Singapore Airlines 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224

|

|

66

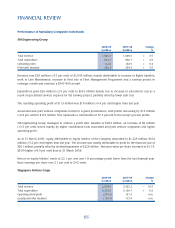

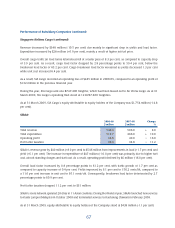

Performance of Subsidiary Companies (continued)

SIA Engineering Group

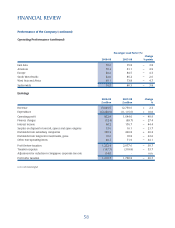

2008-09 2007-08 Change

$ million $ million %

Total revenue 1,045.3 1,009.6 + 3.5

Total expenditure 932.7 906.7 + 2.9

Operating profi t 112.6 102.9 + 9.4

Profi t after taxation 263.3 254.3 + 3.5

Revenue rose $36 million (+3.5 per cent) to $1,045 million, mainly attributable to increase in fl ights handled,

work in Line Maintenance, increase in fl eet size of Fleet Management Programme and a turnkey project to

redesign, retrofi t and overhaul a B747-400 aircraft.

Expenditure grew $26 million (+2.9 per cent) to $933 million mainly due to increase in subcontract cost as a

result of specialised services required for the turnkey project, partially offset by lower staff cost.

The resulting operating profi t of $113 million was $10 million (+9.4 per cent) higher than last year.

Associated and joint venture companies turned in a good performance, with profi ts increasing by $15 million

(+9.6 per cent) to $173 million. This represents a contribution of 57.5 percent to the Group’s pre-tax profi ts.

SIA Engineering Group managed to achieve a profi t after taxation of $263 million, an increase of $9 million

(+3.5 per cent), driven mainly by higher contribution from associated and joint venture companies and higher

operating profi t.

As at 31 March 2009, equity attributable to equity holders of the Company amounted to $1,229 million, $104

million (+9.2 per cent) higher than last year. The increase was mainly attributable to profi t for the fi nancial year of

$261 million, partially offset by dividend payments of $226 million. Net asset value per share increased to $1.14,

$0.09 higher (+8.9 per cent) than at 31 March 2008.

Return on equity holders’ funds at 22.1 per cent was 1.8 percentage points lower than the last fi nancial year.

Basic earnings per share rose 2.1 per cent to 24.2 cents.

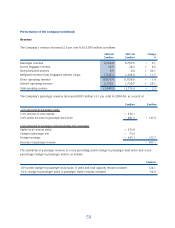

Singapore Airlines Cargo

2008-09 2007-08 Change

$ million $ million %

Total revenue 2,974.0 3,322.2 – 10.5

Total expenditure 3,219.0 3,190.7 + 0.9

Operating (loss)/profi t (245.0) 131.5 n.m.

(Loss)/profi t after taxation (153.9) 115.4 n.m.

FINANCIAL REVIEW