Johnson Controls 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

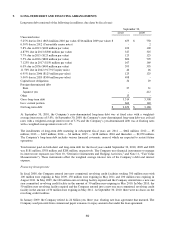

where they offset gains and losses recorded on the Company’s net investment in Japan. At September 30, 2009, the

Company had 37 billion yen of foreign denominated debt designated as a net investment hedge. During the first

quarter of fiscal 2010, the Company retired 19 billion yen of foreign denominated debt which had previously been

designated as a net investment hedge in the Company’s net investment in Japan. During the second quarter of fiscal

2010, the Company retired the remaining 18 billion yen of foreign denominated debt which had previously been

designated as a net investment hedge in the Company’s net investment in Japan. There was no foreign currency

denominated debt outstanding at September 30, 2010.

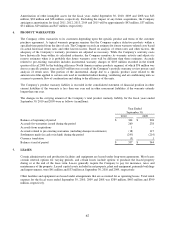

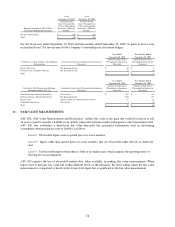

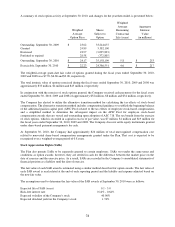

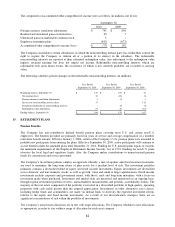

12. STOCK-BASED COMPENSATION

Effective October 1, 2005, the Company adopted ASC 718, ―Stock Compensation,‖ using the modified prospective

method. The modified prospective method requires compensation cost to be recognized beginning on the effective

date (a) for all share-based payments granted after the effective date and (b) for all awards granted to employees

prior to the effective date of ASC 718 that remain unvested on the effective date. The cumulative impact of adopting

ASC 718 was not significant to the Company’s operating results since the Company had previously adopted certain

provisions of this guidance.

The Company has three share-based compensation plans, which are described below. The compensation cost

charged against income for those plans was approximately $52 million, $27 million and $29 million for the fiscal

years ended September 30, 2010, 2009 and 2008, respectively. The total income tax benefit recognized in the

consolidated statements of income for share-based compensation arrangements was approximately $21 million, $11

million and $11 million for the fiscal years ended September 30, 2010, 2009 and 2008, respectively.

Prior to the adoption of ASC 718, the Company applied a nominal vesting approach for employee stock-based

compensation awards with retirement eligible provisions. Under the nominal vesting approach, the Company

recognized compensation cost over the vesting period and, if the employee retired before the end of the vesting

period, the Company recognized any remaining unrecognized compensation cost at the date of retirement. For

stock-based payments issued after the adoption of ASC 718, the Company applies a non-substantive vesting period

approach whereby expense is accelerated for those employees that receive awards and are eligible to retire prior to

the award vesting. Had the Company applied the non-substantive vesting period approach prior to the adoption of

ASC 718, an approximate $2 million reduction of pre-tax compensation cost would have been recognized for the

year ended September 30, 2008. There would have been no impact for the years ended September 30, 2010 and

2009.

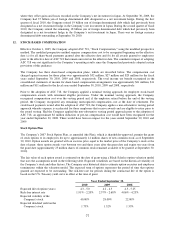

Stock Option Plan

The Company’s 2007 Stock Option Plan, as amended (the Plan), which is shareholder-approved, permits the grant

of stock options to its employees for up to approximately 41 million shares of new common stock as of September

30, 2010. Option awards are granted with an exercise price equal to the market price of the Company’s stock at the

date of grant; those option awards vest between two and three years after the grant date and expire ten years from

the grant date (approximately 25 million shares of common stock remained available to be granted at September 30,

2010).

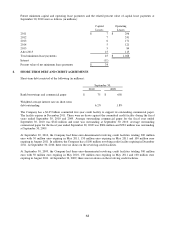

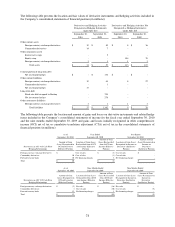

The fair value of each option award is estimated on the date of grant using a Black-Scholes option valuation model

that uses the assumptions noted in the following table. Expected volatilities are based on the historical volatility of

the Company’s stock and other factors. The Company uses historical data to estimate option exercises and employee

terminations within the valuation model. The expected term of options represents the period of time that options

granted are expected to be outstanding. The risk-free rate for periods during the contractual life of the option is

based on the U.S. Treasury yield curve in effect at the time of grant.

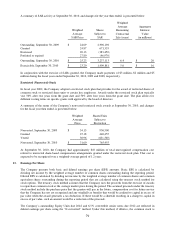

Year Ended September 30,

2010

2009

2008

Expected life of option (years)

4.3 - 5.0

4.2 - 4.5

4.5 - 5.25

Risk-free interest rate

1.91% - 2.20%

2.57% - 2.68%

4.06% - 4.23%

Expected volatility of the

Company's stock

40.00%

28.00%

22.00%

Expected dividend yield on the

Company's stock

1.73%

1.52%

1.55%