Johnson Controls 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

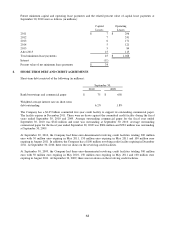

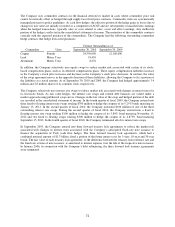

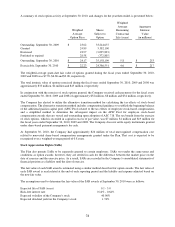

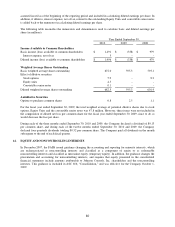

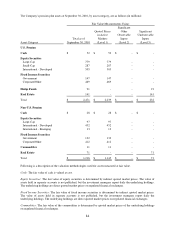

A summary of stock option activity at September 30, 2010, and changes for the year then ended, is presented below:

Weighted

Average

Aggregate

Weighted

Shares

Remaining

Intrinsic

Average

Subject to

Contractual

Value

Option Price

Option

Life (years)

(in millions)

Outstanding, September 30, 2009

$

23.62

33,244,637

Granted

24.89

5,382,100

Exercised

18.97

(3,095,823)

Forfeited or expired

28.58

(372,805)

Outstanding, September 30, 2010

$

24.17

35,158,109

5.8

$

253

Exercisable, September 30, 2010

$

22.23

24,386,551

4.6

$

217

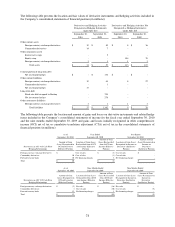

The weighted-average grant-date fair value of options granted during the fiscal years ended September 30, 2010,

2009 and 2008 was $7.70, $6.68 and $9.08, respectively.

The total intrinsic value of options exercised during the fiscal years ended September 30, 2010, 2009 and 2008 was

approximately $33 million, $4 million and $45 million, respectively.

In conjunction with the exercise of stock options granted, the Company received cash payments for the fiscal years

ended September 30, 2010, 2009 and 2008 of approximately $52 million, $8 million and $34 million, respectively.

The Company has elected to utilize the alternative transition method for calculating the tax effects of stock-based

compensation. The alternative transition method includes computational guidance to establish the beginning balance

of the additional paid-in capital pool (APIC Pool) related to the tax effects of employee stock-based compensation,

and a simplified method to determine the subsequent impact on the APIC Pool for employee stock-based

compensation awards that are vested and outstanding upon adoption of ASC 718. The tax benefit from the exercise

of stock options, which is recorded in capital in excess of par value, was $7 million, $1 million and $19 million for

the fiscal years ended September 30, 2010, 2009 and 2008. The Company does not settle equity instruments granted

under share-based payment arrangements for cash.

At September 30, 2010, the Company had approximately $26 million of total unrecognized compensation cost

related to nonvested share-based compensation arrangements granted under the Plan. That cost is expected to be

recognized over a weighted-average period of 0.8 years.

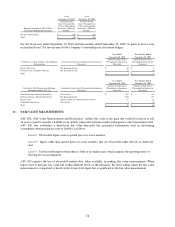

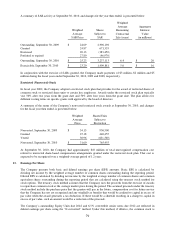

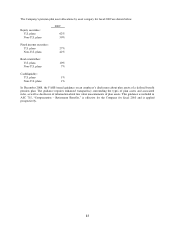

Stock Appreciation Rights (SARs)

The Plan also permits SARs to be separately granted to certain employees. SARs vest under the same terms and

conditions as option awards; however, they are settled in cash for the difference between the market price on the

date of exercise and the exercise price. As a result, SARs are recorded in the Company’s consolidated statements of

financial position as a liability until the date of exercise.

The fair value of each SAR award is estimated using a similar method described for option awards. The fair value of

each SAR award is recalculated at the end of each reporting period and the liability and expense adjusted based on

the new fair value.

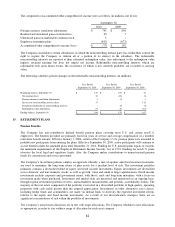

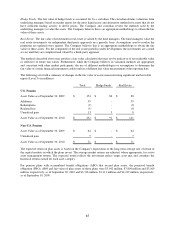

The assumptions used to determine the fair value of the SAR awards at September 30, 2010 were as follows:

Expected life of SAR (years)

0.1 - 3.0

Risk-free interest rate

0.14% - 0.64%

Expected volatility of the Company's stock

40.00%

Expected dividend yield on the Company's stock

1.74%