each of the years in the three-year period ended December 31, 2012 Consolidated Statements of Cash Flows for each of the years in the three-year period ended December 31, 2012 Notes to Consolidated Financial Statements Other Financial Data Management's Report on Internal Control... -

Page 130

... Financial Officer) Senior Vice President and Chief Accounting Officer (Principal Accounting Officer) Director Director Director Director Director Director, Vice Chairman, and Executive Vice President, Lending Director Director, Vice Chairman, and Executive Vice President, Funding, Operations... -

Page 131

... Certificate for 6.45% Series B Non-Cumulative Perpetual Preferred Stock [incorporated by reference to Exhibit 4.1 to TCF Financial Corporation's Current feport on Form 8-K filed December 18, 2012] Copies of instruments with respect to long-term debt will be furnished to the Securities and Exchange... -

Page 132

... TCF Financial Corporation's Current feport on Form 8-K filed January 23, 2009] Form of Year 2009 Executive Stock Award as executed by certain executives, effective January 20, 2009 [incorporated by reference to Exhibit 10(b)-15 to TCF Financial Corporation's Current feport on Form 8-K filed January... -

Page 133

... Current feport on Form 8-K filed May 2, 2011] Trust Agreement for TCF Employees Stock Purchase Plan Supplemental Executive fetirement Plan ("SEfP") effective January 1, 2009 and dated November 20, 2008 [incorporated by reference to Exhibit 10(k) to TCF Financial Corporation's Annual feport on Form... -

Page 134

... ended June 30, 2012] Form of Deferred Director's festricted Stock Agreement dated January 24, 2012 [incorporated by reference to Exhibit 10(j)-2 of TCF Financial Corporation's Quarterly feport on Form 10-Q filed for the quarter ended June 30, 2012] Form of 2012 Management Incentive Plan - Executive... -

Page 135

... Consolidated fatios of Earnings to Fixed Charges and Preferred Stock Dividends for years ended December 31, 2012, 2011, 2010, 2009 and 2008 Subsidiaries of TCF Financial Corporation (as of December 31, 2012) Consent of KPMG LLP dated February 22, 2013 Certification of the Chief Executive Officer... -

Page 136

...Vice Chairman and Executive Vice President, Lending Karen L. Grandstrand Thomas F. Jasper 2,3,5,6,7 Vice Chairman and Executive Vice President, Funding, Operations & Finance Thomas F. Jasper Executive Vice President and Chief Financial Officer Michael S. Jones Commercial Lending Managing Director... -

Page 137

... Vice President and Corporate Human Resources Director, TCF National Bank Barbara E. Shaw Executive Vice President Bradley C. Gunstad Mark D. Nyquist Gateway One Lending & Finance, LLC Chief Executive Officer G. Brian MacInnis Finance/ Treasury Executive Vice President and Chief Financial Officer... -

Page 138

Ofï¬ces Executive Offices TCF Financial Corporation 200 Lake Street East Mail Code: EX0-03-A Wayzata, MN 55391-1693 (952) 745-2760 Minnesota/South Dakota Traditional Branches Minneapolis/St. Paul Area (44) Greater Minnesota (2) South Dakota (1) TCF Equipment Finance, Inc. Headquarters 11100 ... -

Page 139

... stockholders to keep the transfer agent informed of their current address and to cash their dividend payments; otherwise, TCF may be required by state law to report and deliver (or "escheat") these shares and any unclaimed dividends as unclaimed property, even if TCF does not have physical... -

Page 140

... visit our website at http://ir.tcfbank.com for free access to TCF investor information, news releases, investor presentations, quarterly conference calls, annual reports, and SEC filings. Information may also be obtained, free of charge, from: TCF Financial Corporation Corporate Communications 200... -

Page 141

... de novo expansion, acquisition, and process improvement. We are growing by starting and acquiring new businesses, opening new branches, offering new products and services, and improving execution on sales efforts of existing products. The Customer First. TCF strives to place The Customer First. We... -

Page 142

TCF Financial Corporation | 200 Lake Street East Wayzata, MN 55391-1693 | tcfbank.com TCFIR9353