Johnson Controls 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

assets within the Europe automotive experience segment for impairment and determined no additional impairment

existed.

At December 31, 2008, in conjunction with the preparation of its financial statements, the Company concluded it

had a triggering event requiring assessment of impairment of its long-lived assets due to the significant declines in

North American and European automotive sales volumes. As a result, the Company reviewed its long-lived assets

for impairment and recorded a $110 million impairment charge within cost of sales in the first quarter of fiscal 2009,

of which $77 million related to the North America automotive experience segment and $33 million related to the

Europe automotive experience segment.

The Company reviews its equity investments for impairment whenever there is a loss in value of an investment

which is other than a temporary decline. The Company conducts its equity investment impairment analyses in

accordance with ASC 323, ―Investments-Equity Method and Joint Ventures.‖ ASC 323 requires the Company to

record an impairment charge for a decrease in value of an investment when the decline in the investment is

considered to be other than temporary.

At December 31, 2008, in conjunction with the preparation of its financial statements, the Company concluded it

had a triggering event requiring assessment of impairment of its equity investment in a 48%-owned joint venture

with U.S. Airconditioning Distributors, Inc. (U.S. Air) due to the significant decline in North American residential

housing construction starts, which had significantly impacted the financial results of the equity investment. The

Company reviewed its equity investment in U.S. Air for impairment and as a result, recorded a $152 million

impairment charge within equity income (loss) for the building efficiency North America unitary products segment

in the first quarter of fiscal 2009. The U.S. Air investment balance included in the consolidated statement of

financial position at September 30, 2010 was $53 million. The Company does not anticipate future impairment of

this investment as, based on its current forecasts, a further decline in value that is other than temporary is not

considered reasonably likely to occur.

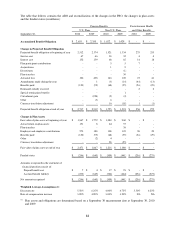

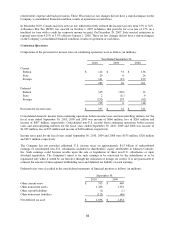

18. INCOME TAXES

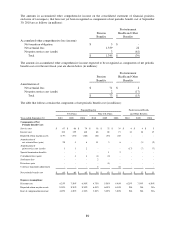

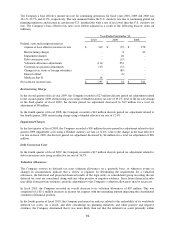

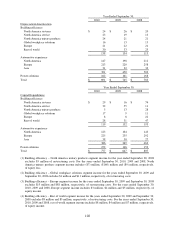

The more significant components of the Company’s income tax provision from continuing operations are as follows

(in millions):

Year Ended September 30,

2010

2009

2008

Tax expense (benefit) at federal statutory rate

$

617

$

(111)

$

463

State income taxes, net of federal benefit

28

(15)

27

Foreign income tax expense at different rates and

foreign losses without tax benefits

(330)

(92)

(148)

U.S. tax on foreign income

(3)

81

(19)

Reserve and valuation allowance adjustments

(138)

180

-

Medicare Part D

16

-

-

Credits

(3)

(11)

(16)

Other

10

-

14

Provision for income taxes

$

197

$

32

$

321