Singapore Airlines 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224

|

|

65

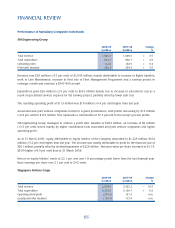

Performance of Subsidiary Companies

The major subsidiary companies are Singapore Airport Terminal Services Limited (“SATS”), SIA Engineering

Company Limited (“SIAEC”), Singapore Airlines Cargo Pte Ltd (“SIA Cargo”) and SilkAir (Singapore) Private Limited

(“SilkAir”). The following performance review includes intra-group transactions.

Singapore Airport Terminal Services Group

2008-09 2007-08 Change

$ million $ million %

Total revenue 1,062.1 958.0 + 10.9

Total expenditure 891.2 783.7 + 13.7

Operating profi t 170.9 174.3 – 2.0

Profi t after taxation 148.4 195.2 – 24.0

SATS Group’s revenue increased by $104 million to $1,062 million, mainly on account of revenue contribution

from Singapore Food Industries, which was acquired in February 2009. SATS Group also started to consolidate

results of Country Food Macau and SATS Hong Kong from 3rd quarter of the fi nancial year.

Operating expenditure increased $108 million (+13.7 per cent) to $891 million primarily from consolidation of

the new subsidiary companies. This fi nancial year also saw the full impact of additional cost from dual terminal

operations with the commencement of Terminal 3 operations at Changi Airport. This was partially offset by Jobs

Credit from the Singapore Government introduced in response to the weakening operating environment.

As a consequence, SATS Group’s operating profi t declined $3 million (-2.0 per cent) to $171 million.

Profi t contribution from overseas associated companies fell 50.3 per cent to $22 million for the fi nancial year

ended 31 March 2009, mainly due to weaker aviation industry.

Profi t after taxation decreased $47 million (-24.0 per cent) to $148 million, due to lower operating profi t, lower

contribution from overseas associated companies and loss on disposal of short-term non-equity investments.

In addition, last year’s results included a one-off exceptional gain on the sale of Express Courier Centre 2 of

$17 million.

As at 31 March 2009, equity holders’ funds of the SATS Group were $1,398 million (+1.0 per cent). Net asset

value per share of the Group as at 31 March 2009 remained at $1.29.

Return on equity holders’ funds at 10.5 per cent, was 3.9 percentage points lower than the last fi nancial year.

Basic earnings per share decreased 4.6 cents (-25.3 per cent) to 13.6 cents.