Singapore Airlines 2009 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2009 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.168

NOTES TO THE FINANCIAL STATEMENTS

31 March 2009

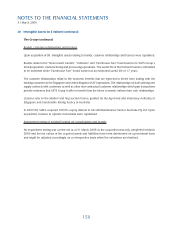

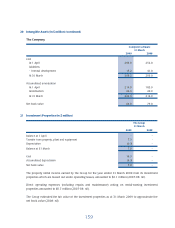

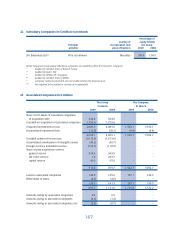

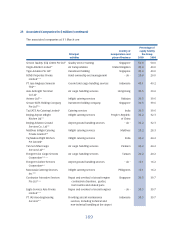

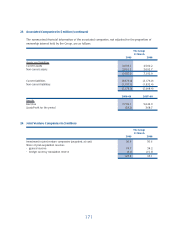

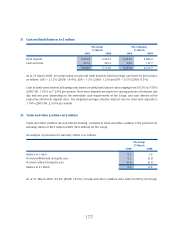

23 Associated Companies (in $ million) (continued)

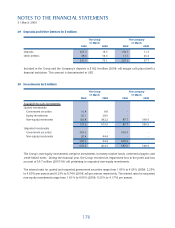

The customer-related intangible assets arose from the acquisition of associated companies and the Group

had engaged an independent third party to perform a fair valuation of these separately identifi ed intangible

assets. The useful life of these intangible assets was determined to be fi ve years and the assets will be

amortised on a straight-line basis over the useful life. The amortisation is included in the line of share of

profi ts of associated companies in the consolidated profi t and loss account.

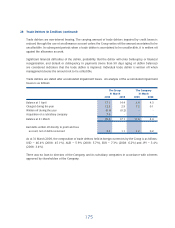

During the fi nancial year, the Company’s associated company, RCMS Properties Private Limited, recorded a

revaluation loss of $29.4 million (2007-08: revaluation gain of $253.4 million) from its annual revaluation

exercise of its land and building. The Company’s share of the revaluation loss of $5.9 million at 31 March

2009 (2008: revaluation gain of $50.7 million) is included under the Group’s share of post-acquisition

capital reserve.

The Group has not recognised losses relating to Tiger Aviation Pte Ltd where its share of losses exceeds

the Group’s interest in this associated company. The Group’s cumulative share of losses at the balance

sheet date was $45.2 million (2008: $31.3 million), of which $6.0 million (2007-08: nil) was the share of

the current year’s losses that have not been recognised. The Group has no obligation in respect of these

unrecognised losses.

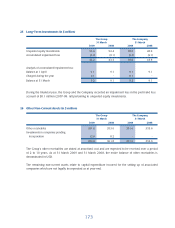

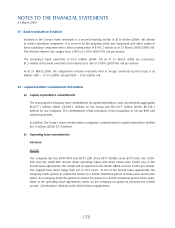

Loans to associated companies are unsecured and have no foreseeable terms of repayments. Accordingly,

the fair values of the loans are not determinable as the timing of future cash fl ows arising from the loans

cannot be estimated reliably. The loans are non-interest bearing, except for $1.4 million (2008: $2.6 million)

and $133.0 million (2008: $133.0 million), which bear interest ranging from 3.43% to 6.05% and LIBOR

plus 2.50% (2007-08: 4.70% to 7.36% and LIBOR plus 2.50%) per annum respectively.

The loan of $133.0 million represents cumulative redeemable preference shares issued by the Company’s

associated company, Virgin Atlantic Limited (“VAL”). The cumulative redeemable preference shares carry

no entitlement to vote at meetings. On a winding up of VAL, the preference shareholders have a right to

receive, in preference to payments to ordinary shareholders, the amount paid up on any share including any

amount paid up by way of share premium plus any arrears or accruals of dividend calculated down to the

date of the return of capital irrespective of whether such dividends have been earned or declared or not.

Amounts owing to/by associated companies are unsecured, trade-related, non-interest bearing and are

repayable on demand.