Johnson Controls 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

related entity expense add back provisions. These Wisconsin tax law changes did not have a material impact on the

Company’s consolidated financial condition, results of operations or cash flows.

In December 2007, Canada enacted a new tax law which effectively reduced the income tax rates from 35% to 32%.

A Business Flat Tax (IETU) was enacted on October 1, 2007 in Mexico that provides for a tax rate of 17% on a

modified tax base with a credit for corporate income tax paid. On December 28, 2007, Italy enacted reductions in

regional taxes from 4.25% to 3.9% effective January 1, 2008. These tax law changes did not have a material impact

on the Company’s consolidated financial condition, results of operations or cash flows.

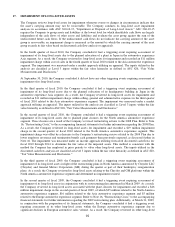

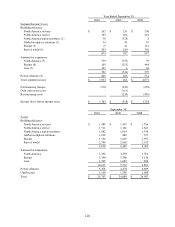

Continuing Operations

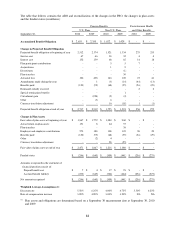

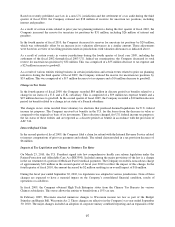

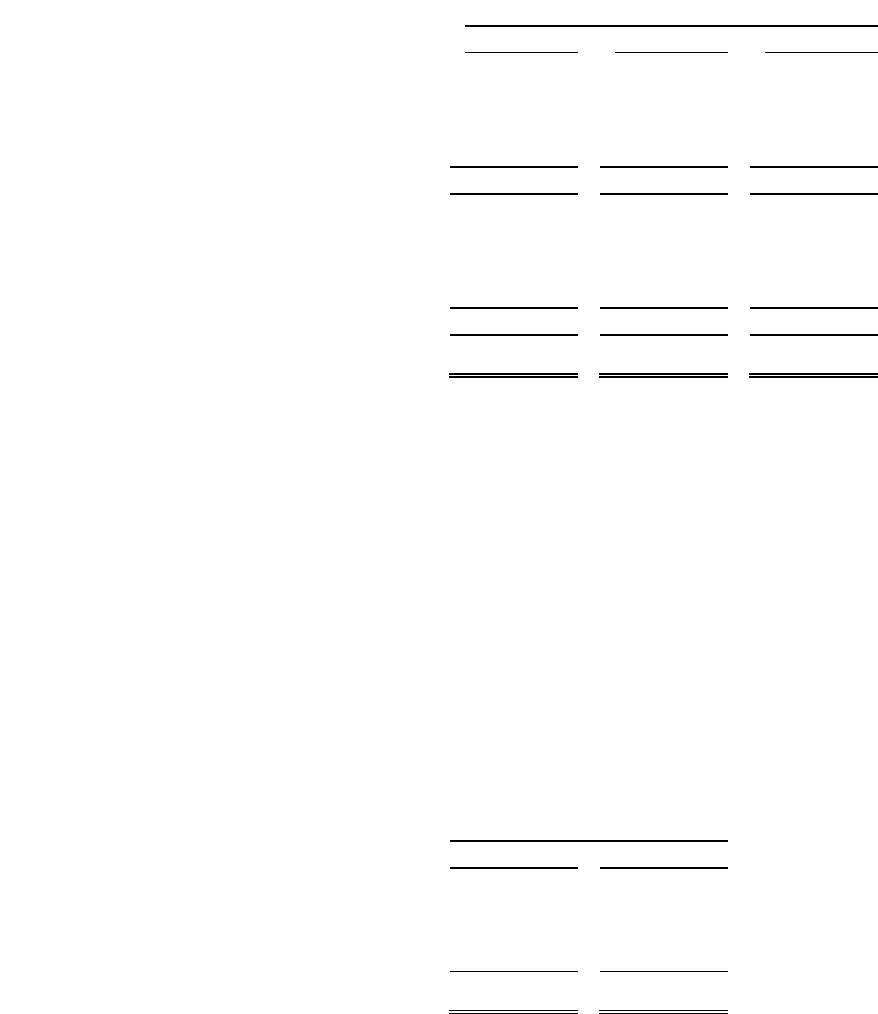

Components of the provision for income taxes on continuing operations were as follows (in millions):

Year Ended September 30,

2010

2009

2008

Current

Federal

$

112

$

53

$

136

State

29

6

26

Foreign

141

(33)

199

282

26

361

Deferred

Federal

145

(276)

13

State

2

(11)

9

Foreign

(232)

293

(62)

(85)

6

(40)

Provision for income taxes

$

197

$

32

$

321

Consolidated domestic income from continuing operations before income taxes and noncontrolling interests for the

fiscal years ended September 30, 2010, 2009 and 2008 was income of $666 million, loss of $263 million and

income of $897 million, respectively. Consolidated non-U.S. income from continuing operations before income

taxes and noncontrolling interests for the fiscal years ended September 30, 2010, 2009 and 2008 was income of

$1,097 million, loss of $55 million and income of $426 million, respectively.

Income taxes paid for the fiscal years ended September 30, 2010, 2009 and 2008 were $535 million, $326 million

and $317 million, respectively.

The Company has not provided additional U.S. income taxes on approximately $4.5 billion of undistributed

earnings of consolidated non-U.S. subsidiaries included in shareholders’ equity attributable to Johnson Controls,

Inc. Such earnings could become taxable upon the sale or liquidation of these non-U.S. subsidiaries or upon

dividend repatriation. The Company’s intent is for such earnings to be reinvested by the subsidiaries or to be

repatriated only when it would be tax effective through the utilization of foreign tax credits. It is not practicable to

estimate the amount of unrecognized withholding taxes and deferred tax liability on such earnings.

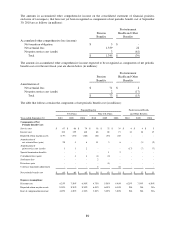

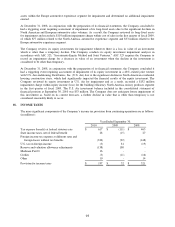

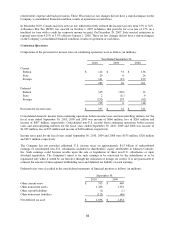

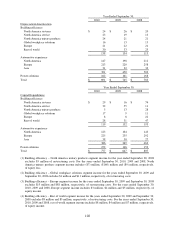

Deferred taxes were classified in the consolidated statements of financial position as follows (in millions):

September 30,

2010

2009

Other current assets

$

533

$

469

Other noncurrent assets

1,436

1,252

Other current liabilities

(1)

(1)

Other noncurrent liabilities

(112)

(66)

Net deferred tax asset

$

1,856

$

1,654