Johnson Controls 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

In March 2010, the Company retired approximately $31 million in principal amount of its fixed rate bonds that

was scheduled to mature on January 15, 2011. The Company used cash to fund the repurchase.

In April 2010, a total of 200 bonds ($200,000 par value) of 6.5% convertible senior notes scheduled to mature

on September 30, 2012 were redeemed for Johnson Controls, Inc. common stock.

In May 2010, the Company retired approximately $18 million in principal amount of its fixed rate bonds

scheduled to mature on January 15, 2011. The Company used cash to fund the repurchases.

In September 2010, the Company entered into a new, $100 million committed revolving facility scheduled to

mature in December 2011. At September 30, 2010, there were no draws outstanding.

The Company also selectively makes use of short-term credit lines. The Company estimates that, as of

September 30, 2010, it could borrow up to $2.6 billion at its current debt ratings on committed credit lines.

The Company believes its capital resources and liquidity position at September 30, 2010 are adequate to meet

projected needs. The Company believes requirements for working capital, capital expenditures, dividends,

minimum pension contributions, debt maturities and any potential acquisitions in fiscal 2011 will continue to be

funded from operations, supplemented by short- and long-term borrowings, if required. The Company currently

manages its short-term debt position in the U.S. and euro commercial paper markets and bank loan markets. In

the event the Company is unable to issue commercial paper, it would have the ability to draw on its $2.05

billion revolving credit facility, which extends until December 2011. There were no draws on the revolving

credit facility as of September 30, 2010. As such, the Company believes it has sufficient financial resources to

fund operations and meet its obligations for the foreseeable future.

The Company’s debt financial covenants require a minimum consolidated shareholders’ equity attributable to

Johnson Controls, Inc. of at least $1.31 billion at all times and allow a maximum aggregated amount of 10% of

consolidated shareholders’ equity attributable to Johnson Controls, Inc. for liens and pledges. For purposes of

calculating the Company’s covenants, consolidated shareholders’ equity attributable to Johnson Controls, Inc. is

calculated without giving effect to (i) the application of ASC 715-60, ―Defined Benefit Plans- Other

Postretirement,‖ or (ii) the cumulative foreign currency translation adjustment. As of September 30, 2010,

consolidated shareholders’ equity attributable to Johnson Controls, Inc. as defined per our covenants was $9.6

billion and there were no outstanding amounts for liens and pledges. The Company expects to remain in

compliance with all covenants and other requirements set forth in its credit agreements and indentures for the

foreseeable future. None of the Company’s debt agreements limit access to stated borrowing levels or require

accelerated repayment in the event of a decrease in the Company’s credit rating.

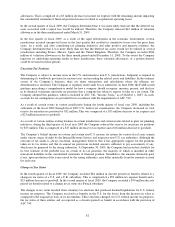

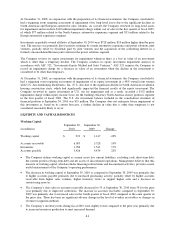

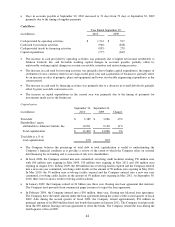

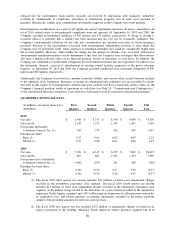

A summary of the Company’s significant contractual obligations as of September 30, 2010 is as follows (in

millions):

2016

Total

2011

2012-2013

2014-2015

and Beyond

Contractual Obligations

Long-term debt

(including capital lease obligations)*

$

3,314

$

662

$

450

$

132

$

2,070

Interest on long-term debt

(including capital lease obligations)*

1,583

160

285

241

897

Operating leases

1,028

296

412

205

115

Purchase obligations

2,934

2,079

714

92

49

Pension and postretirement contributions

550

115

96

98

241

Total contractual cash obligations

$

9,409

$

3,312

$

1,957

$

768

$

3,372

* See "Capitalization" for additional information related to the Company's long-term debt.