Johnson Controls 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

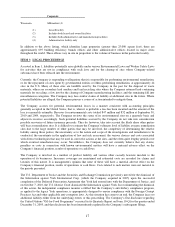

ITEM 1A RISK FACTORS

General Risks

General economic, credit and capital market conditions could adversely affect our financial performance, and

may affect our ability to grow or sustain our businesses and could negatively affect our ability to access the

capital markets.

We compete around the world in various geographic regions and product markets. Global economic conditions

affect each of our three primary businesses. As we discuss in greater detail in the specific risk factors for each of our

businesses that appear below, any future financial distress in the automotive industry or residential and commercial

construction markets could negatively affect our revenues and financial performance in future periods, result in

future restructuring charges, and adversely impact our ability to grow or sustain our businesses.

The capital and credit markets provide us with liquidity to operate and grow our businesses beyond the liquidity that

operating cash flows provide. A worldwide economic downturn and disruption of the credit markets could reduce

our access to capital necessary for our operations and executing our strategic plan. If our access to capital were to

become significantly constrained or costs of capital increased significantly due to lowered credit ratings, prevailing

industry conditions, the volatility of the capital markets or other factors, then our financial condition, results of

operations and cash flows could be adversely affected. The Company’s $2.05 billion five-year revolving credit

facility expires in December 2011. The Company plans to renew the facility prior to its expiration.

We are subject to pricing pressure from our automotive customers.

We face significant competitive pressures in all of our business segments. Because of their purchasing size, our

automotive customers can influence market participants to compete on price terms. If we are not able to offset

pricing reductions resulting from these pressures by improved operating efficiencies and reduced expenditures, those

pricing reductions may have an adverse impact on our business.

We are subject to risks associated with our non-U.S. operations that could adversely affect our results of

operations.

We have significant operations in a number of countries outside the U.S., some of which are located in emerging

markets. Long-term economic uncertainty in some of the regions of the world in which we operate, such as Asia,

South America, the Middle East, Central Europe and other emerging markets, could result in the disruption of

markets and negatively affect cash flows from our operations to cover our capital needs and debt service.

In addition, as a result of our global presence, a significant portion of our revenues and expenses is denominated in

currencies other than the U.S. dollar. We are therefore subject to foreign currency risks and foreign exchange

exposure. Our primary exposures are to the euro, British pound, Japanese yen, Czech koruna, Mexican peso, Swiss

franc, Polish zloty, Canadian dollar and Chinese renminbi. While we employ financial instruments to hedge

transactional and foreign exchange exposure, these activities do not insulate us completely from those exposures.

Exchange rates can be volatile and could adversely impact our financial results.

There are other risks that are inherent in our non-U.S. operations, including the potential for changes in socio-

economic conditions, laws and regulations, including import, export, labor and environmental laws, and monetary

and fiscal policies, protectionist measures that may prohibit acquisitions or joint ventures, unsettled political

conditions, natural and man-made disasters, hazards and losses, violence and possible terrorist attacks.

These and other factors may have a material adverse effect on our non-U.S. operations and therefore on our business

and results of operations.

We are subject to regulation of our international operations that could adversely affect our business and

results of operations.

Due to our global operations, we are subject to many laws governing international relations, including those that

prohibit improper payments to government officials and restrict where we can do business, what information or

products we can supply to certain countries and what information we can provide to a non-U.S. government,

including but not limited to the Foreign Corrupt Practices Act and the U.S. Export Administration Act. Violations of