Johnson Controls 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

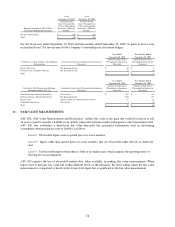

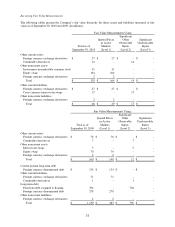

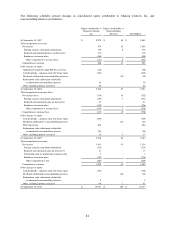

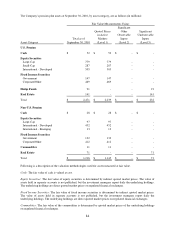

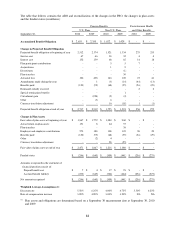

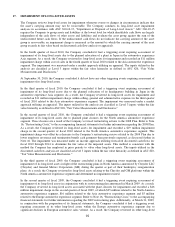

The Company’s pension plan assets at September 30, 2010, by asset category, are as follows (in millions):

Fair Value Measurements Using:

Significant

Quoted Prices

Other

Significant

in Active

Observable

Unobservable

Total as of

Markets

Inputs

Inputs

Asset Category

September 30, 2010

(Level 1)

(Level 2)

(Level 3)

U.S. Pension

Cash

$

52

$

52

$

-

$

-

Equity Securities

Large-Cap

779

779

-

-

Small-Cap

287

287

-

-

International - Developed

505

505

-

-

Fixed Income Securities

Government

147

147

-

-

Corporate/Other

469

469

-

-

Hedge Funds

91

-

-

91

Real Estate

141

-

-

141

Total

$

2,471

$

2,239

$

-

$

232

Non-U.S. Pension

Cash

$

28

$

28

$

-

$

-

Equity Securities

Large-Cap

97

97

-

-

International - Developed

452

452

-

-

International - Emerging

13

13

-

-

Fixed Income Securities

Government

132

132

-

-

Corporate/Other

412

412

-

-

Commodities

11

11

-

-

Real Estate

71

-

-

71

Total

$

1,216

$

1,145

$

-

$

71

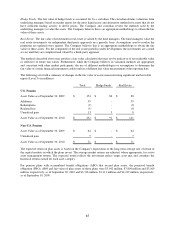

Following is a description of the valuation methodologies used for assets measured at fair value.

Cash: The fair value of cash is valued at cost.

Equity Securities: The fair value of equity securities is determined by indirect quoted market prices. The value of

assets held in separate accounts is not published, but the investment managers report daily the underlying holdings.

The underlying holdings are direct quoted market prices on regulated financial exchanges.

Fixed Income Securities: The fair value of fixed income securities is determined by indirect quoted market prices.

The value of assets held in separate accounts is not published, but the investment managers report daily the

underlying holdings. The underlying holdings are direct quoted market prices on regulated financial exchanges.

Commodities: The fair value of the commodities is determined by quoted market prices of the underlying holdings

on regulated financial exchanges.