Johnson Controls 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

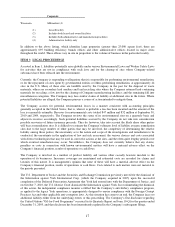

We may be unable to complete or integrate acquisitions effectively, which may adversely affect our growth,

profitability and results of operations.

We expect acquisitions of businesses and assets to play a role in our future growth. We cannot be certain that we

will be able to identify attractive acquisition targets, obtain financing for acquisitions on satisfactory terms or

successfully acquire identified targets. Additionally, we may not be successful in integrating acquired businesses

into our existing operations and achieving projected synergies. Competition for acquisition opportunities in the

various industries in which we operate may rise, thereby increasing our costs of making acquisitions or causing us to

refrain from making further acquisitions. We are also subject to applicable antitrust laws and must avoid

anticompetitive behavior. These and other acquisition-related factors may negatively and adversely impact our

growth, profitability and results of operations.

We are subject to business continuity risks associated with centralization of certain administrative functions.

Certain administrative functions, primarily in North America and Europe, have been or are in the process of being

regionally centralized to improve efficiency and reduce costs. To the extent that these central locations are disrupted

or disabled, key business processes, such as invoicing, payments and general management operations, could be

interrupted.

We are in the process of implementing new information technology systems.

We are in the process of implementing a new global financial consolidations software system. We expect to

implement this system in the first half of fiscal 2011, and it will replace our existing financial consolidations system.

If we do not implement the system successfully, or if the system does not perform in a satisfactory manner, it could

be disruptive and/or adversely affect our operations and results of operations, including our ability to report accurate

and timely financial results. We are also implementing new enterprise resource planning (ERP) systems in certain of

our businesses over a period of several years. As we implement the new ERP systems, the systems may not perform

as expected. This could have an adverse effect on our business.

Our business success depends on attracting and retaining qualified personnel.

Our ability to sustain and grow our business requires us to hire, retain and develop a highly skilled and diverse

management team and workforce. Any unplanned turnover or inability to attract and retain key employees could

have a negative effect on our results of operations.

Building Efficiency Risks

Our building efficiency business relies to a great extent on contracts and business with U.S. government

entities, the loss of which may adversely affect our results of operations.

Our building efficiency business contracts with government entities and is subject to specific rules, regulations and

approvals applicable to government contractors. We are subject to routine audits by the Defense Contract Audit

Agency to assure our compliance with these requirements. Our failure to comply with these or other laws and

regulations could result in contract terminations, suspension or debarment from contracting with the U.S. federal

government, civil fines and damages and criminal prosecution. In addition, changes in procurement policies, budget

considerations, unexpected U.S. developments, such as terrorist attacks, or similar political developments or events

abroad that may change the U.S. federal government’s national security defense posture may affect sales to

government entities.

Volatility in commodity prices may adversely affect our results of operations.

Commodity prices were highly volatile in the past year, primarily steel, aluminum, copper and fuel costs. Increases

in commodity costs negatively impact the profitability of orders in backlog as prices on those orders are fixed;

therefore, in the short term we cannot adjust for changes in commodity prices. If we are not able to recover

commodity cost increases through price increases to our customers on new orders, then such increases will have an

adverse effect on our results of operations. Additionally, unfavorability in our hedging programs during a period of

declining commodity prices could result in lower margins as we reduce prices to match the market on a fixed

commodity cost level.