Johnson Controls 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

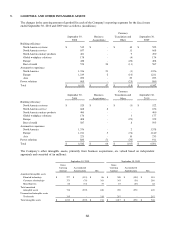

Amortization of other intangible assets for the fiscal years ended September 30, 2010, 2009 and 2008 was $43

million, $38 million and $38 million, respectively. Excluding the impact of any future acquisitions, the Company

anticipates amortization for fiscal 2011, 2012, 2013, 2014 and 2015 will be approximately $43 million, $37 million,

$31 million, $29 million and $27 million, respectively.

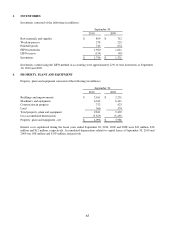

6. PRODUCT WARRANTIES

The Company offers warranties to its customers depending upon the specific product and terms of the customer

purchase agreement. A typical warranty program requires that the Company replace defective products within a

specified time period from the date of sale. The Company records an estimate for future warranty-related costs based

on actual historical return rates and other known factors. Based on analysis of return rates and other factors, the

adequacy of the Company’s warranty provisions are adjusted as necessary. While the Company’s warranty costs

have historically been within its calculated estimates, the Company monitors its warranty activity and adjusts its

reserve estimates when it is probable that future warranty costs will be different than those estimates. Accruals

related to pre-existing warranties includes incremental warranty charges of $105 million recorded in the fourth

quarter of fiscal 2009 by the building efficiency North America unitary products segment, of which $76 million was

due to a specific product issue and $29 million was a result of the Company’s periodic warranty review process and

analysis of return rates. The portion of the incremental charge due to a specific product issue related to the

anticorrosive film applied to certain coils used in residential indoor heating, ventilating and air conditioning units as

a means to promote flow of condensation and adding to the efficiency of the units.

The Company’s product warranty liability is recorded in the consolidated statement of financial position in other

current liabilities if the warranty is less than one year and in other noncurrent liabilities if the warranty extends

longer than one year.

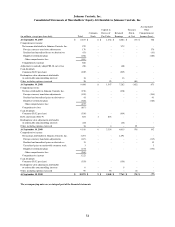

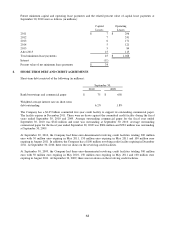

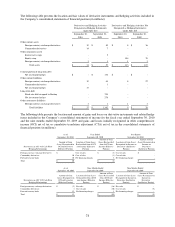

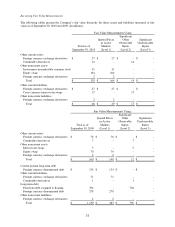

The changes in the carrying amount of the Company’s total product warranty liability for the fiscal years ended

September 30, 2010 and 2009 were as follows (in millions):

Year Ended

September 30,

2010

2009

Balance at beginning of period

$

344

$

204

Accruals for warranties issued during the period

260

238

Accruals from acquisitions

1

-

Accruals related to pre-existing warranties (including changes in estimates)

(18)

115

Settlements made (in cash or in kind) during the period

(245)

(214)

Currency translation

(5)

1

Balance at end of period

$

337

$

344

7. LEASES

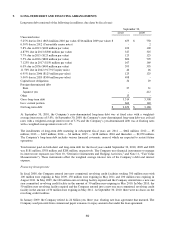

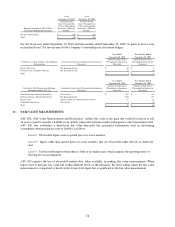

Certain administrative and production facilities and equipment are leased under long-term agreements. Most leases

contain renewal options for varying periods, and certain leases include options to purchase the leased property

during or at the end of the lease term. Leases generally require the Company to pay for insurance, taxes and

maintenance of the property. Leased capital assets included in net property, plant and equipment, primarily buildings

and improvements, were $41 million and $33 million at September 30, 2010 and 2009, respectively.

Other facilities and equipment are leased under arrangements that are accounted for as operating leases. Total rental

expense for the fiscal years ended September 30, 2010, 2009 and 2008 was $389 million, $403 million and $399

million, respectively.