Johnson Controls 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

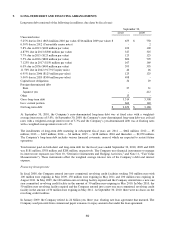

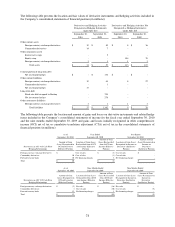

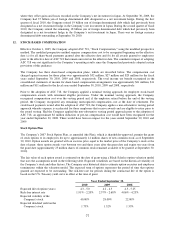

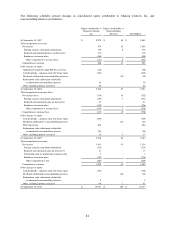

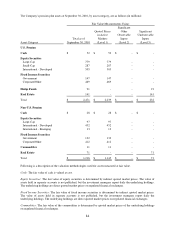

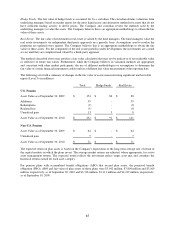

A summary of SAR activity at September 30, 2010, and changes for the year then ended, is presented below:

Weighted

Average

Aggregate

Weighted

Shares

Remaining

Intrinsic

Average

Subject to

Contractual

Value

SAR Price

SAR

Life (years)

(in millions)

Outstanding, September 30, 2009

$

24.69

2,996,198

Granted

24.87

671,335

Exercised

20.13

(383,450)

Forfeited or expired

27.80

(46,970)

Outstanding, September 30, 2010

$

25.23

3,237,113

6.4

$

20

Exercisable, September 30, 2010

$

23.20

1,909,881

5.0

$

16

In conjunction with the exercise of SARs granted, the Company made payments of $3 million, $2 million and $5

million during the fiscal years ended September 30, 2010, 2009 and 2008, respectively.

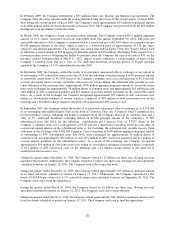

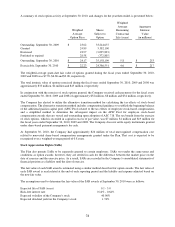

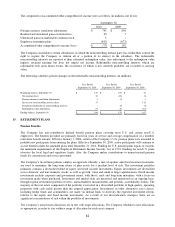

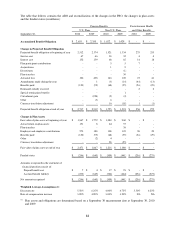

Restricted (Nonvested) Stock

In fiscal year 2002, the Company adopted a restricted stock plan that provides for the award of restricted shares of

common stock or restricted share units to certain key employees. Awards under the restricted stock plan typically

vest 50% after two years from the grant date and 50% after four years from the grant date. The plan allows for

different vesting terms on specific grants with approval by the board of directors.

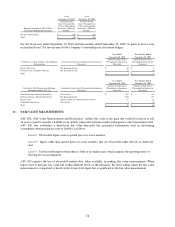

A summary of the status of the Company’s nonvested restricted stock awards at September 30, 2010, and changes

for the fiscal year then ended, is presented below:

Weighted

Shares/Units

Average

Subject to

Price

Restriction

Nonvested, September 30, 2009

$

34.13

956,500

Granted

25.18

440,455

Vested

30.96

(631,500)

Nonvested, September 30, 2010

$

31.60

765,455

At September 30, 2010, the Company had approximately $10 million of total unrecognized compensation cost

related to nonvested share-based compensation arrangements granted under the restricted stock plan. That cost is

expected to be recognized over a weighted-average period of 1.2 years.

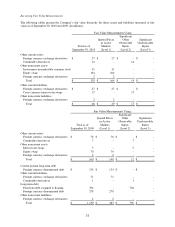

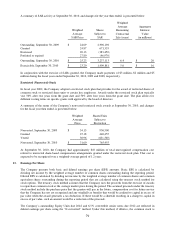

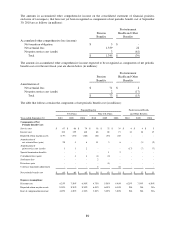

13. Earnings Per Share

The Company presents both basic and diluted earnings per share (EPS) amounts. Basic EPS is calculated by

dividing net income by the weighted average number of common shares outstanding during the reporting period.

Diluted EPS is calculated by dividing net income by the weighted average number of common shares and common

equivalent shares outstanding during the reporting period that are calculated using the treasury stock method for

stock options. The treasury stock method assumes that the Company uses the proceeds from the exercise of awards

to repurchase common stock at the average market price during the period. The assumed proceeds under the treasury

stock method include the purchase price that the grantee will pay in the future, compensation cost for future service

that the Company has not yet recognized and any windfall tax benefits that would be credited to capital in excess of

par value when the award generates a tax deduction. If there would be a shortfall resulting in a charge to capital in

excess of par value, such an amount would be a reduction of the proceeds.

The Company’s outstanding Equity Units due 2042 and 6.5% convertible senior notes due 2012 are reflected in

diluted earnings per share using the ―if-converted‖ method. Under this method, if dilutive, the common stock is