Singapore Airlines 2009 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2009 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224

|

|

198

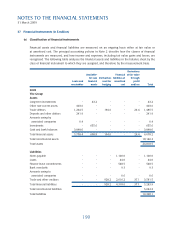

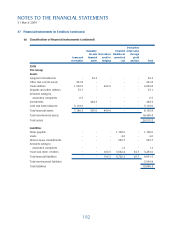

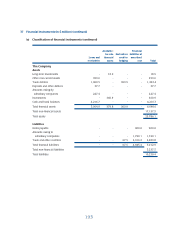

NOTES TO THE FINANCIAL STATEMENTS

31 March 2009

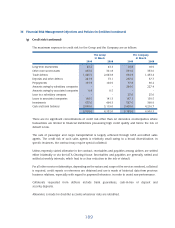

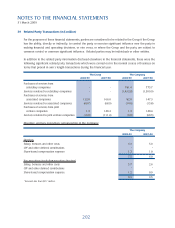

37 Financial Instruments (in $ million) (continued)

(c) Derivative fi nancial instruments and hedging activities (continued)

Fair value through profi t and loss

In addition, there are cross currency swap contracts in place where the Group pays SGD and receives

USD with exchange rates ranging from 1.3085 to 1.6990. These contracts are used to protect the

foreign exchange risk exposure of the Group’s USD-denominated lease liabilities. The maturity period

of these contracts ranges from 21 August 2015 to 14 February 2018.

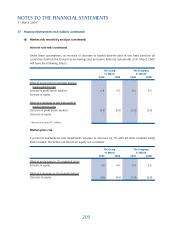

(d) Market risk sensitivity analysis

The Group has used a sensitivity analysis technique that measures the estimated change to the

profi t and loss and equity of either an instantaneous increase or decrease of 0.01% (1 basis point) in

market interest rates or a 1% strengthening or weakening in SGD against all other currencies, from

the rates applicable at 31 March 2009, for each class of fi nancial instrument with all other variables

remaining constant. This analysis is for illustrative purposes only, as in practice, market rates rarely

change in isolation.

Jet fuel price risk

The jet fuel price risk sensitivity analysis is based on the assumption that all other factors, such as

fuel surcharge and uplifted fuel volume, remain constant. Under this assumption, and excluding the

effects of hedging, an increase in price of one US dollar per barrel of jet fuel affects the Group’s and the

Company’s annual fuel costs by $54.4 million and $45.7 million (2007-08: $49.7 million and $40.3

million) respectively.

The fuel hedging sensitivity analysis is based on contracts that are still outstanding as at balance

sheet date and assumes that all jet fuel, gasoil and regrade hedges are highly effective. Under these

assumptions, with an increase or decrease in both jet fuel and gasoil prices, each by one US dollar per

barrel, the before tax effects on equity are as follows:

The Group The Company

31 March 31 March

2009 2008 2009 2008

Effect of an increase in one USD per barrel

Increase in equity 14.3 18.5 11.8 15.1

Effect of a decrease in one USD per barrel

Decrease in equity (14.3) (18.5) (11.8) (15.1)