Johnson Controls 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

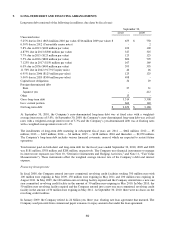

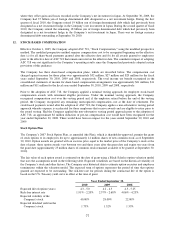

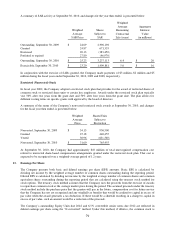

During the quarter ended March 31, 2010, the Company issued $500 million aggregate principal amount of 5.0%

senior unsecured fixed rate notes due in fiscal 2020. Net proceeds from the issue were used for general corporate

purposes including the retirement of short-term debt.

During the quarter ended June 30, 2010, a total of 200 bonds ($200,000 par value) of the Company’s 6.5%

convertible senior notes scheduled to mature on September 30, 2012, were redeemed for Johnson Controls, Inc.

common stock.

During the quarter ended June 30, 2010, the Company retired approximately $18 million in principal amount of its

fixed rate bonds scheduled to mature on January 15, 2011. The Company used cash to fund the repurchases.

During the quarter ended September 30, 2010, the Company entered into a new, $100 million committed revolving

credit facility scheduled to mature in December 2011. At September 30, 2010, there were no draws outstanding.

10. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

In March 2008, the FASB issued guidance enhancing required disclosures regarding derivatives and hedging

activities, including how an entity uses derivative instruments, how derivative instruments and related hedged items

are accounted for and affect an entity’s financial position, financial performance and cash flows. This guidance is

included in ASC 815, ―Derivatives and Hedging,‖ and was effective for the Company beginning in the second

quarter of fiscal 2009 and is applied prospectively.

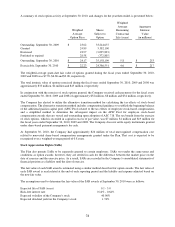

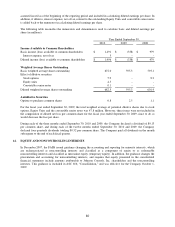

The Company selectively uses derivative instruments to reduce market risk associated with changes in foreign

currency, commodities, stock-based compensation liabilities and interest rates. Under Company policy, the use of

derivatives is restricted to those intended for hedging purposes; the use of any derivative instrument for speculative

purposes is strictly prohibited. A description of each type of derivative utilized by the Company to manage risk is

included in the following paragraphs. In addition, refer to Note 11, ―Fair Value Measurements,‖ to the financial

statements for information related to the fair value measurements and valuation methods utilized by the Company

for each derivative type.

The Company has global operations and participates in the foreign exchange markets to minimize its risk of loss

from fluctuations in foreign currency exchange rates. The Company primarily uses foreign currency exchange

contracts to hedge certain of its foreign exchange rate exposures. The Company hedges 70% to 90% of the nominal

amount of each of its known foreign exchange transactional exposures.

The Company has entered into foreign currency denominated debt obligations and cross-currency interest rate swaps

to selectively hedge portions of its net investment in Japan. The currency effects of the debt obligations and cross-

currency interest rate swaps are reflected in the accumulated other comprehensive income (AOCI) account within

shareholders’ equity attributable to Johnson Controls, Inc. where they offset gains and losses recorded on the

Company’s net investment in Japan. At September 30, 2009, the Company had 37 billion yen of foreign

denominated debt designated as a net investment hedge. During the first quarter of fiscal 2010, the Company retired

19 billion yen of foreign denominated debt which had previously been designated as a net investment hedge in the

Company’s net investment in Japan. During the second quarter of fiscal 2010, the Company retired the remaining 18

billion yen of foreign denominated debt which has previously been designated as a net investment hedge in the

Company’s net investment in Japan. In its place, the Company entered into three cross-currency interest rate swaps

totaling 20 billion yen. In the fourth quarter of fiscal 2010, a 5 billion yen cross-currency swap expired and the

Company replaced it with a new 5 billion yen cross-currency swap. There were no cross-currency interest rate swaps

outstanding at September 30, 2009.