Johnson Controls 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

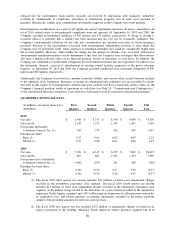

In December 2007, the FASB issued guidance changing the accounting for business combinations in a number of

areas including the treatment of contingent consideration, preacquisition contingencies, transaction costs, in-process

research and development and restructuring costs. In addition, under this guidance changes in an acquired entity’s

deferred tax assets and uncertain tax positions after the measurement period will impact income tax expense. This

guidance is included in ASC 805, ―Business Combinations,‖ and was adopted by the Company in the first quarter of

fiscal 2010 (October 1, 2009). This guidance changes the Company’s accounting treatment for business

combinations on a prospective basis.

In December 2007, the FASB issued guidance changing the accounting and reporting for minority interests, which

are recharacterized as noncontrolling interests and classified as a component of equity. This new consolidation

method changes the accounting for transactions with minority interest holders. This guidance is included in ASC

810, ―Consolidation,‖ and was adopted by the Company in the first quarter of fiscal 2010 (October 1, 2009). The

adoption of this guidance did not have a material impact on the Company’s consolidated financial condition and

results of operations. Refer to Note 14, ―Equity and Noncontrolling Interests,‖ for further discussion.

In September 2006, the FASB issued guidance that defines fair value, establishes a framework for measuring fair

value and expands disclosures about fair value measurements. This guidance also establishes a fair value hierarchy

that prioritizes information used in developing assumptions when pricing an asset or liability. This guidance is

included in ASC 820, ―Fair Value Measurements and Disclosures.‖ The Company adopted this guidance effective

October 1, 2008. In February 2008, the FASB delayed the effective date of this guidance for nonfinancial assets and

nonfinancial liabilities that are recognized or disclosed in the financial statements on a nonrecurring basis to fiscal

years beginning after November 15, 2008. The provisions of this guidance for nonfinancial assets and nonfinancial

liabilities were effective for the Company in the first quarter of fiscal 2010 (October 1, 2009) and will be applied

prospectively to fair value assessments such as the Company’s long-lived asset impairment analyses. Refer to Note

17, ―Impairment of Long-Lived Assets,‖ for further discussion.

RISK MANAGEMENT

The Company selectively uses derivative instruments to reduce market risk associated with changes in foreign

currency, commodities, interest rates and stock-based compensation. All hedging transactions are authorized and

executed pursuant to clearly defined policies and procedures, which strictly prohibit the use of financial instruments

for speculative purposes. At the inception of the hedge, the Company assesses the effectiveness of the hedge

instrument and designates the hedge instrument as either (1) a hedge of a recognized asset or liability or of a

recognized firm commitment (a fair value hedge), (2) a hedge of a forecasted transaction or of the variability of cash

flows to be received or paid related to an unrecognized asset or liability (a cash flow hedge) or (3) a hedge of a net

investment in a non-U.S. operation (a net investment hedge). The Company performs hedge effectiveness testing on

an ongoing basis depending on the type of hedging instrument used.

For all foreign currency derivative instruments designated as cash flow hedges, retrospective effectiveness is tested

on a monthly basis using a cumulative dollar offset test. The fair value of the hedged exposures and the fair value of

the hedge instruments are revalued and the ratio of the cumulative sum of the periodic changes in the value of the

hedge instruments to the cumulative sum of the periodic changes in the value of the hedge is calculated. The hedge

is deemed as highly effective if the ratio is between 80% and 125%. For commodity derivative contracts designated

as cash flow hedges, effectiveness is tested using a regression calculation. Ineffectiveness is minimal as the

Company aligns most of the critical terms of its derivatives with the supply contracts.

For net investment hedges, the Company assesses its net investment positions in the non-U.S. operations and

compares it with the outstanding net investment hedges on a quarterly basis. The hedge is deemed effective if the

aggregate outstanding principal of the hedge instruments designated as the net investment hedge in a non-U.S.

operation does not exceed the Company’s net investment positions in the respective non-U.S. operation.

For interest hedges such as interest rate swaps, the Company elected the long haul method and assesses retrospective

and prospective effectiveness and measures ineffectiveness on a quarterly basis.

For equity swaps, these derivative instruments are not designated as hedging instruments under ASC 815,

―Derivatives and Hedging,‖ and require no assessment of effectiveness on a quarterly basis.

A discussion of the Company’s accounting policies for derivative financial instruments is included in Note 1,

―Summary of Significant Accounting Policies,‖ to the accompanying financial statements, and further disclosure