Johnson Controls 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

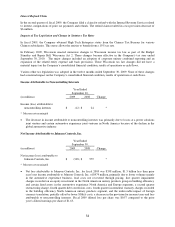

To better align the Company’s resources with its growth strategies while reducing the cost structure of its global

operations, the Company committed to a restructuring plan (2008 Plan) in the fourth quarter of fiscal 2008 and

recorded a $495 million restructuring charge. The restructuring charge related to cost reduction initiatives in its

automotive experience, building efficiency and power solutions businesses and included workforce reductions and

plant consolidations. The Company expects to substantially complete the 2008 Plan by the end of 2011. The

automotive-related restructuring was in response to the fundamentals of the European and North American

automotive markets. The actions targeted reductions in the Company’s cost base by decreasing excess

manufacturing capacity due to lower industry production and the continued movement of vehicle production to low-

cost countries, especially in Europe. The restructuring actions in building efficiency were primarily in Europe where

the Company centralized certain functions and rebalanced its resources to target the geographic markets with the

greatest potential growth. Power solutions actions focused on optimizing its regional manufacturing capacity.

Since the announcement of the 2008 Plan in September 2008, the Company has experienced lower employee

severance and termination benefit cash payouts than previously calculated for building efficiency – Europe and

automotive experience – Europe of approximately $95 million, of which $32 million was identified in the current

fiscal year, due to favorable severance negotiations, individuals transferred to open positions within the Company

and changes in cost reduction actions from plant consolidation to downsizing of operations. The underspend of the

initial 2008 Plan is committed to be utilized for similar additional restructuring actions. The underspend experienced

by building efficiency – Europe is committed to be utilized for workforce reductions and plant consolidations in

building efficiency – Europe. The underspend experienced by automotive experience – Europe is committed to be

utilized for additional plant consolidations for automotive experience – North America and workforce reductions in

building efficiency – Europe. Also, in the fourth quarter of fiscal 2010, the Company sold one plant in automotive

experience – North America it had planned to close as a part of the 2008 Plan. The loss on the sale of the plant of

$12 million was offset by a decrease in the Company’s restructuring reserve for employee severance and

termination benefits related to the planned workforce reductions which will no longer occur. The planned workforce

reductions disclosed for the 2008 Plan have been updated for the Company’s revised actions.

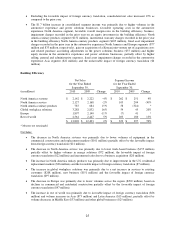

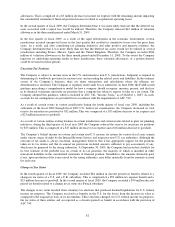

The 2008 and 2009 Plans included workforce reductions of approximately 20,400 employees (9,500 for automotive

experience – North America, 5,200 for automotive experience – Europe, 1,100 for automotive experience – Asia,

400 for building efficiency – North America, 2,700 for building efficiency – Europe, 700 for building efficiency –

rest of world, and 800 for power solutions). Restructuring charges associated with employee severance and

termination benefits are paid over the severance period granted to each employee and on a lump sum basis when

required in accordance with individual severance agreements. As of September 30, 2010, approximately 16,400 of

the employees have been separated from the Company pursuant to the 2008 and 2009 Plans. In addition, the 2008

and 2009 Plans included 33 plant closures (14 for automotive experience – North America, 11 for automotive

experience – Europe, 3 for automotive experience – Asia, 1 for building efficiency – North America, 1 for building

efficiency – rest of world, and 3 for power solutions). As of September 30, 2010, 23 of the 33 plants have been

closed. The restructuring charge for the impairment of long-lived assets associated with the plant closures was

determined using fair value based on a discounted cash flow analysis.

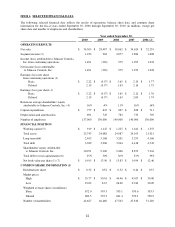

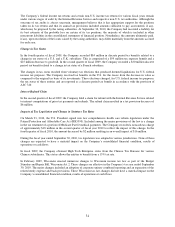

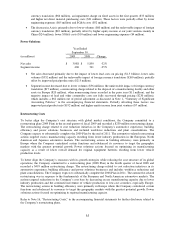

Net Financing Charges

Year Ended

September 30,

(in millions)

2010

2009

Change

Net financing charges

$

170

$

239

-29%

The decrease in net financing charges was primarily due to lower debt levels, including the conversion of the

Company’s convertible senior notes and Equity Units in September 2009, and lower interest rates in fiscal 2010.

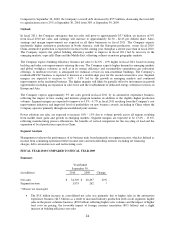

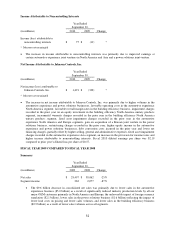

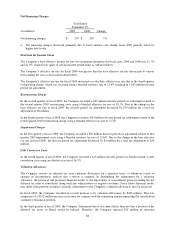

Provision for Income Taxes

The Company’s base effective income tax rate for continuing operations for fiscal years 2010 and 2009 was 18.1%

and 22.7%, respectively (prior to certain discrete period items as outlined below).

The Company’s effective tax rate for fiscal 2010 was less than the base effective tax rate due in part to various items

during the year as discussed in detail below.