Johnson Controls 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

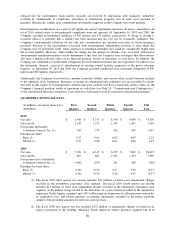

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that

the asset’s carrying amount may not be recoverable. The Company conducts its long-lived asset impairment

analyses in accordance with ASC 360-10-15, ―Impairment or Disposal of Long-Lived Assets.‖ ASC 360-10-15

requires the Company to group assets and liabilities at the lowest level for which identifiable cash flows are largely

independent of the cash flows of other assets and liabilities and evaluate the asset group against the sum of the

undiscounted future cash flows. If the undiscounted cash flows do not indicate the carrying amount of the asset

group is recoverable, an impairment charge is measured as the amount by which the carrying amount of the asset

group exceeds its fair value based on discounted cash flow analysis or appraisals.

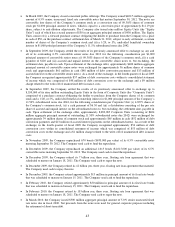

In the fourth quarter of fiscal 2010, the Company concluded it had a triggering event requiring assessment of

impairment of its long-lived assets due to the planned relocation of a plant in Japan in the automotive experience

Asia segment. As a result, the Company reviewed its long-lived assets for impairment and recorded an $11 million

impairment charge within cost of sales in the fourth quarter of fiscal 2010 related to the Asia automotive experience

segment. The impairment was measured under a market approach utilizing an appraisal. The inputs utilized in the

analysis are classified as Level 3 inputs within the fair value hierarchy as defined in ASC 820, ―Fair Value

Measurements and Disclosures.‖

At September 30, 2010, the Company concluded it did not have any other triggering events requiring assessment of

impairment of its long-lived assets.

In the third quarter of fiscal 2010, the Company concluded it had a triggering event requiring assessment of

impairment of its long-lived assets due to the planned relocation of its headquarters building in Japan in the

automotive experience Asia segment. As a result, the Company reviewed its long-lived assets for impairment and

recorded an $11 million impairment charge within selling, general and administrative expenses in the third quarter

of fiscal 2010 related to the Asia automotive experience segment. The impairment was measured under a market

approach utilizing an appraisal. The inputs utilized in the analysis are classified as Level 3 inputs within the fair

value hierarchy as defined in ASC 820, ―Fair Value Measurements and Disclosures.‖

In the second quarter of fiscal 2010, the Company concluded it had a triggering event requiring assessment of

impairment of its long-lived assets due to planned plant closures for the North America automotive experience

segment. These closures are a result of the Company’s revised restructuring actions to the 2008 Plan. Refer to Note

16, ―Restructuring Costs,‖ to the accompanying financial statements for further information regarding the 2008 Plan.

As a result, the Company reviewed its long-lived assets for impairment and recorded a $19 million impairment

charge in the second quarter of fiscal 2010 related to the North America automotive experience segment. This

impairment charge was offset by a decrease in the Company’s restructuring reserve related to the 2008 Plan due to

lower employee severance and termination benefit cash payments than previously expected, as discussed further in

Note 16. The impairment was measured under an income approach utilizing forecasted discounted cash flows for

fiscal 2010 through 2014 to determine the fair value of the impaired assets. This method is consistent with the

method the Company has employed in prior periods to value other long-lived assets. The inputs utilized in the

discounted cash flow analysis are classified as Level 3 inputs within the fair value hierarchy as defined in ASC 820,

―Fair Value Measurements and Disclosures.‖

In the third quarter of fiscal 2009, the Company concluded it had a triggering event requiring assessment of

impairment of its long-lived assets in light of the restructuring plans in North America announced by Chrysler LLC

(Chrysler) and General Motors Corporation (GM) during the quarter as part of their bankruptcy reorganization

plans. As a result, the Company reviewed its long-lived assets relating to the Chrysler and GM platforms within the

North America automotive experience segment and determined no impairment existed.

In the second quarter of fiscal 2009, the Company concluded it had a triggering event requiring assessment of

impairment of its long-lived assets in conjunction with its restructuring plan announced in March 2009. As a result,

the Company reviewed its long-lived assets associated with the plant closures for impairment and recorded a $46

million impairment charge in the second quarter of fiscal 2009, of which $25 million related to the North America

automotive experience segment, $16 million related to the Asia automotive experience segment and $5 million

related to the Europe automotive experience segment. Refer to Note 16, ―Restructuring Costs,‖ to the accompanying

financial statements for further information regarding the 2009 restructuring plan. Additionally, at March 31, 2009,

in conjunction with the preparation of its financial statements, the Company concluded it had a triggering event

requiring assessment of its other long-lived assets within the Europe automotive experience segment due to

significant declines in European automotive sales volume. As a result, the Company reviewed its other long-lived

assets within the Europe automotive experience segment for impairment and determined no additional impairment

existed.