Singapore Airlines 2009 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2009 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224

|

|

197

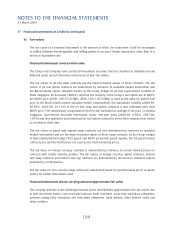

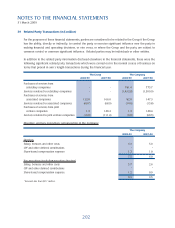

37 Financial Instruments (in $ million) (continued)

(c) Derivative fi nancial instruments and hedging activities (continued)

Cash fl ow hedges (continued)

As at 31 March 2009, the Company has also set aside USD 268.7 million (2008: USD 331.5 million)

in short-term deposits to hedge against foreign currency risk for a portion of the forecast USD capital

expenditure in the next 10 months.

During the fi nancial year, the Group entered into fi nancial instruments to hedge expected future

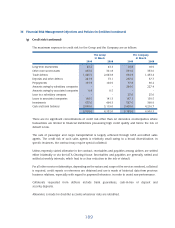

payments in SGD. The outstanding contracts are as follows:

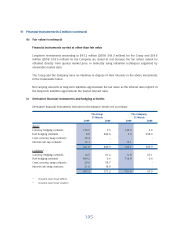

Currency hedging contracts maturing in April 2009 – March 2010

The Group and the Company

Foreign currency

Currency amount sold SGD purchased

AUD 30.5 30.4

CHF 3.0 3.9

CNY 43.0 9.1

EUR 6.0 11.8

GBP 10.4 22.8

INR 351.0 10.1

JPY 1,748.0 28.5

KRW 2,295.0 2.5

NZD 7.6 6.0

TWD 18.0 0.8

The cash fl ow hedges of the expected future purchases in USD and expected future payments in SGD in the

next 12 months are assessed to be highly effective and at 31 March 2009, a net fair value gain before tax

of $455.1 million (2008: net fair value loss before tax of $115.8 million), with a related deferred tax credit

of $110.5 million (2008: $24.3 million), is included in the fair value reserve in respect of these contracts.

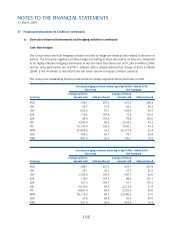

As at 31 March 2009, the Company had interest rate cap contracts at a strike rate of 6.50% (2008: nil),

maturing in 7 to 10 years, to hedge against risk of increase in aircraft lease rentals.

The Group also has interest rate swap contracts in place whereby it pays fi xed rates of interest ranging from

3.00% to 4.95% and receives a variable rate linked to LIBOR. These contracts are used to protect a portion

of the lease liabilities from exposure to fl uctuations in interest rates. The maturity period of these contracts

ranges from 1 March 2014 to 5 March 2016.

The cash fl ow hedges of some of the interest rate swap contracts are assessed to be highly effective and

as at 31 March 2009, a net fair value loss before tax of $14.4 million (2008: $14.8 million), with a related

deferred tax asset of $2.4 million (2008: $2.7 million), was included in the fair value reserve in respect of

these contracts.