Johnson Controls 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Interest Refund Claim

In the second quarter of fiscal 2009, the Company filed a claim for refund with the Internal Revenue Service related

to interest computations of prior tax payments and refunds. The refund claim resulted in a tax provision decrease of

$6 million.

Impacts of Tax Legislation and Change in Statutory Tax Rates

In fiscal 2009, the Company obtained High Tech Enterprise status from the Chinese Tax Bureaus for various

Chinese subsidiaries. This status allows the entities to benefit from a 15% tax rate.

In February 2009, Wisconsin enacted numerous changes to Wisconsin income tax law as part of the Budget

Stimulus and Repair Bill, Wisconsin Act 2. These changes became effective in the Company's tax year ended

September 30, 2010. The major changes included an adoption of corporate unitary combined reporting and an

expansion of the related entity expense add back provisions. These Wisconsin tax law changes did not have a

material impact on the Company’s consolidated financial condition, results of operations or cash flows.

Various other tax legislation was adopted in the twelve months ended September 30, 2009. None of these changes

had a material impact on the Company’s consolidated financial condition, results of operations or cash flows.

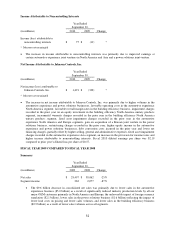

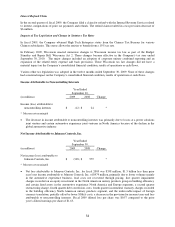

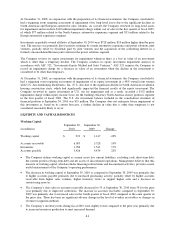

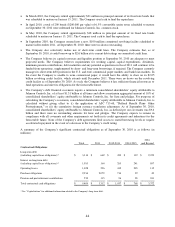

Income Attributable to Noncontrolling Interests

Year Ended

September 30,

(in millions)

2009

2008

Change

Income (loss) attributable to

noncontrolling interests

$

(12)

$

24

*

* Measure not meaningful

The decrease in income attributable to noncontrolling interests was primarily due to losses at a power solutions

joint venture and certain automotive experience joint ventures in North America because of the decline in the

global automotive industry.

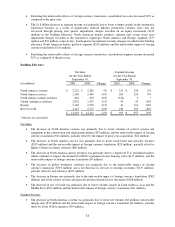

Net Income Attributable to Johnson Controls, Inc.

Year Ended

September 30,

(in millions)

2009

2008

Change

Net income (loss) attributable to

Johnson Controls, Inc.

$

(338)

$

979

*

* Measure not meaningful

Net loss attributable to Johnson Controls, Inc. for fiscal 2009 was $338 million, $1.3 billion less than prior

year’s net income attributable to Johnson Controls, Inc. of $979 million, primarily due to lower volumes mainly

in the automotive experience business, lead costs not recovered through pricing, first quarter impairment

charges recorded on an equity investment in the North American unitary products group in building efficiency

and certain fixed assets in the automotive experience North America and Europe segments, a second quarter

restructuring charge, fourth quarter debt conversion costs, fourth quarter incremental warranty charges recorded

in the building efficiency North American unitary products segment, and the unfavorable impact of foreign

currency translation, partially offset by lower SG&A costs, a decrease in the provision for income taxes and loss

attributable to noncontrolling interests. Fiscal 2009 diluted loss per share was $0.57 compared to the prior

year’s diluted earnings per share of $1.63.