Johnson Controls 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Decreased demand from our customers in the automotive industry may adversely affect our results of

operations.

Our financial performance in the power solutions business depends, in part, on conditions in the automotive

industry. Sales to OEMs accounted for approximately 23% of the total sales of the power solutions business in fiscal

2010. Declines in the North American and European automotive production levels could reduce our sales and

adversely affect our results of operations. In addition, if any OEMs reach a point where they cannot fund their

operations, we may incur write offs of accounts receivable, incur impairment charges or require additional

restructuring actions beyond our current restructuring plans.

A variety of other factors could adversely affect the results of operations of our power solutions business.

Any of the following could materially and adversely impact the results of operations of our power solutions

business: loss of, or changes in, automobile battery supply contracts with our large original equipment and

aftermarket customers; the increasing quality and useful life of batteries or use of alternative battery technologies,

both of which may contribute to a growth slowdown in the lead-acid battery market; delays or cancellations of new

vehicle programs; market and financial consequences of any recalls that may be required on our products; delays or

difficulties in new product development, including lithium-ion technology; financial instability or market declines of

our customers or suppliers; interruption of supply of certain single-source components; the increasing global

environmental regulation related to the manufacture and recycling of lead-acid batteries; our ability to secure

sufficient tolling capacity to recycle batteries; and the lack of the development of a market for hybrid vehicles.

ITEM 1B UNRESOLVED STAFF COMMENTS

The Company has no unresolved written comments regarding its periodic or current reports from the staff of the

SEC that were issued 180 days or more preceding the end of our fiscal 2010.

ITEM 2 PROPERTIES

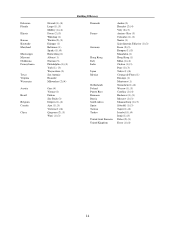

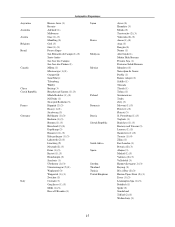

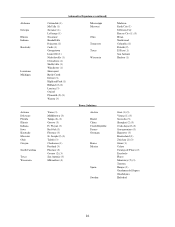

At September 30, 2010, the Company conducted its operations in 63 countries throughout the world, with its world

headquarters located in Milwaukee, Wisconsin. The Company’s wholly- and majority-owned facilities, which are

listed in the table on the following pages by business and location, totaled approximately 95 million square feet of

floor space and are owned by the Company except as noted. The facilities primarily consisted of manufacturing,

assembly and/or warehouse space. The Company considers its facilities to be suitable and adequate for their current

uses. The majority of the facilities are operating at normal levels based on capacity.