Singapore Airlines 2009 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2009 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

149

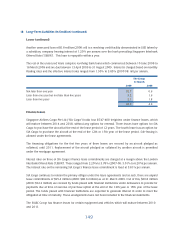

18 Long-Term Liabilities (in $ million) (continued)

Loans (continued)

Another unsecured loan of $0.8 million (2008: nil) is a revolving credit facility denominated in USD taken by

a subsidiary company bearing interest of 1.20% per annum over the bank prevailing Singapore Interbank

Offered Rate (“SIBOR”). This loan is repayable within a year.

The rest of the unsecured loans comprise revolving bank loans which commenced between 10 June 2008 to

16 March 2009 and are due between 13 April 2009 to 31 August 2009. Interest is charged based on monthly

fl oating rates and the effective interest rates ranged from 1.95% to 3.85% (2007-08: nil) per annum.

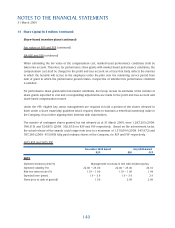

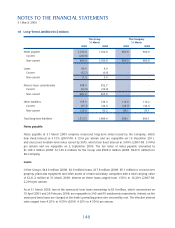

The Group

31 March

2009 2008

Not later than one year 32.7 0.6

Later than one year but not later than fi ve years 9.2 1.6

Later than fi ve years 2.1 1.8

44.0 4.0

Finance leases

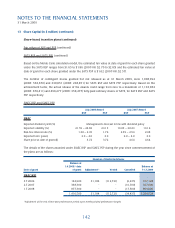

Singapore Airlines Cargo Pte Ltd (“SIA Cargo”) holds four B747-400 freighters under fi nance leases, which

will mature between 2014 and 2018, without any options for renewal. Three leases have options for SIA

Cargo to purchase the aircraft at the end of the lease period of 12 years. The fourth lease has an option for

SIA Cargo to purchase the aircraft at the end of the 12th or 15th year of the lease period. Sub-leasing is

allowed under the lease agreements.

The fi nancing obligations for the fi rst fi ve years of three leases are secured by an aircraft pledged as

collateral, until 2011. Replacement of the aircraft pledged as collateral by another aircraft is permitted

under the mortgage agreement.

Interest rates on three of SIA Cargo’s fi nance lease commitments are charged at a margin above the London

Interbank Offered Rate (“LIBOR”). These ranged from 2.20% to 3.78% (2007-08: 5.01% to 6.20%) per annum.

The interest rate on the remaining SIA Cargo’s fi nance lease commitment is fi xed at 5.81% per annum.

SIA Cargo continues to remain the primary obligor under the lease agreements and as such, there are unpaid

lease commitments of $95.4 million (2008: $86.6 million) as at 31 March 2009. Out of this, $60.8 million

(2008: $52.2 million) are covered by funds placed with fi nancial institutions under defeasance to provide for

payments due at time of exercise of purchase option at the end of the 12th year or 15th year of the lease

period. The funds placed with fi nancial institutions are expected to generate interest in order to meet the

obligation at time of maturity. These arrangements have not been included in the fi nancial statements.

The SIAEC Group has fi nance leases for certain equipment and vehicles which will mature between 2010

and 2011.