Johnson Controls 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

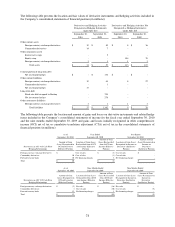

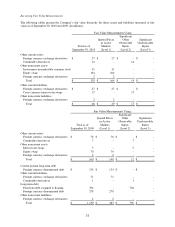

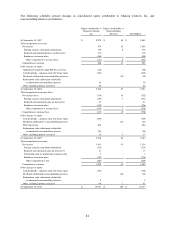

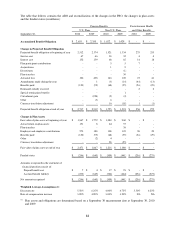

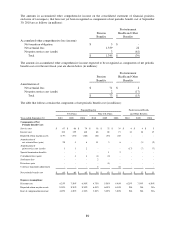

The following schedules present changes in consolidated equity attributable to Johnson Controls, Inc. and

noncontrolling interests (in millions):

Equity Attributable to

Johnson Controls,

Inc.

Equity Attributable to

Noncontrolling

Interests

Total Equity

At September 30, 2007

$

8,873

$

88

$

8,961

Total comprehensive income:

Net income

979

25

1,004

Foreign currency translation adjustments

170

8

178

Realized and unrealized losses on derivatives

(93)

-

(93)

Employee retirement plans

(188)

-

(188)

Other comprehensive income (loss)

(111)

8

(103)

Comprehensive income

868

33

901

Other changes in equity:

Adjustment to initially adopt FIN 48, net of tax

(68)

-

(68)

Cash dividends - common stock ($0.52 per share)

(309)

-

(309)

Dividends attributable to noncontrolling interests

-

(34)

(34)

Redemption value adjustment attributable

to redeemable noncontrolling interests

16

-

16

Other, including options exercised

26

-

26

At September 30, 2008

9,406

87

9,493

Total comprehensive income (loss):

Net income (loss)

(338)

16

(322)

Foreign currency translation adjustments

(194)

3

(191)

Realized and unrealized gains on derivatives

41

-

41

Employee retirement plans

(326)

-

(326)

Other comprehensive income (loss)

(479)

3

(476)

Comprehensive income (loss)

(817)

19

(798)

Other changes in equity:

Cash dividends - common stock ($0.52 per share)

(309)

-

(309)

Dividends attributable to noncontrolling interests

-

(23)

(23)

Debt conversion

804

-

804

Redemption value adjustment attributable

to redeemable noncontrolling interests

(20)

-

(20)

Other, including options exercised

36

1

37

At September 30, 2009

9,100

84

9,184

Total comprehensive income:

Net income

1,491

43

1,534

Foreign currency translation adjustments

(115)

-

(115)

Realized and unrealized gains on derivatives

13

-

13

Unrealized gains on marketable common stock

3

-

3

Employee retirement plans

(170)

-

(170)

Other comprehensive loss

(269)

-

(269)

Comprehensive income

1,222

43

1,265

Other changes in equity:

Cash dividends - common stock ($0.52 per share)

(350)

-

(350)

Dividends attributable to noncontrolling interests

-

(22)

(22)

Redemption value adjustment attributable

to redeemable noncontrolling interests

9

-

9

Other, including options exercised

90

1

91

At September 30, 2010

$

10,071

$

106

$

10,177