Johnson Controls 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

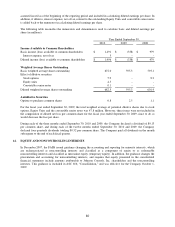

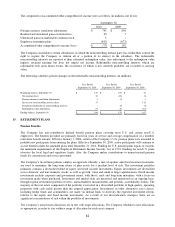

Valuation Methods

Foreign currency exchange derivatives – The Company selectively hedges anticipated transactions that are subject to

foreign exchange rate risk primarily using foreign currency exchange hedge contracts. The foreign currency

exchange derivatives are valued under a market approach using publicized spot and forward prices. As cash flow

hedges, the effective portion of the hedge gains or losses due to changes in fair value are initially recorded as a

component of accumulated other comprehensive income and are subsequently reclassified into earnings when the

hedged transactions occur and affect earnings. Any ineffective portion of the hedge is reflected in the consolidated

statement of income. These contracts are highly effective in hedging the variability in future cash flows attributable

to changes in currency exchange rates at September 30, 2010 and 2009. The fair value of foreign currency exchange

derivatives not designated as hedging instruments under ASC 815 are recorded in the consolidated statement of

income.

Commodity derivatives – The Company selectively hedges anticipated transactions that are subject to commodity

price risk, primarily using commodity hedge contracts, to minimize overall price risk associated with the Company’s

purchases of lead, copper and aluminum. The commodity derivatives are valued under a market approach using

publicized prices, where available, or dealer quotes. As cash flow hedges, the effective portion of the hedge gains or

losses due to changes in fair value are initially recorded as a component of accumulated other comprehensive

income and are subsequently reclassified into earnings when the hedged transactions, typically sales or cost related

to sales, occur and affect earnings. Any ineffective portion of the hedge is reflected in the consolidated statement of

income. These contracts are highly effective in hedging the variability in future cash flows attributable to changes in

commodity price changes at September 30, 2010 and 2009.

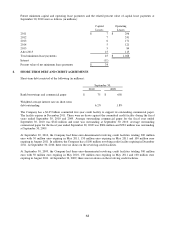

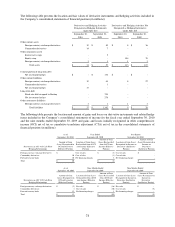

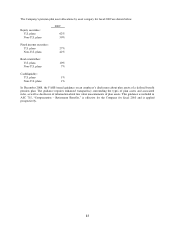

Interest rate swaps and related debt – The Company selectively uses interest rate swaps to reduce market risk

associated with changes in interest rates for its fixed-rate bonds. As fair value hedges, the interest rate swaps and

related debt balances are valued under a market approach using publicized swap curves. Changes in the fair value of

the swap and hedged portion of the debt are recorded in the consolidated statement of income. In the fourth quarter

of fiscal 2009, the Company entered into three fixed to floating interest rate swaps totaling $700 million to hedge the

coupons of its 5.25% bonds maturing on January 15, 2011. In the second quarter of fiscal 2010, the Company

terminated a $100 million portion of one of the three interest swaps mentioned above. During the second quarter of

fiscal 2010, the Company entered into a fixed to floating interest rate swap totaling $100 million to hedge the

coupons of its 5.80% bond maturing November 15, 2012 and two fixed to floating interest rate swaps totaling $300

million to hedge the coupons of its 4.875% bond maturing September 15, 2013. In the fourth quarter of fiscal 2010,

the Company terminated all of its interest rate swaps. The fair value adjustments to the related debt will be

amortized over the remaining term of the debt.

Investments in marketable common stock – The Company invested in certain marketable common stock during the

third quarter of fiscal 2010. The securities are valued under a market approach using publicized share prices. As of

September 30, 2010, the Company recorded an unrealized gain of $3 million in accumulated other comprehensive

income and no unrealized losses on these investments.

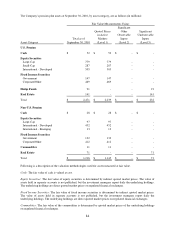

Equity swaps – The Company selectively uses equity swaps to reduce market risk associated with certain of its

stock-based compensation plans, such as its deferred compensation plans. The equity swaps are valued under a

market approach as the fair value of the swaps is based on the Company’s stock price at the reporting period date.

Changes in fair value on the equity swaps are reflected in the consolidated statement of income within selling,

general and administrative expenses.

Cross-currency interest rate swaps – The Company selectively uses cross-currency interest rate swaps to hedge the

foreign currency rate risk associated with certain of its investments in Japan. The cross-currency interest rate swaps

are valued using market assumptions. Changes in the market value of the swaps are reflected in the foreign currency

translation adjustments component of accumulated other comprehensive income where they offset gains and losses

recorded on the Company’s net investment in Japan. The Company entered into three cross-currency swaps totaling

20 billion yen during the second quarter of fiscal 2010. In the fourth quarter of fiscal 2010, a 5 billion yen cross-

currency swap expired and the Company replaced it with a new 5 billion yen cross-currency swap. These swaps are

designated as hedges in the Company’s net investment in Japan. There were no cross-currency interest rate swaps

outstanding at September 30, 2009.

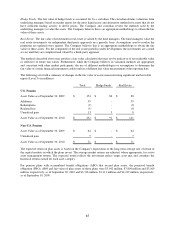

Foreign currency denominated debt – The Company has entered into certain foreign currency denominated debt

obligations to selectively hedge portions of its net investment in Japan. The currency effects of the debt obligations

are reflected in the foreign currency translation adjustments component of accumulated other comprehensive income