Johnson Controls 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

In December 2007, the FASB issued guidance changing the accounting and reporting for minority interests, which

are recharacterized as noncontrolling interests and classified as a component of equity. This new consolidation

method changes the accounting for transactions with minority interest holders. This guidance is included in ASC

810, ―Consolidation,‖ and was adopted by the Company in the first quarter of fiscal 2010 (October 1, 2009). The

adoption of this guidance did not have a material impact on the Company’s consolidated financial condition and

results of operations. Refer to Note 14, ―Equity and Noncontrolling Interests,‖ for further discussion.

In September 2006, the FASB issued guidance that defines fair value, establishes a framework for measuring fair

value and expands disclosures about fair value measurements. This guidance also establishes a fair value hierarchy

that prioritizes information used in developing assumptions when pricing an asset or liability. This guidance is

included in ASC 820, ―Fair Value Measurements and Disclosures.‖ The Company adopted this guidance effective

October 1, 2008. In February 2008, the FASB delayed the effective date of this guidance for nonfinancial assets and

nonfinancial liabilities that are recognized or disclosed in the financial statements on a nonrecurring basis to fiscal

years beginning after November 15, 2008. The provisions of this guidance for nonfinancial assets and nonfinancial

liabilities were effective for the Company in the first quarter of fiscal 2010 (October 1, 2009) and will be applied

prospectively to fair value assessments such as the Company’s long-lived asset impairment analyses. Refer to Note

17, ―Impairment of Long-Lived Assets,‖ for further discussion.

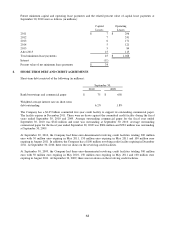

2. ACQUISITIONS

In July 2010, the Company acquired an additional 40% of a power solutions Korean joint venture. The acquisition

increased the Company’s ownership percentage to 90%. The remaining 10% was acquired by the local management

team. The Company paid approximately $86 million (excluding cash acquired of $57 million) for the additional

ownership percentage and incurred approximately $10 million of acquisition costs and related purchase accounting

adjustments. As a result of the acquisition, the Company recorded a non-cash gain of $47 million within power

solutions equity income to adjust the Company’s existing equity investment in the Korean joint venture to fair

value. Goodwill of $51 million was recorded as part of the transaction. The purchase price allocation may be

subsequently adjusted to reflect final valuation studies.

Also during fiscal 2010, the Company completed three acquisitions for a combined purchase price of $35 million, of

which $32 million was paid as of September 30, 2010. The acquisitions in the aggregate were not material to the

Company’s consolidated financial statements. In connection with the acquisitions, the Company recorded goodwill

of $9 million. The purchase price allocation may be subsequently adjusted to reflect final valuation studies.

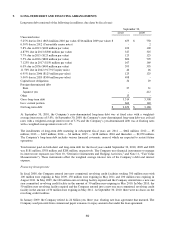

During fiscal 2009, the Company completed four acquisitions for a combined purchase price of $43 million, of

which $38 million was paid in the twelve months ended September 30, 2009. None of the acquisitions were material

to the Company’s consolidated financial statements. In connection with these acquisitions, the Company recorded

goodwill of $30 million, of which $26 million was recorded during fiscal 2009.

In July 2008, the Company formed a joint venture to acquire the interior product assets of Plastech Engineered

Products, Inc. (Plastech). Plastech filed for bankruptcy in February 2008. The Company owns 70% of the newly

formed entity and certain Plastech term lenders hold the remaining noncontrolling interest. The Company

contributed cash and injection molding plants to the new entity with a fair value of $262 million. The lenders

contributed their rights to receive Plastech’s interiors business obtained in exchange for certain Plastech debt. The

combined equity in the new entity was approximately $375 million. Goodwill of $199 million was recorded as part

of the transaction. In the third quarter of fiscal 2009, the Company finalized valuations associated with the

acquisition and recorded a $21 million increase to goodwill.

Also in fiscal 2008, the Company completed seven additional acquisitions for a combined purchase price of $108

million, none of which were material to the Company’s consolidated financial statements. In connection with these

acquisitions, the Company recorded goodwill of $66 million.