Johnson Controls 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

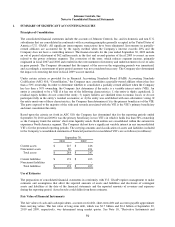

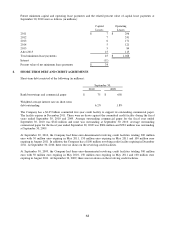

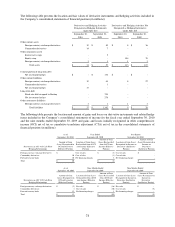

9. LONG-TERM DEBT AND FINANCING ARRANGEMENTS

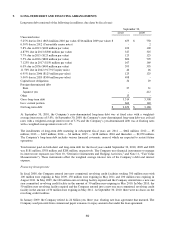

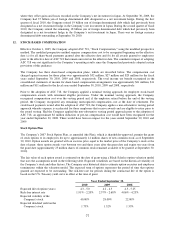

Long-term debt consisted of the following (in millions; due dates by fiscal year):

September 30,

2010

2009

Unsecured notes

5.25% due in 2011 ($654 million 2010 par value, $746 million 2009 par value)

$

655

$

750

6.50% due in 2012 (Convertible senior notes)

-

2

5.8% due in 2013 ($100 million par value)

102

100

4.875% due in 2013 ($300 million par value)

327

325

7.7% due in 2015 ($125 million par value)

125

125

5.5% due in 2016 ($800 million par value)

800

799

7.125% due in 2017 ($150 million par value)

167

169

6.0% due in 2036 ($400 million par value)

395

395

11.50% due in 2042 (917,915 equity units)

46

46

6.95% due in 2046 ($125 million par value)

125

125

5.00% due in 2020 ($500 million par value)

498

-

Capital lease obligations

34

29

Foreign-denominated debt

Euro

27

31

Japanese yen

-

412

Other

13

-

Gross long-term debt

3,314

3,308

Less: current portion

662

140

Net long-term debt

$

2,652

$

3,168

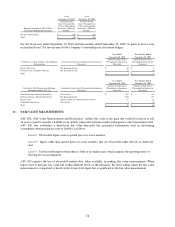

At September 30, 2010, the Company’s euro-denominated long-term debt was at fixed rates with a weighted-

average interest rate of 5.0%. At September 30, 2009, the Company’s euro-denominated long-term debt was at fixed

rates with a weighted-average interest rate of 5.3% and the Company’s yen-denominated debt was at floating rates

with a weighted average interest rate of 1.1%.

The installments of long-term debt maturing in subsequent fiscal years are: 2011 — $662 million; 2012 — $5

million; 2013 — $445 million; 2014 — $4 million; 2015 — $128 million; 2016 and thereafter — $2,070 million.

The Company’s long-term debt includes various financial covenants, none of which are expected to restrict future

operations.

Total interest paid on both short and long-term debt for the fiscal years ended September 30, 2010, 2009 and 2008

was $181 million, $358 million and $288 million, respectively. The Company uses financial instruments to manage

its interest rate exposure (see Note 10, ―Derivative Instruments and Hedging Activities,‖ and Note 11, ―Fair Value

Measurements‖). These instruments affect the weighted average interest rate of the Company’s debt and interest

expense.

Financing Arrangements

In fiscal 2008, the Company entered into new committed, revolving credit facilities totaling 350 million euro with

100 million euro expiring in May 2009, 150 million euro expiring in May 2011 and 100 million euro expiring in

August 2011. In May 2009, the 100 million euro revolving facility expired and the Company entered into a new one

year committed, revolving credit facility in the amount of 50 million euro expiring in May 2010. In May 2010, the

50 million euro revolving facility expired and the Company entered into a new one year committed, revolving credit

facility in the amount of 50 million euro expiring in May 2011. At September 30, 2010, there were no draws on the

revolving credit facilities.

In January 2009, the Company retired its 24 billion yen, three year, floating rate loan agreement that matured. The

Company used proceeds from commercial paper issuances to repay amounts due under the loan agreement.