Johnson Controls 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

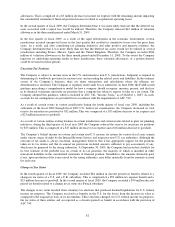

At December 31, 2008, in conjunction with the preparation of its financial statements, the Company concluded it

had a triggering event requiring assessment of impairment of its long-lived assets due to the significant declines in

North American and European automotive sales volumes. As a result, the Company reviewed its long-lived assets

for impairment and recorded a $110 million impairment charge within cost of sales in the first quarter of fiscal 2009,

of which $77 million related to the North America automotive experience segment and $33 million related to the

Europe automotive experience segment.

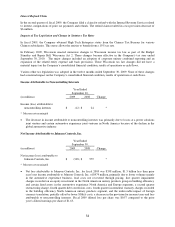

Investments in partially-owned affiliates at September 30, 2010 were $728 million, $10 million higher than the prior

year. The increase was primarily due to positive earnings by certain automotive experience and power solutions joint

ventures, partially offset by dividends paid by joint ventures and the acquisition of the controlling interest in a

formerly unconsolidated Korean joint venture in the power solutions segment.

The Company reviews its equity investments for impairment whenever there is a loss in value of an investment

which is other than a temporary decline. The Company conducts its equity investment impairment analyses in

accordance with ASC 323, ―Investments-Equity Method and Joint Ventures.‖ ASC 323 requires the Company to

record an impairment charge for a decrease in value of an investment when the decline in the investment is

considered to be other than temporary.

At December 31, 2008, in conjunction with the preparation of its financial statements, the Company concluded it

had a triggering event requiring assessment of impairment of its equity investment in a 48%-owned joint venture

with U.S. Airconditioning Distributors, Inc. (U.S. Air) due to the significant decline in North American residential

housing construction starts, which had significantly impacted the financial results of the equity investment. The

Company reviewed its equity investment in U.S. Air for impairment and as a result, recorded a $152 million

impairment charge within equity income (loss) for the building efficiency North America unitary products segment

in the first quarter of fiscal 2009. The U.S. Air investment balance included in the consolidated statement of

financial position at September 30, 2010 was $53 million. The Company does not anticipate future impairment of

this investment as, based on its current forecasts, a further decline in value that is other than temporary is not

considered reasonably likely to occur.

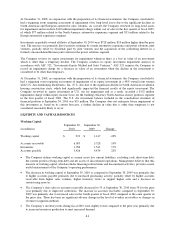

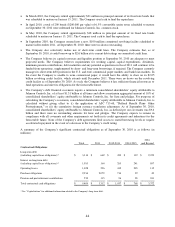

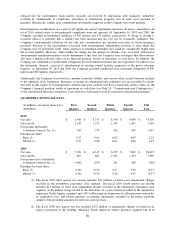

LIQUIDITY AND CAPITAL RESOURCES

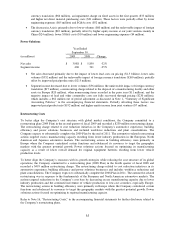

Working Capital

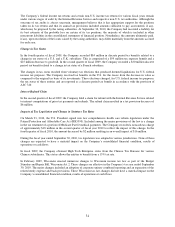

September 30,

September 30,

(in millions)

2010

2009

Change

Working capital

$

919

$

1,147

-20%

Accounts receivable

6,095

5,528

10%

Inventories

1,786

1,521

17%

Accounts payable

5,426

4,434

22%

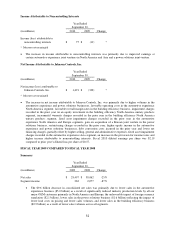

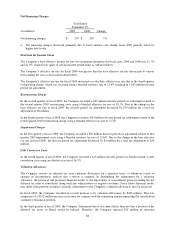

The Company defines working capital as current assets less current liabilities, excluding cash, short-term debt,

the current portion of long-term debt and net assets of discontinued operations. Management believes that this

measure of working capital, which excludes financing-related items and discontinued activities, provides a more

useful measurement of the Company’s operating performance.

The decrease in working capital at September 30, 2010 as compared to September 30, 2009 was primarily due

to higher accounts payable primarily due to increased purchasing activity, partially offset by higher accounts

receivable from higher sales volumes, higher inventory levels to support higher sales and a decrease in

restructuring reserves.

The Company’s days sales in accounts receivable decreased to 55 at September 30, 2010 from 58 for the prior

year primarily due to improved collections. The increase in accounts receivable compared to September 30,

2009 was primarily due to increased sales in the fourth quarter of fiscal 2010 compared to the same quarter in

the prior year. There has been no significant adverse change in the level of overdue receivables or changes in

revenue recognition methods.

The Company’s inventory turns during fiscal 2010 were slightly lower compared to the prior year primarily due

to increased inventory production to meet increased demand.