Johnson Controls 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

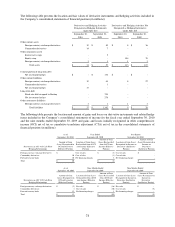

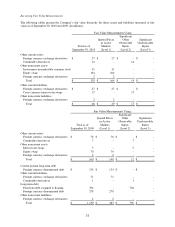

The Company uses commodity contracts in the financial derivatives market in cases where commodity price risk

cannot be naturally offset or hedged through supply base fixed price contracts. Commodity risks are systematically

managed pursuant to policy guidelines. As cash flow hedges, the effective portion of the hedge gains or losses due to

changes in fair value are initially recorded as a component of AOCI and are subsequently reclassified into earnings

when the hedged transactions, typically sales or costs related to sales, occur and affect earnings. Any ineffective

portion of the hedge is reflected in the consolidated statement of income. The maturities of the commodity contracts

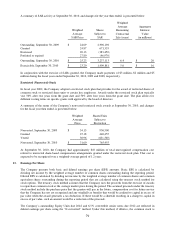

coincide with the expected purchase of the commodities. The Company had the following outstanding commodity

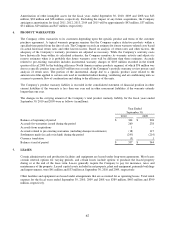

hedge contracts that hedge forecasted purchases:

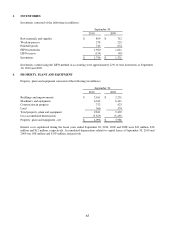

Volume Outstanding as of

Commodity

Units

September 30, 2010

September 30, 2009

Copper

Pounds

24,550,000

12,180,000

Lead

Metric Tons

18,450

-

Aluminum

Metric Tons

8,276

-

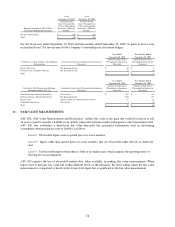

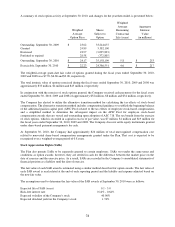

In addition, the Company selectively uses equity swaps to reduce market risk associated with certain of its stock-

based compensation plans, such as its deferred compensation plans. These equity compensation liabilities increase

as the Company’s stock price increases and decrease as the Company’s stock price decreases. In contrast, the value

of the swap agreement moves in the opposite direction of these liabilities, allowing the Company to fix a portion of

the liabilities at a stated amount. As of September 30, 2010 and 2009, the Company had hedged approximately 3.4

million and 2.8 million shares of its common stock, respectively.

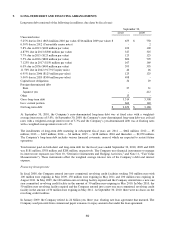

The Company selectively uses interest rate swaps to reduce market risk associated with changes in interest rates for

its fixed-rate bonds. As fair value hedges, the interest rate swaps and related debt balances are valued under a

market approach using publicized swap curves. Changes in the fair value of the swap and hedged portion of the debt

are recorded in the consolidated statement of income. In the fourth quarter of fiscal 2009, the Company entered into

three fixed to floating interest rate swaps totaling $700 million to hedge the coupons of its 5.25% bonds maturing on

January 15, 2011. In the second quarter of fiscal 2010, the Company unwound $100 million of one of the three

outstanding interest rate swaps. During the second quarter of fiscal 2010, the Company entered into a fixed to

floating interest rate swap totaling $100 million to hedge the coupon of its 5.80% bond maturing November 15,

2012 and two fixed to floating swaps totaling $300 million to hedge the coupon of its 4.875% bond maturing

September 15, 2013. In the fourth quarter of fiscal 2010, the Company terminated all of its interest rate swaps.

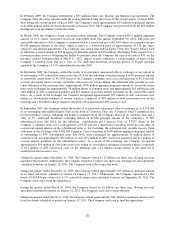

In September 2005, the Company entered into three forward treasury lock agreements to reduce the market risk

associated with changes in interest rates associated with the Company’s anticipated fixed-rate note issuance to

finance the acquisition of York (cash flow hedge). The three forward treasury lock agreements, which had a

combined notional amount of $1.3 billion, fixed a portion of the future interest cost for 5-year, 10-year and 30-year

bonds. The fair value of each treasury lock agreement, or the difference between the treasury lock reference rate and

the fixed rate at time of note issuance, is amortized to interest expense over the life of the respective note issuance.

In January 2006, in connection with the Company’s debt refinancing, the three forward lock treasury agreements

were terminated.